Gold and silver technical levels and analysis

Recommended by Richard Snow

Find out what our analysts are forecasting for gold in the third quarter

Gold rose in light of the expected low volatility

Gold’s expected 30-day volatility continues to decline at a time when gold prices have rebounded from their lowest level at the end of June. Low volatility usually favors range bound trading conditions where the market lacks sustained momentum to break out of the consolidation period in search of a new trend.

Gold fluctuations across gold volatility index (GVZ)

Source: TradingView, prepared by Richard Snow

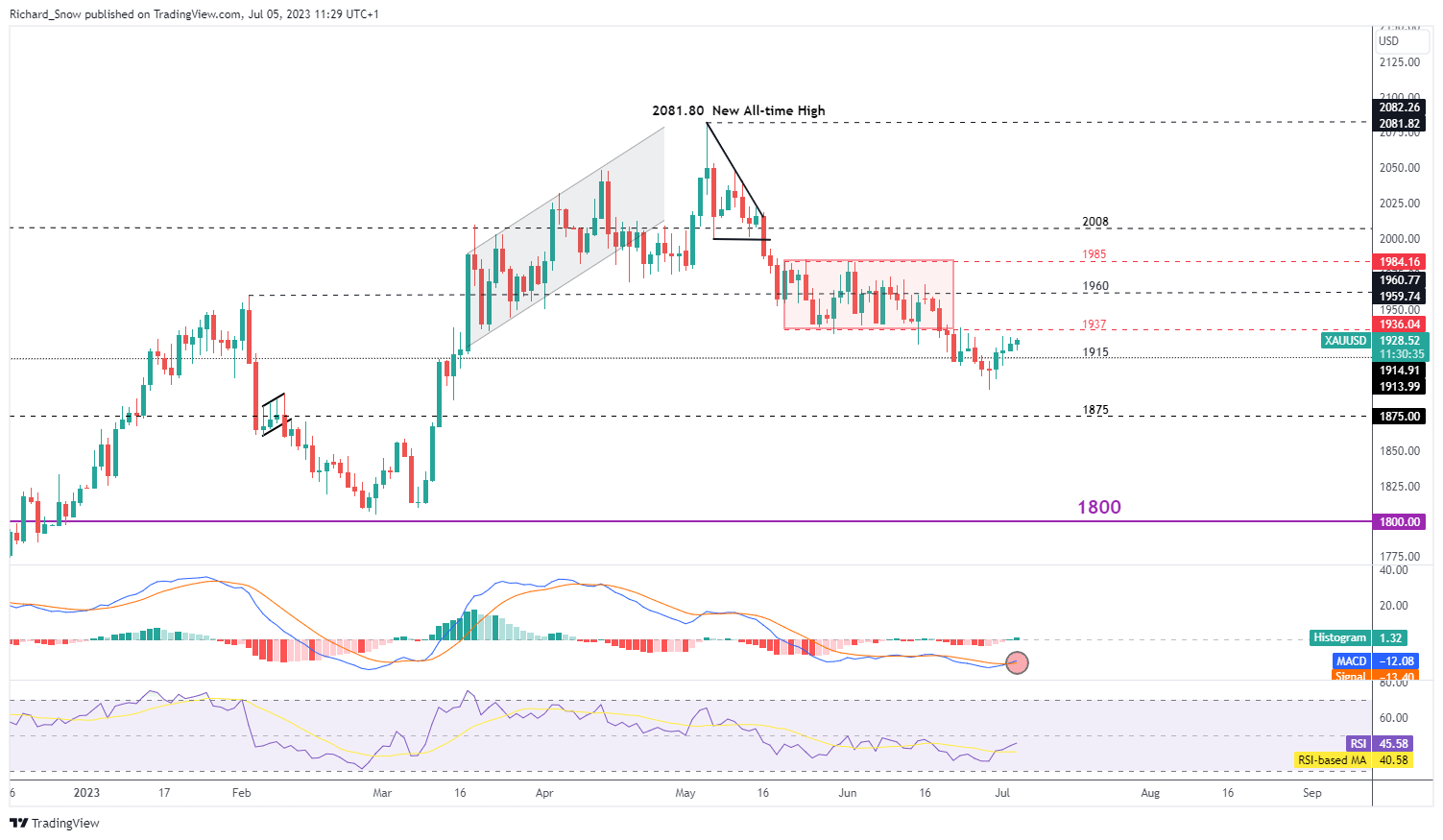

Gold bulls are trying to recover

The gold bulls have been out of favor since hitting a new all-time high in May of this year, with prices falling nearly 9% to a recent swing low. More hawkish rate guidance from the Fed threatens to trigger a hike in US interest rates, something the market is already grappling with more and more. Markets have been lagging behind the Fed, and expect market pressures to lead to bearish revisions on the interest rate front.

However, US economic data has held up quite well. Last week, a surprisingly upward revision to the final reading of GDP growth indicated that the economy was doing quite well on a relative basis. Moreover, the labor market continues to show its resilience as companies remain eager to retain employees for fear of not finding suitable replacements.

