Article written by IG Chief Market Analyst Axel Rudolph

The FTSE 100 is approaching the upper bound of the trading range

The FTSE 100 is making further advances even though a slew of UK companies are seeing their share prices fall on concern about the Bank of England (BoE) having to raise interest rates further.

The upper bound of the near 1-month sideways trading range is about to be hit with late May and current June highs at 7655 to 7660. Further resistance can be spotted at 7679 mid-May low.

Potential retracements for Friday should find support between June 12th and June 13th highs of 7,611 to 7,604.

FTSE 100 daily chart

Source: I.G

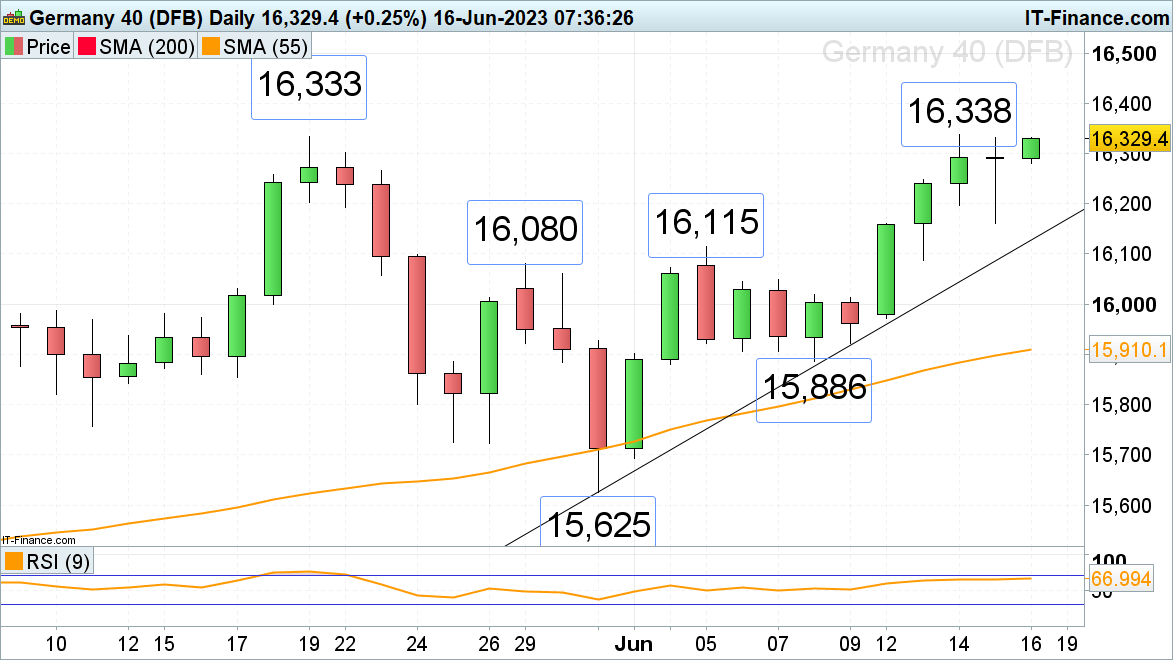

The DAX 40 continues to rise

The DAX 40 continues to rally towards a May high of 16,333 and a record high for the week at 16,338 as the European Central Bank on Thursday raised eight consecutive interest rate hikes by 25 basis points to 3.50% and hawkish expectations haven’t spoiled the party.

Above the all-time record high of 16,338 lies the 16,400 mark and the 16,500 area.

Immediate support can be seen at this morning’s low of 16208, below Thursday’s low of 16160 should act as temporary support.

DAX daily chart

Source: I.G

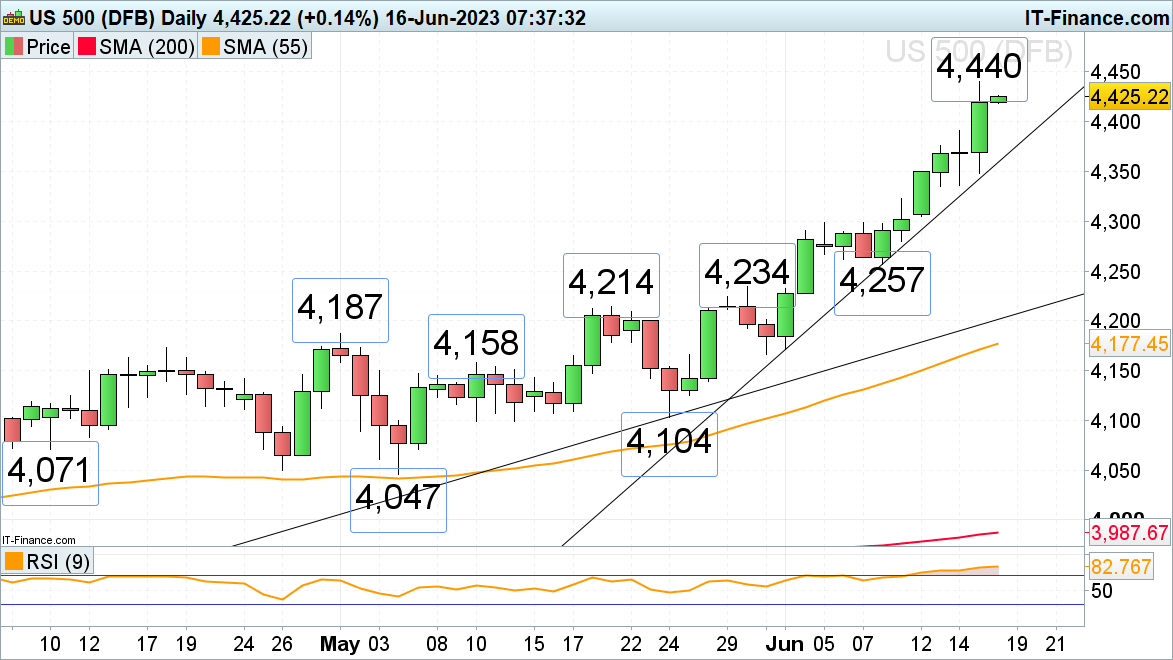

The Standard & Poor’s 500 is surging forward

The S&P 500 is about to end its fifth consecutive week of rising prices with an acceleration to the upside, having so far seen six consecutive days of rising prices despite the Fed’s hawkish stance allowing two more rate hikes. Visible.

Above Thursday’s 14-month high of 4,440, achieved above the peak of 4,421 March 2022, lurks the minor psychological mark of 4,500 which is the next bullish target.

With the option expiring today and a lot of Fed members speaking on Friday and next week, some volatility may soon enter the mix.

As the market view does not want to believe the Fed is just pausing and not ending the monetary tightening cycle, potential slippages could find support around the minor psychological level of 4400 and at Wednesday’s high of 4391 today.

S&P 500 daily chart

Source: I.G