Key points of the FOMC decision:

- The Fed will keep its benchmark interest rate unchanged at 5.00%-5.25% at the end of its June meeting, in line with expectations.

- Policy makers are pointing to a higher than previously thought peak rate in March, which means the hiking cycle is not over despite the day’s pause.

- gold prices Erase session gains after Federal Open Market Committee Ad crosses the wires

Recommended by Diego Coleman

Get your free gold forecast

Most read: The Japanese Yen continues to take a beating from the BoJ’s policy outside stance

The Federal Reserve wrapped up one of its most anticipated and anticipated policy meetings today, choosing to leave its benchmark interest rate unchanged in its current range of 5.00% to 5.25%, in line with market expectations.

The decision, which some senior FOMC members have sent widely in recent weeks, was reached unanimously, signaling that policymakers are staying on the same page and agreeing on a strategy to tackle inflation back to its long-term target of 2.0%.

The wait-and-see move comes as the Fed tries to buy time to better assess the evolving outlook and the cumulative impact of past actions. For context, the bank has rallied at each of its last 10 meetings, delivering 500 basis points of tightening since March 2022, in one of the most aggressive normalization cycles in decades.

The Fast and Furious tightening campaign appears to be paying off. Core CPI was above 8% for most of the past year, but is now running at 4.0% year over year. While an improvement in direction is welcome, it should not be confused with a job done; After all, the current rate is still twice the target while the base metric shows very sticky.

Main line and basic CPI chart

Source: BLS

Federal Open Market Committee Policy Statement

The statement was very similar to the one issued in May, with a few minor modifications. In a repeat of June, the central bank indicated that the economy is expanding at a modest pace and that employment gains were solid. She also confirmed that inflation remains high.

With regard to monetary policy expectations, the bank indicated that standing this month will allow the committee to evaluate additional information and its implications for monetary policy. The Bank also reiterated that “in determining the extent to which additional stabilization may be appropriate,” it will take into account the impact of full tightening, delays in implementation and economic/financial conditions.

Today’s guidelines weren’t overly stringent, but she clearly retained a flair for hiking and an open mind about future steps.

Recommended by Diego Coleman

Get free forecasts in US dollars

Summary of economic forecasts

gross domestic productbasic personal consumption expenditures and unemployment rate

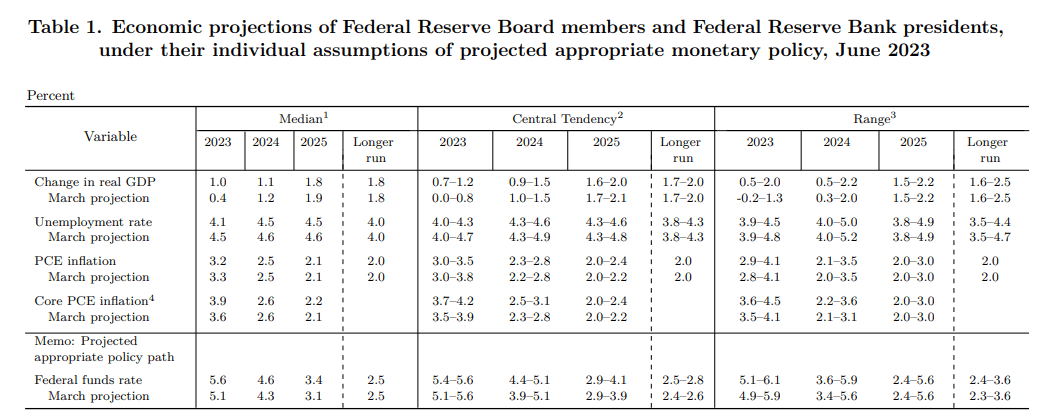

There were significant changes in the June Summary Economic Prospects (SEP) from the March quarterly estimates.

Going into the key details, the 2023 GDP and core PCE forecasts were revised up: the former from 0.6% to 1.0% and the latter from 3.6% to 3.9%. Economic activity forecasts indicate that there is no recession on the horizon yet.

For next year, GDP is expected to rise by 1.1%, just below the assumption of 1.2% three months ago. For its part, we see the Fed’s preferred measure of inflation drop to 2.6% in that period, on par with the previous estimate.

Looking at the employment situation, the unemployment rate at the end of the year fell to 4.1% from 4.5%, indicating confidence in the labor market’s ability to withstand a tighter monetary policy. In 2024, unemployment is expected to rise to 4.5%, less than a tenth of a percent from March’s point of view.

