US Dollar, Australian Dollar, Canadian Dollar and Mexican Peso vs. Japanese Yen – Forecast:

- US dollar / Japanese yen Steady after the acceleration of price pressures across Japan last month.

- The main focus now is on the BoJ meeting next week.

- How key JPY Crosses look at going into next week?

Recommended by Manish Grady

Get your free predictions for the best trading opportunities

The Japanese yen was steady even as price pressures accelerated in Japan last month amid the growing view that inflation had peaked.

The core CPI nationwide rose to 3.3% in June from 3.2% in May. The so-called core core inflation measure (which excludes both food and energy) slowed to 4.2% year-on-year from 4.3% in May. This follows the slower-than-expected Tokyo June inflation report as cost drivers eased, providing some room for the Bank of Japan (BOJ) to continue with ultra-easy monetary policy for the time being.

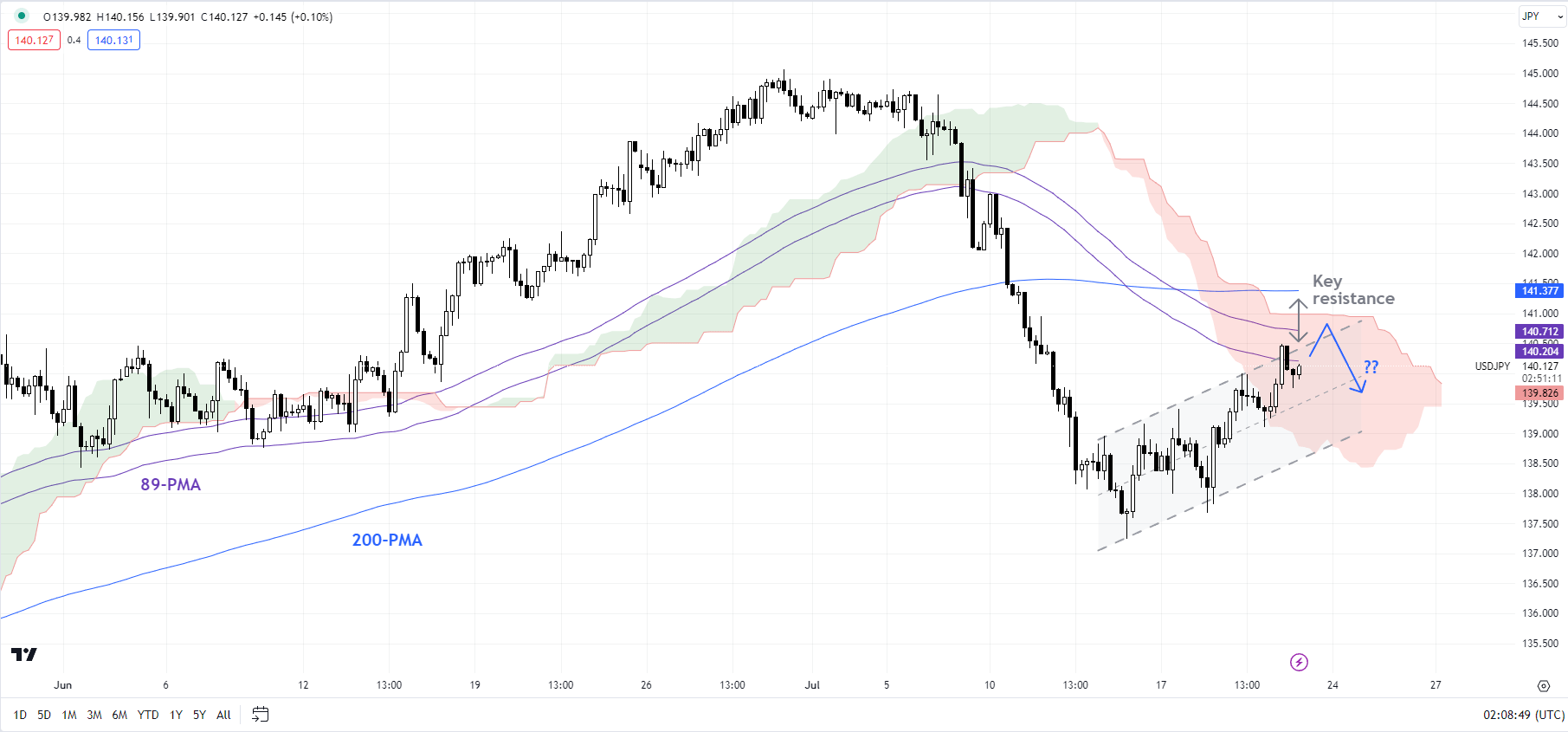

USD/JPY daily chart

Chart by Manish Gradi using TradingView

The BoJ is widely expected to keep its policy settings unchanged when it meets next week, but the main focus will be on the new quarterly outlook and discussions regarding phasing out the controversial yield curve control (YCC) policy after the BoJ’s summary of views at the June policy meeting quoted a board member as saying the central bank should discuss adjusting the YCC to improve market function and mitigate the “high cost.”

