Bitcoin has consistently outperformed all major asset classes over the past decade, cementing its role as a benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from having more dollars to maximizing their Bitcoin holdings.

Bitcoin is the hurdle rate

Bitcoin is to digital assets what Treasuries are to the legacy financial system, a fundamental benchmark. While no investment is without risk, holding Bitcoin in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

With BTC outperforming all other asset classes in 9 of the past 12 years (by order of magnitude)Not surprisingly, it has usurped Treasuries as a “risk-free price” in the minds of many investors — especially those with knowledge of monetary history and thus the appeal of Bitcoin’s verifiable scarcity.

Another way to phrase this is that the financial goal of digital asset investors is acquisition More Bitcoin Instead of getting more dollars. All investments or spending are viewed through the lens of BTC as an opportunity cost.

MicroStrategy has shown what this looks like in the corporate world with their new KPI: BTC Yield. To quote from September 20, Form 8-K: “The Company uses BTC yield as a key performance indicator to help evaluate the performance of its strategy of acquiring Bitcoin in a manner that the Company believes is accretive to shareholders.” MicroStrategy took full advantage of the tools available to them as a multibillion-dollar public company: access to low-interest-rate debt and the ability to issue new equity. This KPI shows that they are getting more BTC per outstanding share despite the fact that they are engaging in the traditionally dilutive activity of issuing new shares.

Mission accomplished: they get more Bitcoin.

But MicroStrategy has an advantage that the average fund manager or retail investor doesn’t: it’s a publicly traded company with the ability to tap capital markets at little or no cost. Individual owners cannot issue shares on the public market in order to raise capital and obtain BTC. We also cannot issue convertible bonds and borrow dollars at an interest rate close to zero.

This begs the question: How can we accumulate more Bitcoin? How can we get a positive “BTC return”?

Bitcoin mining

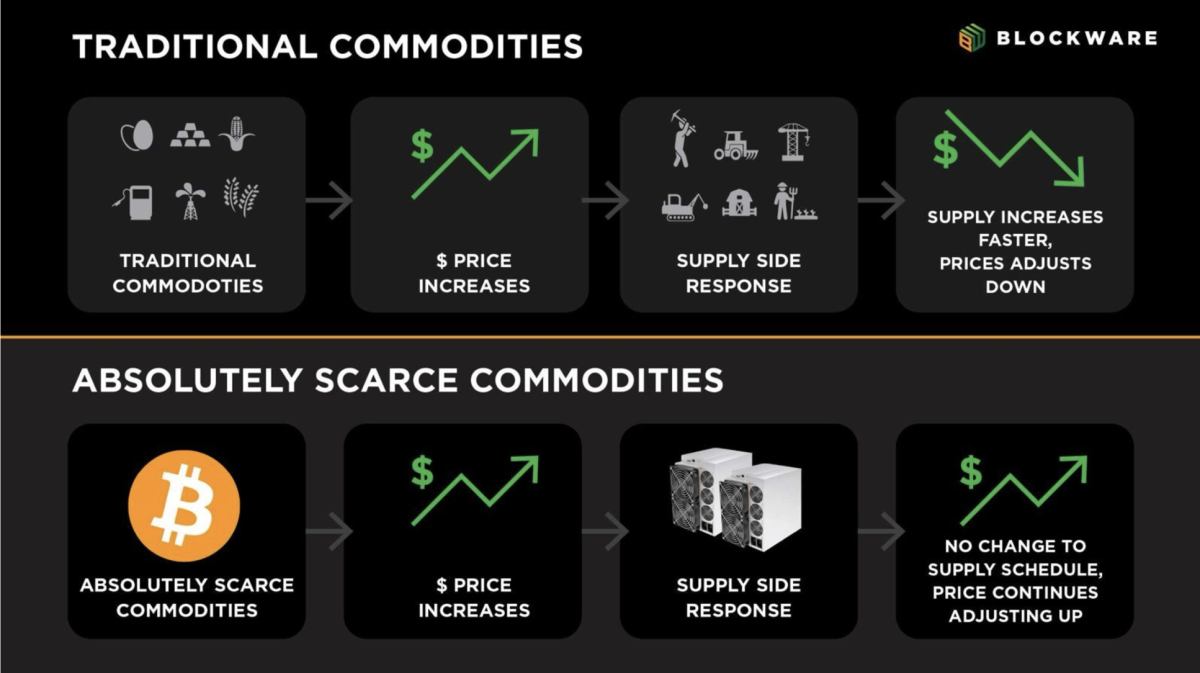

Bitcoin miners earn Bitcoin (BTC) by contributing computational power to the Bitcoin network, receiving a larger amount of Bitcoin (BTC) than the cost of electricity to power their device(s). Now this is easier said than done. The Bitcoin protocol enforces a pre-determined supply schedule using “difficulty adjustments” – meaning that more computational power allocated to Bitcoin mining results in limited block rewards being split into smaller chunks.

