gold price (XAU/American dollar) analysis, price and chart

- A weaker US dollar is helping gold move higher.

- Retail sentiment is mixed.

Recommended by Nick Cooley

Download our new Q3 Gold brand guide

For all market movement data releases and events, see DailyFX Economic Calendar

US Treasury yields fell sharply over the past week as traders increased their bets that the Federal Reserve’s monetary tightening program is coming to an end. The yield on exchange rate sensitive TREs is down 50bps since last Thursday, while the yields on exchange rate sensitive ETs have declined by about 30bps along the curve, while the yields on 30bps have declined about 18bps over the same time. a period. On the short end at least, it looks like we’re past peak rates.

2 year UST return daily chart

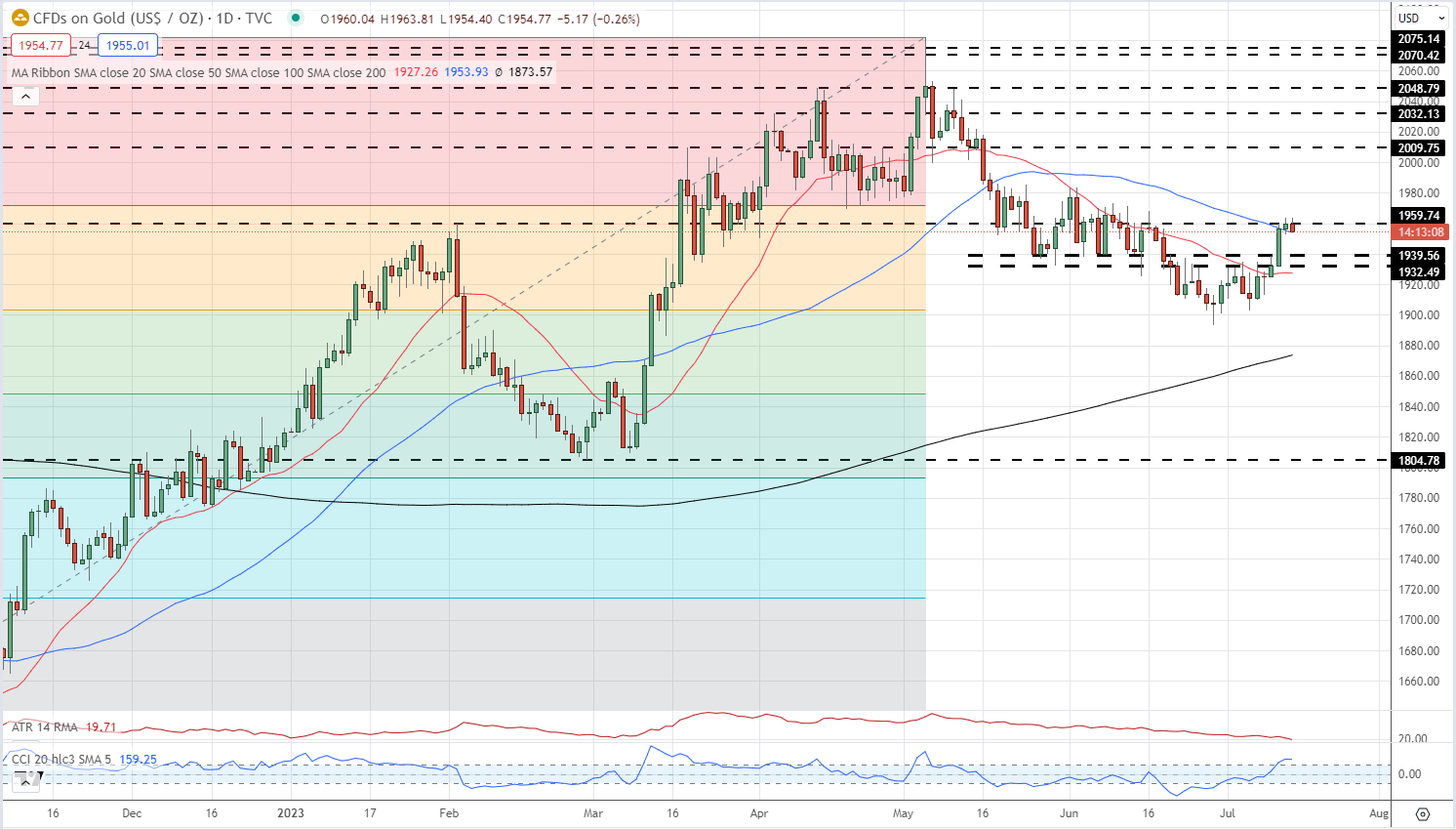

A tailwind of lower rates helped push gold through a support-turned-resistance area around $1932 an ounce. and $1,940 an ounce. This area is now back at support and should withstand any short-term selling. Below here, the 20-day simple moving average is acting as additional support. On the upside, 1971 dollars / ounce. and $1,985 an ounce. It must act as a brake on any move up.

Find out what kind of forex trader you are

Daily gold price chart – july 14, 2023

Chart via TradingView

|

change in |

Longs |

Shorts |

Hey |

| Daily | -2% | -1% | -2% |

| weekly | -7% | 13% | -1% |

Retail traders remain long of gold but sentiment is mixed

Retail trader data shows that 65.23% of traders are net long with the ratio of long to short traders at 1.88 to 1, the number of net long traders is 2.79% higher than yesterday and 13.82% lower than last week, while the number of net long traders is Sell to traders is 5.32% lower than yesterday and 41.56% higher than last week.

We usually take a view contrarian to crowd sentiment, and the fact that traders are holding on suggests that gold prices could continue lower. Positioning is net longer than yesterday but less net buying than last week. A mixture of current feelings and recent changes gives us More mixed bias in gold trading.

what is your opinion of gold Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.