Bank of Japan Governor Kazuo Ueda stressed that the central bank is still some way away from achieving its 2% target, ensuring the continuation of ultra-loose monetary policy for the time being.

USD/JPY 240 minute chart

Chart by Manish Gradi using TradingView

USD/JPY: Rally may run out of steam soon

On the technical charts, USD/JPY is approaching a strong convergence ceiling, including the 200-period moving average, the 89-period, and the upper edge of the Ichimoku Cloud on the 240-minute charts. This coincides with the 38.2%-50% retracement of the decline since early July. A sharp slide has increased the odds of a breakout of the USD/JPY uptrend since the beginning of 2023. For more information on this, see “Cracks Appearance in the Downtrend of the Japanese Yen; USD/JPY, CAD/JPY, MXN/JPY Price Setup,” posted on July 10. A retest of last week’s low of 137.25 seems likely.

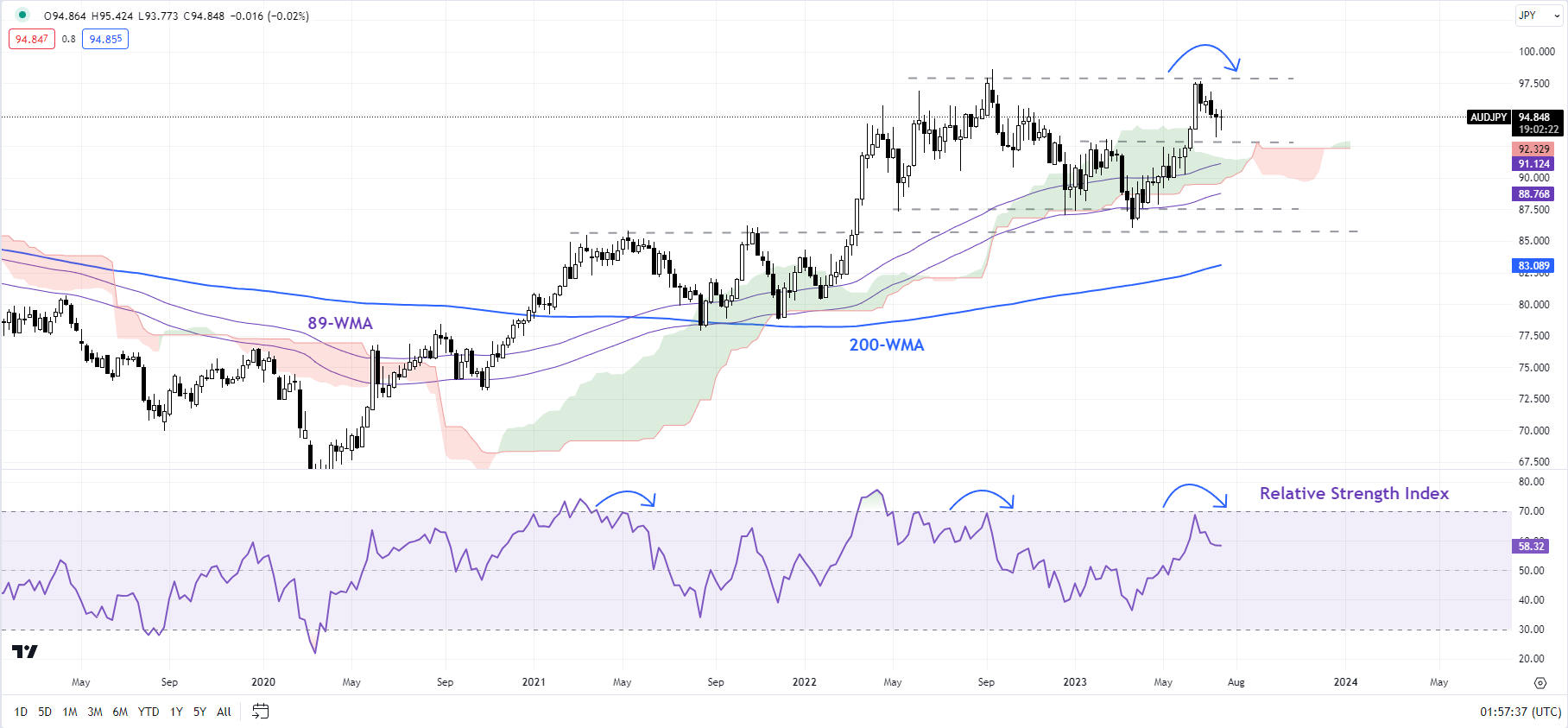

AUD/JPY weekly chart

Chart by Manish Gradi using TradingView

Australian Dollar / Japanese Yen: The uptrend is capped

AUD/JPY failed to extend its gains after sharp rally in mid-June to the decisive ceiling at 2022 high of 98.40. A downward reversal of the 14-week relative strength index (RSI) from the upper ceiling at 70 raises odds of some weakness in the crossover if history is any guide (see chart). A break below the immediate support at the mid-February high of 93.00 could expose the downside towards 89.00.