The most efficient Bitcoin miners are those who maximize their computational power while minimizing operating costs. This is achieved by obtaining the latest and most efficient Bitcoin mining hardware, and operating at the lowest possible electricity rate.

Under current market conditions (As of 11/21/2024), 1 Bitcoin costs ~$98,000. However, the Antminer S21 Pro mining at an electricity rate of $0.078/kWh is capable of producing 1 BTC for approximately $40,000 worth of electricity. That’s an operating margin of nearly 145%. A business is typically considered to have a “healthy profit margin” if it is in the 5-10% range – and mining easily beats this. This is despite the fact that as of the Bitcoin halving in April 2024, they are earning half the amount of Bitcoin per unit of account.

Price growth outweighs the difficulty of growth

The price of a financial asset – specifically Bitcoin – is determined on margin. This means that the price of an asset is determined by the most recent transactions between buyers and sellers. In other words, the price reflects what the last buyer is willing to pay and what the last seller is willing to accept.

This, in part, is what enables BTC’s notoriously volatile price movement. A shortage of sellers at price Conversely, a lack of buyers at price X means that the seller must lower his order to find the next marginal buyer. BTC can quickly move up or down based on the lack of sellers or buyers in a certain range.

Therefore, the speed at which the price of Bitcoin can move is much higher than the difficulty of mining across the network. Significant growth in network mining difficulty is not achieved through marginal bid/ask spreads, but rather through the culmination of ASIC manufacturing, energy production and mining infrastructure development. There is no shortcut to the time and human capital required to increase the total computational power on the Bitcoin network.

It is this dynamic that creates opportunities for Bitcoin miners to accumulate massive amounts of Bitcoin.

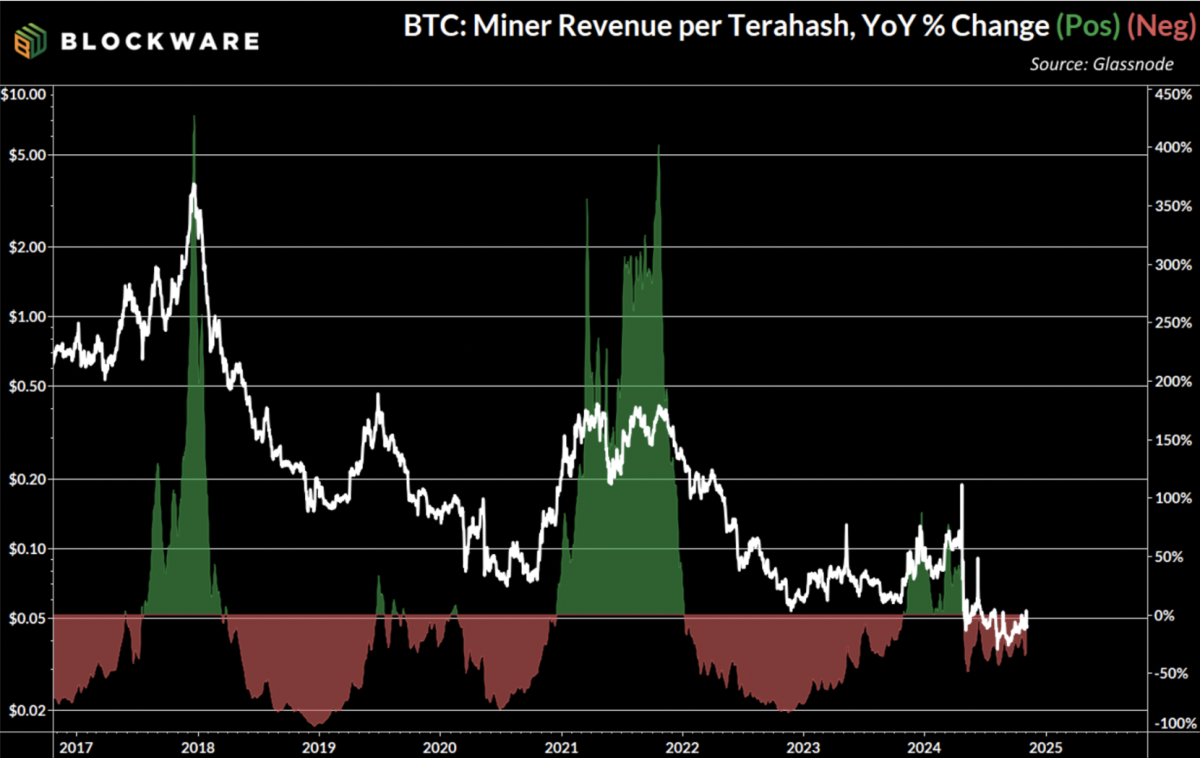

The chart here shows the exponential growth in Bitcoin mining profitability that occurs during bull markets. “Hashprice” measures how much revenue Bitcoin miners earn per unit of account on a daily basis. On an annual basis, the hash price increased by more than 300% at the peak of each Bitcoin mining cycle. This means that miners more than tripled their profit margins over a 12-month period.