Gold is approaching the former support level of the 1937-1985 consolidation channel. Here, the bears may be looking for test signals and reversal of the recent bullish recovery. As interest rates rise, gold loses its attractiveness because it is not a return-bearing investment, which increases the chance of holding gold.

1937 can also be seen as a tripwire for a bullish extension as 1985 can finally be seen at the next level of resistance for the precious metal. MACD indicates that momentum is on the side of recovery here, but again, 1937 remains a key.

Daily Gold (XAU/American dollar) Schedule

Source: TradingView, prepared by Richard Snow

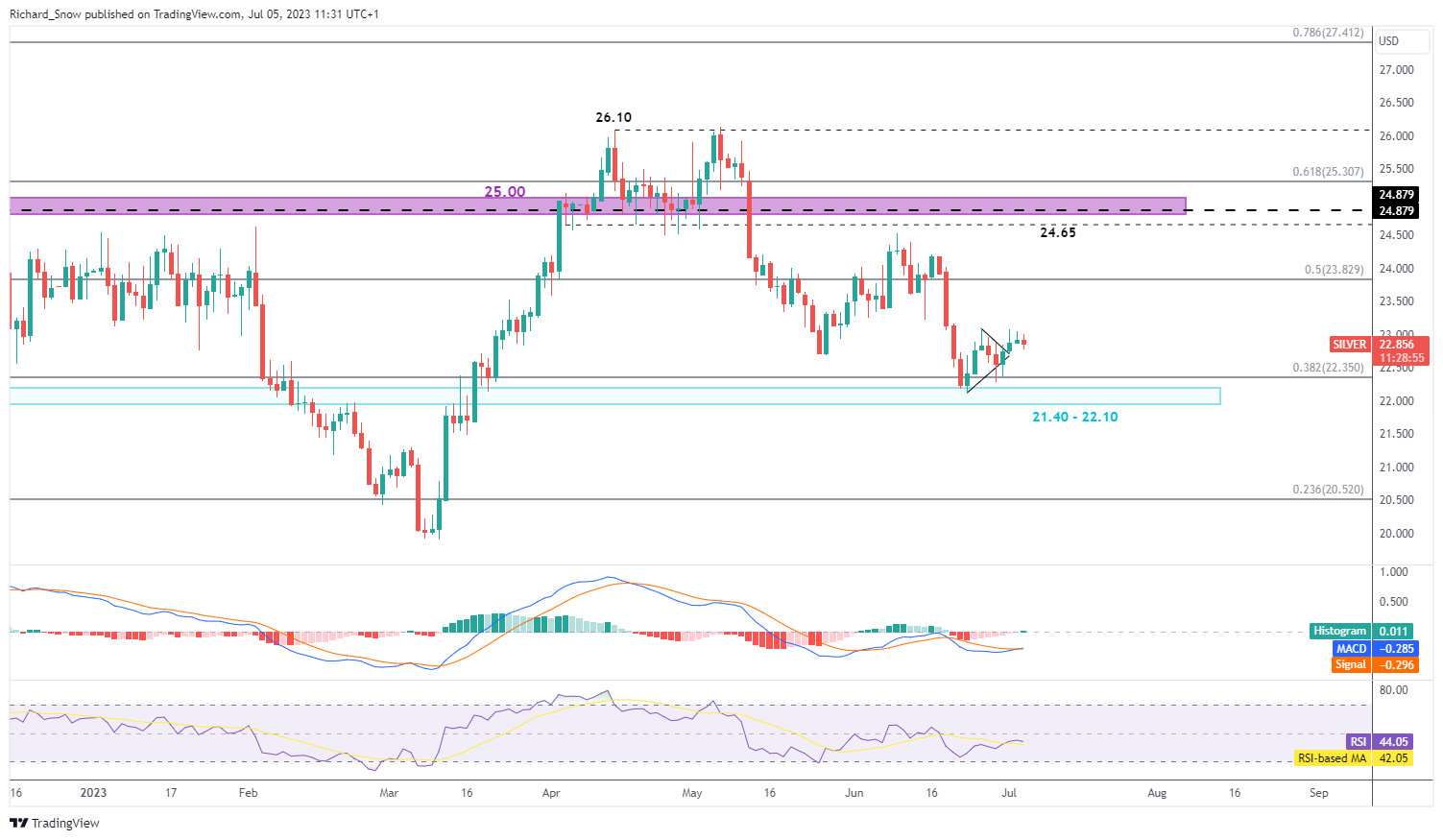

Silver erupts from the Pennant Formation

Silver is more bullish due to the recent break above what appears to be a scientific formation. A pennant formation usually leads to bearish continuation scenarios but the invalidation of such a move is now being implemented.

The bullish momentum has been unconvincing so far, as prices seem to be struggling to trade convincingly above 23.10 – the high point of the pennant. Bullish targets can be seen around 23.83, before focusing on 24.65.

The 38.2% Fibonacci retracement of the 2021-2022 major move at 22.35 is showing for the bears in case the metal tested 23.10 before heading lower.

Daily Silver Chart (XAG/USD)

Source: TradingView, prepared by Richard Snow

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @employee