Fed Dot Plot

The dot plot, which sets Fed officials’ estimates of how borrowing costs will evolve in the future, was tighter than the version provided in March. However, the average interest rate forecast for 2023 increased from 5.1% to 5.6%. The new peak rate is equivalent to the target range of 5.50%-5.75%, which means two more hikes during the second half of the year.

For 2024, policymakers see the federal funds rate drop to 4.6%. Three months ago, the central bank saw interest rates at 4.3%. Fast forward to 2025, the headline rate is expected to drop to 3.4%, lower than envisaged in March when the policy setting forecast was 3.1%. All this indicates a lack of appetite for aggressive interest rate cuts in the coming years in the face of steady inflation.

The table below summarizes the Fed’s new macroeconomic forecasts

Source: Federal Reserve

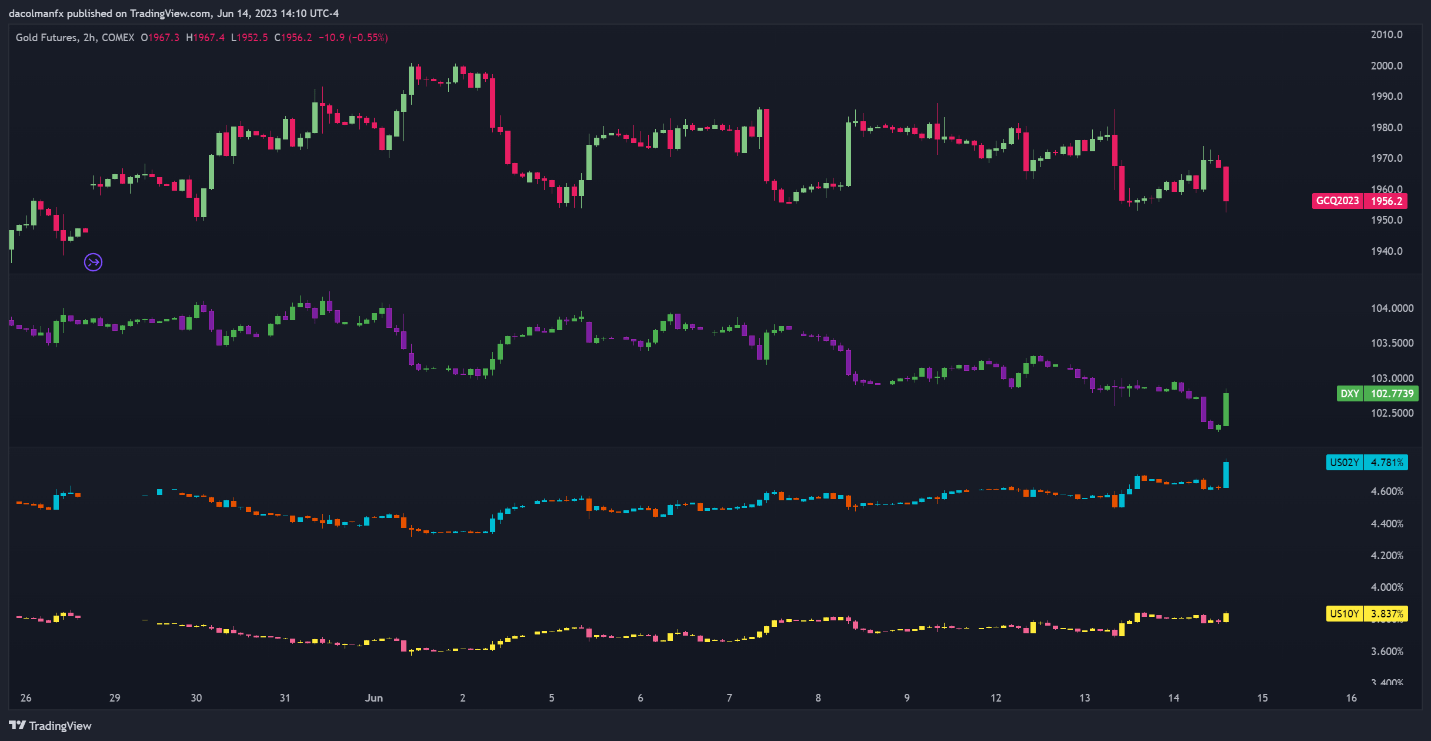

In an immediate reaction, gold prices erased the gains of the early session, and sank into the negative zone, under the pressure of the jump in US bond yields and the recovery of the US dollar. In general, a steeper Fed tightening path and the prospect of higher interest rates for a longer period should be negative for non-yielding assets such as precious metals. In any case, Powell’s press conference may provide more insight into the central bank’s monetary policy outlook.

Keep tuning in for more in-depth analysis

Gold prices, US dollar and productivity chart

Source: TradingView