Holding Bitcoin is very simple, but it is one of the most difficult and challenging things to do.

HODling bitcoin is the choice. You have to wake up every day and choose to continue HODLing BTC. When you have every reason to sell Bitcoin, you should continue to hold it. This is where most people fail.

You start worrying about losing money. The fear of making mistakes becomes a cloud over your head and you start wondering if you are wasting your time and ruining your future by owning Bitcoin.

It’s really not for the weak, so I understand why a lot of people can’t understand holding onto such a volatile asset, so early in its existence. It stands to reason that most people are not willing to invest in Bitcoin, but those who do have been rewarded handsomely for their efforts.

This American HODL thread sums up HODLing bitcoin perfectly.

Here’s the story of $106,600 per Bitcoin.

6 years ago, in 2018, I accumulated cash all year knowing that I would buy back Bitcoin at the “bottom”.

We spent 3 months or so consolidating about $6,600.

I got impatient and was like damn, this is my moment and posted half my collection.…

– American Hodl 🇺🇸 (@americanhodl8) December 17, 2024

I remember what it was like in 2018 when the price of Bitcoin fell by 50%. At the time, I was a young college student working as a physical therapist. I was in a position to take as much risk as possible because taking care of myself was my only responsibility, so this massive drop didn’t affect me mentally much. But for US company HODL, as well as many other Bitcoin users with wives and children to take care of, the risks here have risen dramatically.

Many Bitcoin users want the price to fall, so they can accumulate cheap Bitcoin. But for many Bitcoin users who have already accumulated Bitcoin at cheaper prices, it can be distressing to see the price of Bitcoin fall by 70-80% in bear markets. After all, Bitcoin users are working to preserve wealth and increase their purchasing power. Therefore, when the price of Bitcoin drops significantly, many feel it is like a punch in the gut. Losing money is bad.

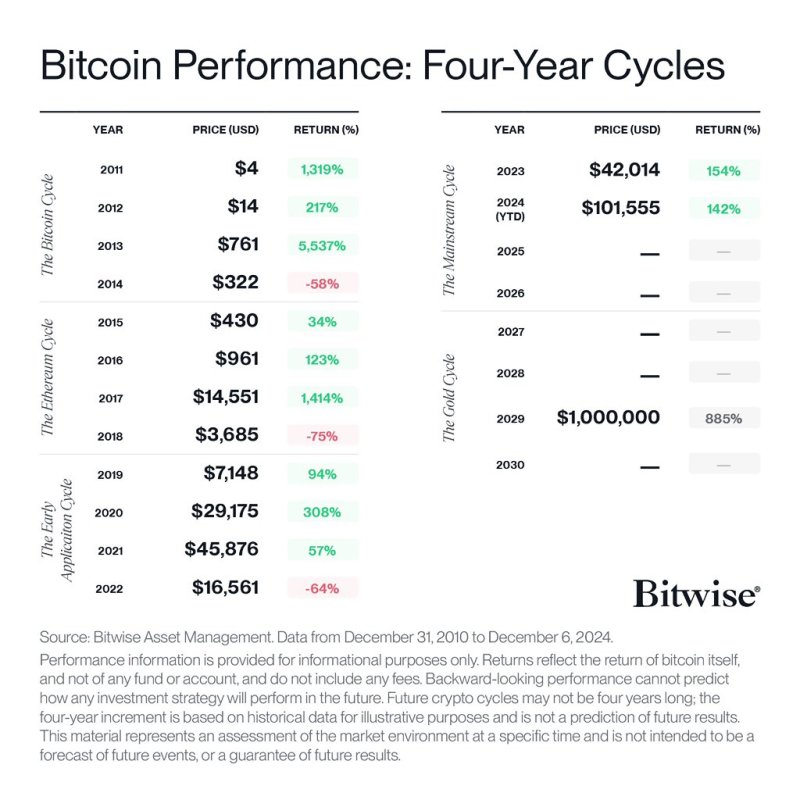

However, if you can weather harsh bear markets, bull markets reward those who weathered the storm, and those who made the effort to understand this asset and why these extreme lows and highs occur. Historically, the price of Bitcoin rises for three years in a row, then falls for one year.

Holding Bitcoin is not easy. It is normal and human to feel bear market depression and bull euphoria. So, when Bitcoin’s value inevitably declines in the future after a bull market, be prepared to HODL.

Don’t put yourself in a situation where you can’t afford a 70-80% correction.

Understand the origin of what you got and realize that this is normal and that everything is fine. If you can do this, you will come out of the bear market alive, and you will be in a good position to capitalize on the next bull market.

This article is a takes. The opinions expressed are entirely those of the author and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

Comments are closed, but trackbacks and pingbacks are open.