The world’s No. 1 cobalt miner is sounding the alarm about the metal’s diminishing role in electric car batteries.

Article content

(Bloomberg) — The world’s No. 1 cobalt miner has sounded the alarm about the metal’s diminishing role in electric vehicle batteries.

China’s CMOC Group Ltd, which produces cobalt much faster than rivals such as Glencore Plc, said the importance of the raw material in the energy transition was declining rapidly.

The adoption of cobalt-free lithium iron phosphate, or LFP, batteries has gained momentum in recent years, due to them being cheaper to manufacture. The proportion of China’s electric vehicle batteries containing cobalt will fall to 31% in 2024, from 44% two years ago, according to CRU Consulting Group.

Advertisement 2

Article content

“We expect that electric vehicle batteries will never return to the cobalt-based era,” CMOC spokesman Zhou Xing said in an email response to questions. He added that “cobalt is much less important than we think” and that the proportion of batteries containing the metal may eventually drop to less than a tenth.

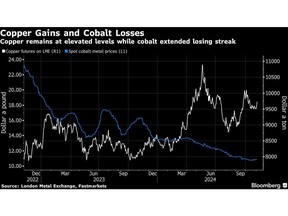

CMOC’s bearish view of the market comes amid a glut of the metal that has largely resulted from the Chinese company’s expansion of two massive copper and cobalt mines in the Democratic Republic of the Congo. It smashed its full-year production target in the first nine months of the year, helping push cobalt prices to the lowest level since 2016.

While the Chinese miner is ramping up production, Glencore, which was overtaken by CMOC as the largest cobalt supplier last year, has cut production at its Mutanda assets in the Democratic Republic of Congo.

Cobalt, which is also used in aerospace alloys and in the petrochemical industry, is often mined as a byproduct of copper extraction, and CMOC has been keen to extract more of the red metal as it heads to a long-term bull run. Hoarding cobalt to stem falling prices would be expensive due to increased expenses, such as storage costs, Zhou said.

Article content

Advertisement 3

Article content

“The global outlook for cobalt looks bearish for next year: new, cheap metal refining capacity has come on stream in China and Indonesia,” said Thomas Matthews, battery materials analyst at CRU. He added that prices are expected to fall on average next year and it will take a few years to recover.

CMOC is establishing close relationships with Contemporary Amperex Technology Co., Ltd. Ltd., the world’s largest battery maker which also became its second-largest shareholder in 2022. CATL has been buying cobalt from CMOC, helping it secure orders in an oversupplied market.

“Secure and stable supplies of cobalt enable us to better meet customer demand,” a CATL spokesperson said in an email response to questions. Investing in upstream suppliers was a way to “ensure supply chain security,” he said, but the company believes the market share for LFP batteries will continue to rise.

But CMOC is starting to feel the pinch of lower cobalt prices, despite ramping up production aggressively and saying in August that it had seen supply and demand reach “good balance” within two years.

“We are troubled by the fact that the presence of so many cobalt by-products has caused prices to decline, and thus the company’s cobalt profits have been greatly reduced,” Zhou said.

Advertisement 4

Article content

On the wire

The head of China’s central bank pledged to maintain an accommodative monetary policy stance and double counter-cyclical adjustments to support the country’s economic growth.

After months of relative silence, Chinese state media has begun to unravel its narrative about the US presidential election, mocking this year’s election season as a “money-burning” display of “unprecedented chaos.”

How would China react if former President Donald Trump returned to the White House and imposed major new tariffs? Bloomberg Economics says Beijing’s retaliatory goals may be similar to what happened last time — especially agricultural and energy exports from Republican-leaning countries.

This week’s diary

Wednesday 6 November:

- CCTD weekly online briefing on Chinese coal, at 15:00

- Asian Tin Week in Shanghai, Day 1

- China International Import Expo in Shanghai, Day 2

- China International Lead and Zinc Week in Changsha, Hunan, Day 2

Thursday 7 November:

- First batch of Chinese trade data for October, including steel, iron ore and copper imports; Exports of steel, aluminum and rare earths; Oil, gas and coal imports; Imports and exports of petroleum products; Imports of soybeans, edible oil, rubber, meat and offal ~ 11:00

- China’s foreign exchange reserves for October, including gold

- Sustainable Mining Conference in Shanghai

- Asian Tin Week in Shanghai, Day 2

- China International Import Expo in Shanghai, day three

- China International Lead and Zinc Week in Changsha, Hunan, Day 3

Advertisement 5

Article content

Friday 8 November:

- Weekly iron ore port stocks in China

- Weekly Commodity Stocks on the Shanghai Stock Exchange, ~15:00

- Monthly supply and demand report for crops in China

- Asian Tin Week in Shanghai, Day 3

- China International Import Expo in Shanghai, day four

- China International Oil and Gas Trade Conference, Day 1

Saturday 9 November

- China inflation data for October, 09:30

- China will release October financing and money supply totals by November 15

- China International Import Expo in Shanghai, day 5

- China International Oil and Gas Trade Conference, Day 2

Sunday 10 November

- China International Import Expo in Shanghai, last day

-With assistance from Winnie Chou, Jack Farshi, and William Close.

Article content

Comments are closed, but trackbacks and pingbacks are open.