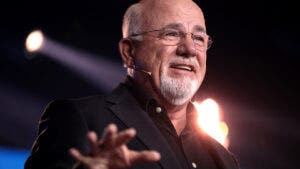

Dave Ramsey Says Those Predicting The ‘Economic End Of The World’ Over The National Debt Have Been Consistently Wrong

Dave Ramsey has seen it all when it comes to forecasts about the economy. And when it comes to the national debt, it’s clear: People have been sounding the alarm about the “economic apocalypse” for decades, but until now, they’ve been consistently wrong.

Don’t miss:

symbolic subscriber His thoughts on the subject, explaining how, In his late twentiesHe was deeply concerned about the rapid growth of the national debt. At the time, it was believed that this could lead to a complete economic collapse. “I’ve noticed that people in my world are writing books about the economic end of the world,” he said. “And they keep making mistakes, so I don’t want to write this book.”

SEE ALSO: Global gaming market expected to generate $272 billion by the end of the year – For $0.55 per share, this venture capital-backed startup with a user base of over 7 million gives investors easy access to this asset market.

While he acknowledges that debt is a serious concern, Ramsey does not believe it is about to cause the economy to collapse. He said, “Is this worrying? Yes, worrying. But will it lead to the plane crashing? Apparently not.”

Ramsey explained that the national debt affects the economy in subtle but important ways. The government finances its debt through sales Treasury billswhich investors buy because they earn interest. But Ramsey points out that if these investors had invested their money in businesses or other productive areas of the economy instead, they could have created more growth and opportunity.

“It steals money from the economy in that sense,” Ramsey said. He added that the cost of interest payments on debt is increasingly consuming the federal budget. “Taking care of it just became a bigger and bigger part of the ‘budget,’ as if they had a budget.”

TRENDING: The average American couple has saved this much money for retirement – How to compare?

Despite his concerns about the national debt, Ramsey remains confident in the country’s ability to repay its debt stock market As a safe place to invest. He admitted that there has always been a certain level of manipulation in the market, but he still encourages people to invest. “I think it’s still a safe place for people to invest in. I have millions and millions of dollars Mutual fundsHe said.

Comments are closed, but trackbacks and pingbacks are open.