This article is also available in Spanish.

Bitcoin mining company MARA – formerly known as Marathon Digital – announced the acquisition of an additional 703 bitcoins. This purchase increases the company’s total cryptocurrency holdings to 34,794 BTC.

MARA’s Bitcoin Holdings rose to 34,794, with the CEO sharing a bullish outlook

in advertisement Made yesterday on X, MARA, one of the world Leading Bitcoin mining companies revealed that they acquired 703 Bitcoins at an average price of $95,395. This brings the company’s total purchases of Bitcoin for the month of November to 6,474 Bitcoin, after its acquisition of 5,771 Bitcoin last week.

Related reading

The latest purchase increases the company’s total digital assets to 34,794 Bitcoin, worth approximately $3.3 billion at current market prices. Additionally, the company revealed that BTC’s year-to-date return per share is 36.7%.

Earlier this month, MARA raised $1 billion through the issuance of 0% convertible senior notes due 2030. A portion of the $200 million funds were used to buy back some of its bonds due 2026. The company also reserved $160 $1 million of the proceeds, with the intention of distributing them to future Bitcoin purchases if market prices become favourable.

like I mentioned Yesterday, MARA CEO Fred Thiel noted – in an interview with CNBC – that more institutional investors are interested in BTC, hoping that the Donald Trump administration will establish favorable regulations for cryptocurrencies in the United States.

MARA stock closed at $26.92 on November 27, marking a 7.81% increase on the day. In the past six months, the stock price has risen by 26.92%, coinciding with growing optimism towards digital assets as market sentiment improves with changes in government administration.

Corporate moves could push Bitcoin beyond $100,000

MARA’s aggressive strategy in acquiring Bitcoin mirrors that of MicroStrategy, which has the largest Bitcoin holdings globally. Under Michael Saylor’s leadership, MicroStrategy has spent billions on Bitcoin purchases this month, with a total of $4.6 billion and $5.4 billion In consecutive weeks.

Related reading

As President-elect Trump’s inauguration approaches on January 20, many companies around the world are doing so Warming Even adding BTC to their balance sheets. Recently, it launched Canada-based online video sharing platform Rumble Customized $20 million for future BTC purchases. Likewise, Japanese investment firm Metaplanet’s total Bitcoin holdings recently exceeded 1,000 BTC.

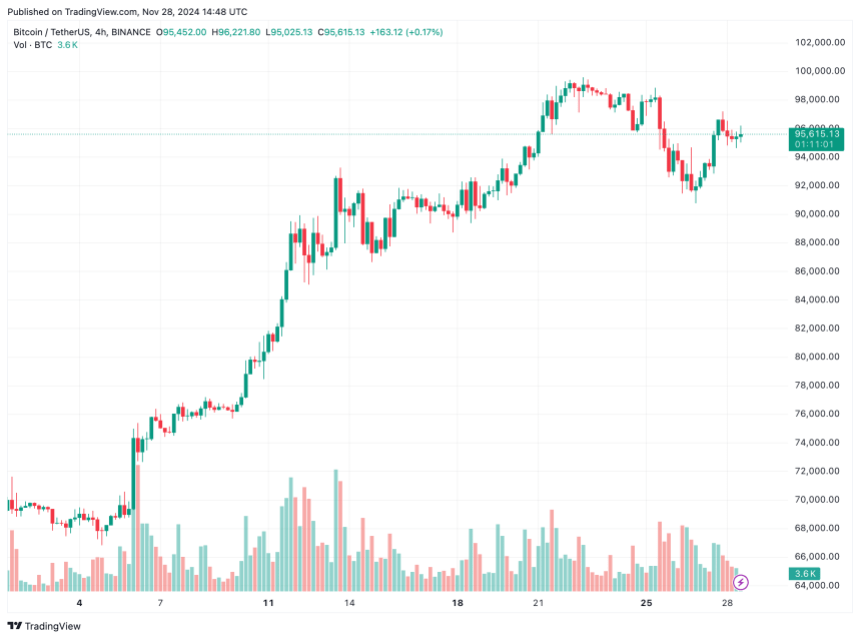

The race to collect as much Bitcoin as possible has sparked some enthusiasm among cryptocurrency analysts anticipating the digital asset breach The $100,000 mark early next year. Bitcoin is trading at $95,615 at press time, up 1% in the past 24 hours.

Featured image from Unsplash, charts from Yahoo! Finance and Tradingview.com

Comments are closed, but trackbacks and pingbacks are open.