In the long term, this metric tends to decline as more entities start mining Bitcoin, miners upgrade to more powerful and efficient machines, and block support is halved every four years. However, during bull markets, the set of forces that are a positive catalyst for mining difficulty (and thus a net negative for mining profitability) pales in comparison to the rapid growth in Bitcoin’s price.

Price volatility in Bitcoin mining hardware

In addition to wider profit margins during bull markets, Bitcoin miners have a concurrent advantage in the fact that ASIC prices tend to move in tandem with the price of Bitcoin. During the 2020 – 2024 cycle, the Antminer S19 will be operational (the most efficient ASIC at that time) Trading commenced at ~$24/ton. By November 2021 – when the price of Bitcoin reached its peak – they began trading at up to US$120 per ton.

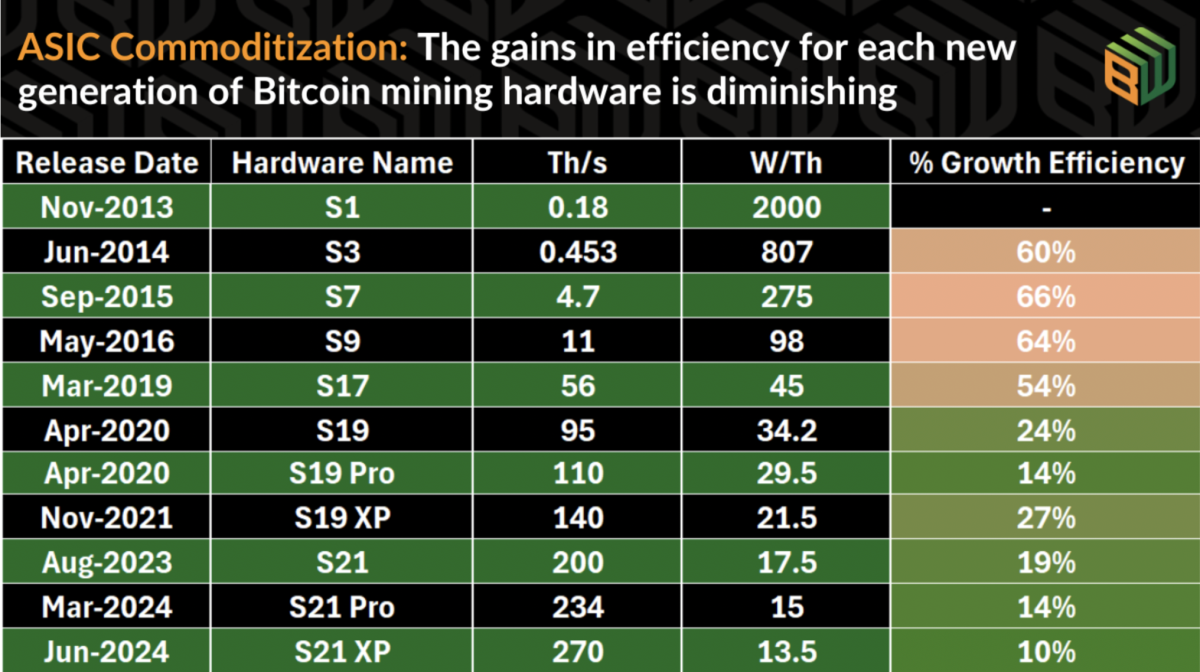

Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware. In the early days of Bitcoin mining, technological advances were rapid and powerful – so much so that new ASIC hardware would render older models obsolete overnight. However, the marginal gains of new ASICs have diminished to the point that older models are able to remain competitive for several years after release.

Since the S19 was launched in 2020 and has held a non-zero market price today, it is reasonable to expect that the S21 line of machines will be able to hold value for much longer. This gives miners a huge boost when it comes to accumulating Bitcoin, because the initial cost of purchasing the machines is no longer “sunk.” Their hardware has a price, a price that is tied to Bitcoin, and there is a resource available to obtain it. Liquidity.

Blockware Market

Block programs have been developed This platform To enable any investor – institutional or retail – to gain direct exposure to Bitcoin mining. Marketplace users can purchase Bitcoin mining hardware hosted in one of Blockware’s tier-1 data centers and also have access to industrial energy prices. These machines are already online, eliminating the long waits that have historically caused some miners to miss those key months in the cycle when price exceeds network difficulty.

Moreover, this platform was created by Bitcoiners, for Bitcoiners. Which means that hardware is purchased using Bitcoin as a medium of exchange, and Blockware never keeps the mining rewards – they are sent directly to the user’s wallet.

Finally, this provides miners with the aforementioned opportunity, but not the obligation, to sell their hardware at any time and at any price. This enables miners to take advantage of fluctuations in ASIC prices, recover the cost of their hardware, and accumulate more BTC faster than if they used a traditional “pure play” approach.

This innovation removes the barriers that have historically made hosted mining difficult, enabling miners to focus on the task: amassing more Bitcoin.

For institutional investors looking for great prices for mining hardware, Contact the Blockware team directly.

Comments are closed, but trackbacks and pingbacks are open.