iQoncept

Despite a disappointing start to 2023, the healthcare sector has several promising industries waiting to outperform this year, Goldman Sachs said in a recent report after the bank concluded its annual healthcare conference in Dana Point, California, last month. .

the The event, which was held for the 44th time with the participation of more than 200 companies, provides a glimpse into the mid-year sentiment in the healthcare sector. Healthcare stocks in the S&P 500 have lost about 5% this year, becoming the third worst performing sector in the benchmark.

According to Asad Haider, head of healthcare research at Goldman, the sector posted one of the lowest first-half performances in at least three decades this year. He attributes the underperformance to regulatory issues, growth concerns, macroeconomic turnover, and investor preference for large-cap technology stocks.

In a small survey of investors conducted by Goldman Sachs in conjunction with the event, only 46% expected health care to outperform the S&P 500 in the second half of 2023, while the remainder expected a subdued or underperforming sector.

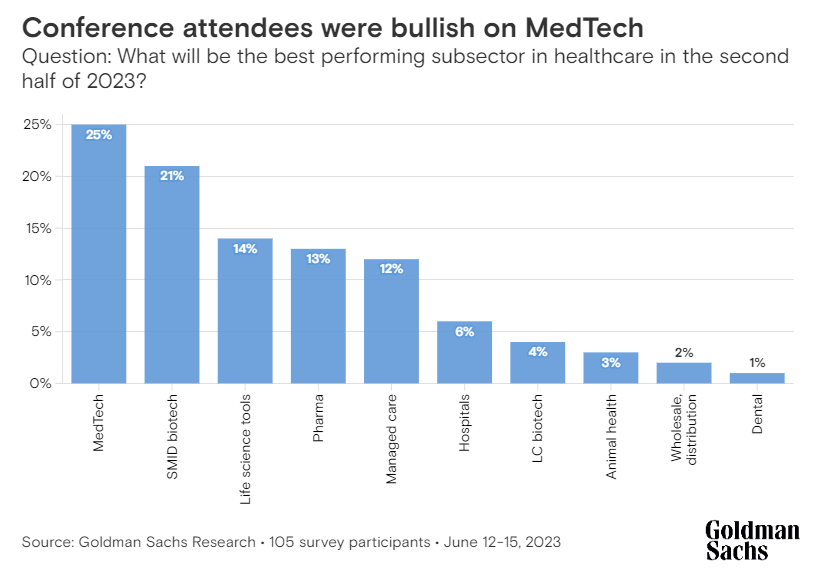

“However, there were several pockets of optimism,” the analyst added, noting that respondents voted that MedTech was the sub-sector likely to outperform in the second half of 2023, given the strong action volumes seen in Second Quarter.

With 25% indicating bullish views on MedTech, biotechnology and life sciences instrument makers SMID-cap came in second and third, with 21% and 14% positive votes, respectively, while dental stocks came in last. At the same time, 12% and 6% of the participants were optimistic about managed care and hospitals, respectively.

On one end of the medical spectrum hardware makers, which underperformed during COVID, is emerging stronger as volumes of surgical and elective procedures are restored and normalized amid waning cost pressures. On the contrary, post-COVID normalization trends have made it difficult for pandemic beneficiaries such as life sciences, instrumentation, and managed care companies.

Meanwhile, mergers and acquisitions were among the most widely discussed topics at the conference, Haider said. The analyst attributes biopharmaceutical companies’ interest in mergers and acquisitions to a potential loss of about $200 billion in revenue that the sector is expected to lose this decade as some key drugs exit patents.

It is estimated that pharmaceutical and biotech companies spent $85 billion on acquisitions during the first five months of the year, compared to about $36 billion for the same period last year.

The sudden rise in M&A activity has already prompted regulatory scrutiny. The FTC filed a lawsuit in May to block Amgen’s (AMGN) $28 billion acquisition of Horizon Therapeutics (HZNP), which was set to become last year’s largest biopharmaceutical M&A deal.

Haidar said that despite the regulatory uncertainty, especially with regard to larger deals, “the basic expectation is that there will be mergers and acquisitions going on,” noting that “the pharmaceutical industry will need to grow and be on a massive amount of cash.”

According to Goldman Sachs, the global pharmaceutical industry has $700 billion in dry powder in cash and leverage to splurge on in acquisitions and research and development deals.

Leading MedTech Players: Abbott Laboratories (New York Stock Exchange: ABT), intuitive surgery (Nasdaq: ISRG), Medtronic plc (New York Stock Exchange: MDT), Stryker Corporation (New York Stock Exchange: SYK), Boston Scientific Corporation (BSX), Becton and Dickinson (BDX), Edwards Lifesciences (EW), DexCom (DXCM)

Managed care companies: UnitedHealth Group (UN), Elertain Health (ELV), CVS Health Corporation (CVS), The Cigna Group (CI)

Healthcare providers include HCA Healthcare (HCA), Community Health Systems (CYH), Surgery Partners (SGRY), Tenet Healthcare (THC), Comprehensive Health Services (UHS), and Select Medical Holdings (SEM).

Leading biopharmaceutical companies: Pfizer (PFE), Merck (MRK), Bristol-Myers Squibb (BMY), Eli Lilly (LLY), AstraZeneca (AZN), GSK (GSK), Sanofi (SNY) (OTCPK: SNYNF), Novo Nordisk (NVO), AbbVie (ABBV), Gilead (GILD), Johnson & Johnson (JNJ), Biogen (BIIB), Amgen (AMGN), Moderna (MRNA)

Life sciences instrument makers: Thermo Fisher Scientific (TMO), Danaher Corporation (DHR), Agilent Technologies (A), Illumina (ILMN)

Dental stock: Align Technology (ALGN), Henry Schein (HSIC), Dentsply Sirona (XRAY)