High yield funds can be risky. In an ideal world, every extremely generous dividend yield would be a direct result of strong companies generating a lot of excess cash earnings. In the real world, these problems are most often associated with falling stock prices and companies in deep financial trouble. As a result, high returns tend to be associated with disappointing price charts and mediocre total returns, at best.

What if I told you that one of the largest income-focused exchange-traded funds (ETFs) on the market today combines rich returns with impressive fund price gains? the JPMorgan Nasdaq Premium Equity Income ETF (NASDAQ: JEPQ) It checks those two boxes for shareholders – and more.

The Premium Income ETF is a very young fund, launched in May 2022. You may also have overlooked it in the vast sea of income-producing ETFs because it is an actively managed fund. Passive index funds tend to have lower annual fees, so it makes sense to start your fund screening process with that criterion.

But this JP Morgan The instrument may be worth a management fee of 0.35%. Here’s a quick summary of the fund’s unique qualities:

-

The experienced Premium Income ETF management team relies on data science to pick high-income stocks from growth-oriented stocks. Nasdaq 100 Market index.

-

54% of the portfolio is currently invested in IT and communications services – two market sectors closely linked to the ongoing AI boom.

-

Includes the top 10 holdings Complete list of Magnificent 7 stocks. – Proven winners with very large market values.

-

Some of these tech giants don’t pay dividends, but fund managers get monthly income from them in other ways.

-

Annual dividend yield is currently 9.3% after rising to over 12% over the summer.

-

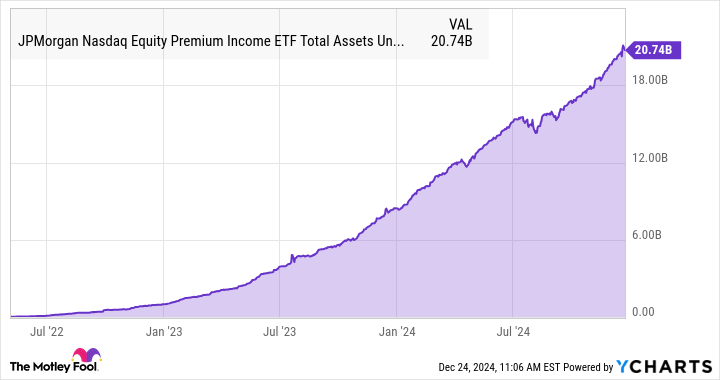

It has a huge assets under management of $20.7 billion, despite its short history in the market. Investors were quick to embrace this promising new fund:

-

Profits-enhancing methods include some risky tricks, such as selling short-term call options to generate payouts from volatile stocks. This is great when it works, but it can also lead to poor fund performance and Low returns in light of the ongoing market downturn.

-

The fund was launched two months ago This bull market He started. It has not yet been tested in a weak economy, which could unleash the downsides of options-based investment tactics.

-

A management fee of 0.35% may not sound like much, but it is well above the 0.06% average for today’s 10 largest ETFs, and even more so than lower-cost funds like ETFs. Vanguard S&P 500 ETF (NYSEMKT: flight). Fees can make a big difference in the long run. The Vanguard fund’s 0.03% annual fee adds up to 0.3% over a decade, while the Premium Income ETF’s fee will add up to 3.6% over the same period.

Comments are closed, but trackbacks and pingbacks are open.