Analysis of Nikkei (Japan 225)

- The Nikkei finished the first half of the year narrowly behind the Nasdaq as foreign investors piled on

- The depreciation of the yen and the damage from US data to risk appetite sent the Nikkei lower

- Possible double top formation for Nikkei, indicating potential for extended selling

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Learn how to forecast the price of the yen in the third quarter

The Nikkei 1H finished in second place, behind the high-flying Nasdaq

The Nikkei was one of the best-performing stock indices in the world during the first half of 2023, bested only by the high-flying Nasdaq Technology Index. In fact, the Nikkei finished the first hour with a gain of 27.8%, just below the Nasdaq’s 29.86%.

The performance of the main indicators since the beginning of the year to date

Source: FT, Bloomberg. Prepared by Richard Snow

The stellar performance is said to be due to a number of tailwinds that are forcing asset managers to rethink their views on Japanese stocks. Continuous monetary support from the unchanging Bank of Japan Governor Mr. Ueda creates an environment with ample access to credit, and the depreciation of the Japanese yen improves the company’s profitability. The added advantage of the yen’s continued depreciation is that it makes it cheaper to buy Japanese stocks for foreign buyers who have already piled into the domestic stock market.

A recent Bank of America report revealed that inflows into Japanese stocks over the past five weeks amounted to $8.9 billion. Over the same time period, inflows to large US VC funds were $12.9 billion – the most in nearly 8 months as investors look to squeeze every last ounce out of a stock rally.

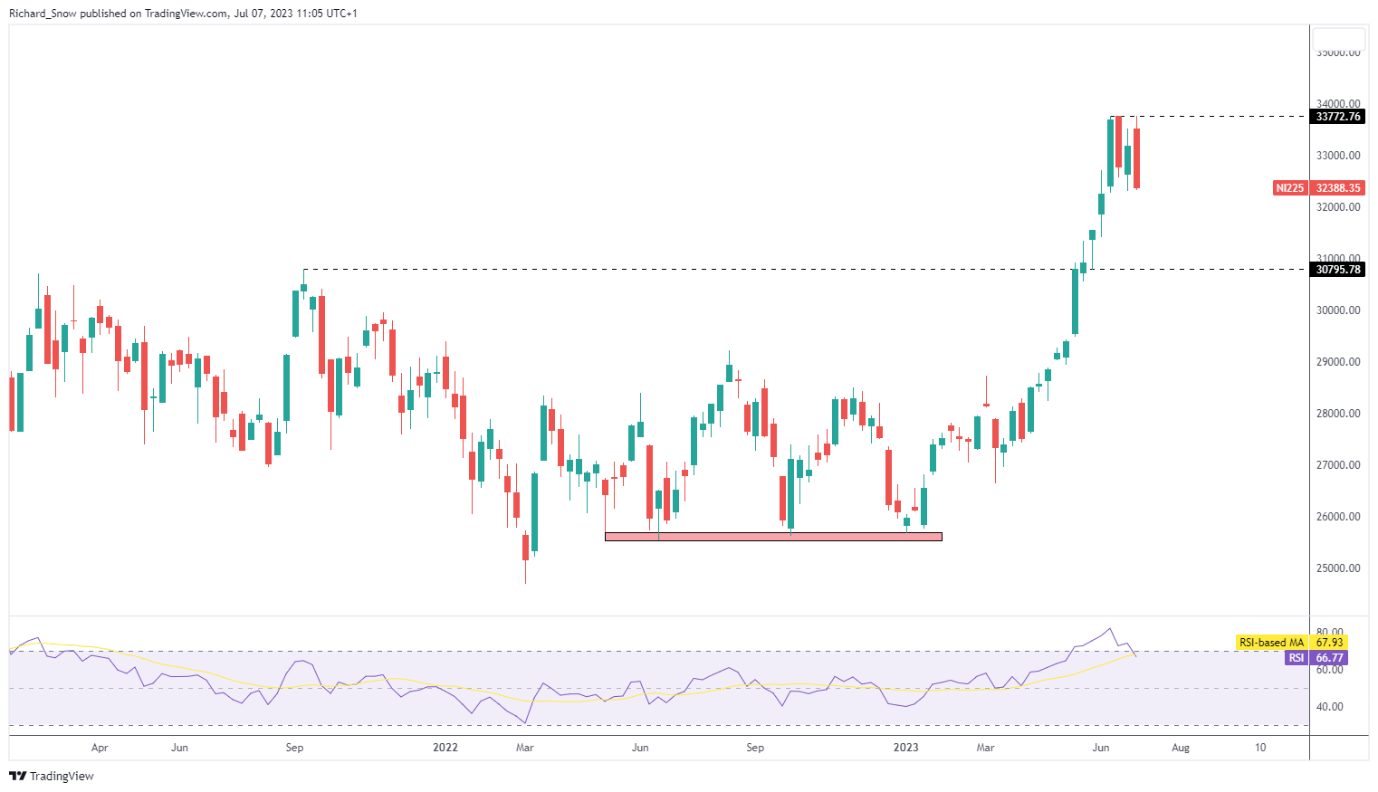

Nikkei technical levels to consider

The Nikkei has risen significantly this year as can be seen from the weekly chart. The bullish momentum stalled at the well-defined level of 33,772 – which failed to see the slightest move higher. Since the retest of 33,772, the index has sold off, ending an extended period when the index fluctuated in and out of overbought territory.

Nikkei weekly chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

The new quarter brings with it a lot of opportunities

The yen’s rise, on news of broad participation in wage increases this year – indicating policy normalization ahead – appears to have weighed on the Nikkei bulls. At the same time, a series of impressive US economic data (upward GDP revision, improvement in services PMI, ADP employment data yesterday) indicate that the Fed’s hawkish insistence is not being let down.

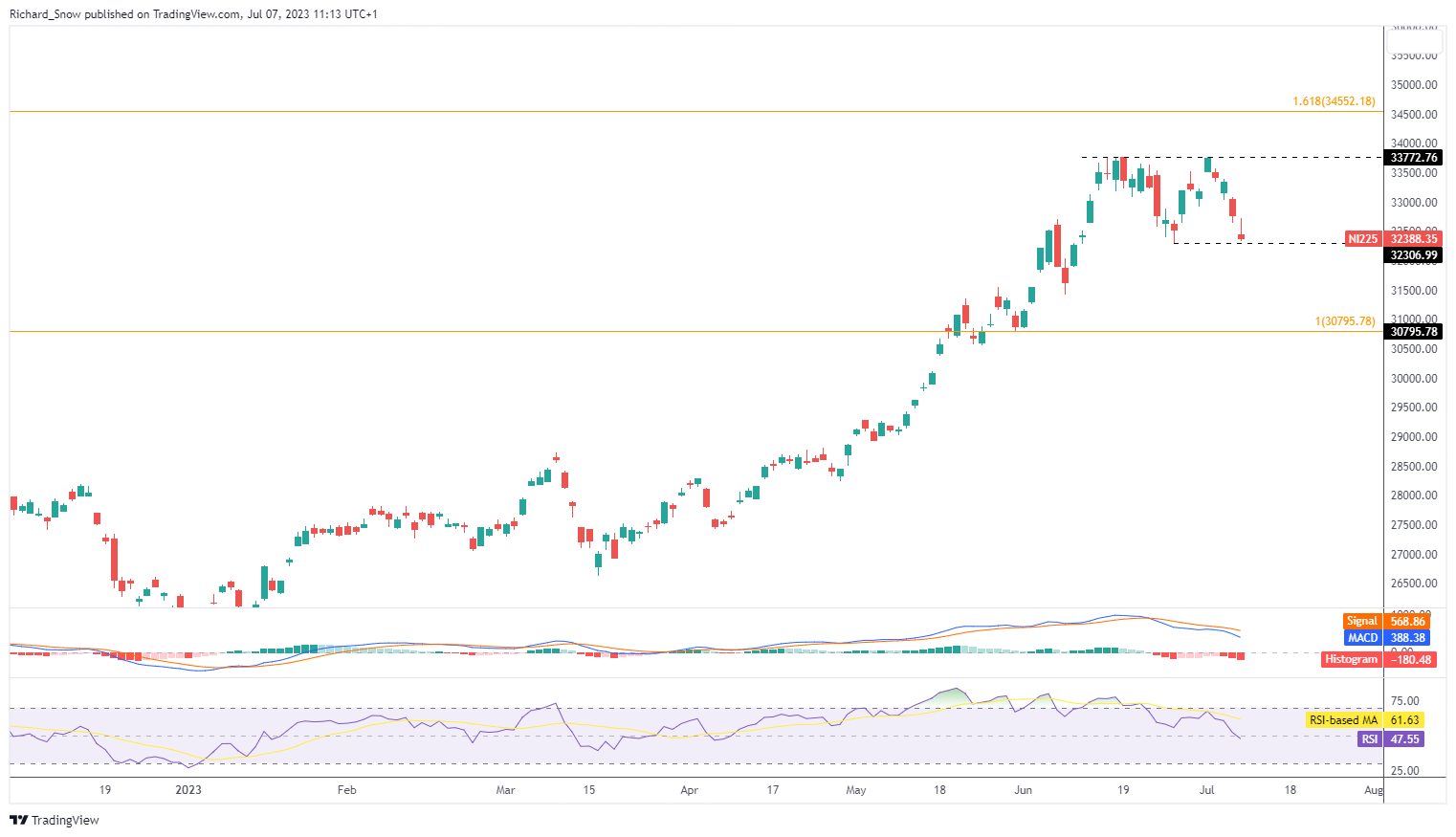

The daily chart helps to zoom in on price direction and more recent levels of interest if we want to see extended selling. Of course, the recent swing low at 32307 provides a litmus test for the continuation of the downside as the MACD indicates that the momentum is still on the sellers side.

The emergence of what appears to be a double top indicates the possibility of further decline. With the index closing the week lower, after initially rallying during intraday trading on Friday, our focus turns to the US Nonfarm Payrolls data as this could affect risk sentiment early next week.

Nikki daily chart

Source: TradingView, prepared by Richard Snow

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @employee