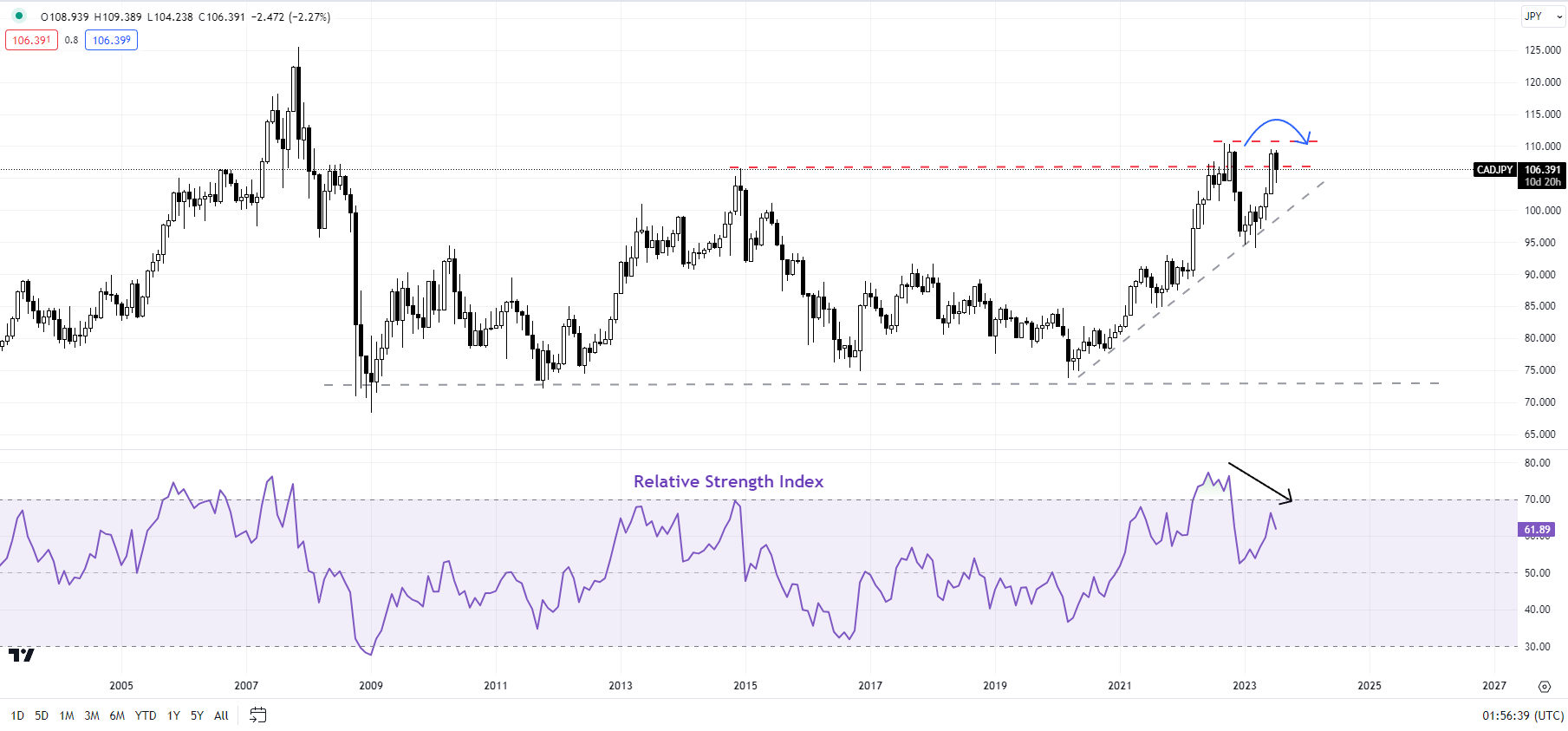

CAD/JPY monthly chart

Chart by Manish Gradi using TradingView

CAD/JPY: Pullback is possible

A weak rebound in the 14-month RSI even as CAD/JPY has returned to highs in late 2022 is a strong sign that the crosses rebound from April is running out of breath. CAD/JPY faces initial resistance at 106.85 (50% retracement of the drop from end of June), and a stronger barrier at 107.50 (61.8% retracement).

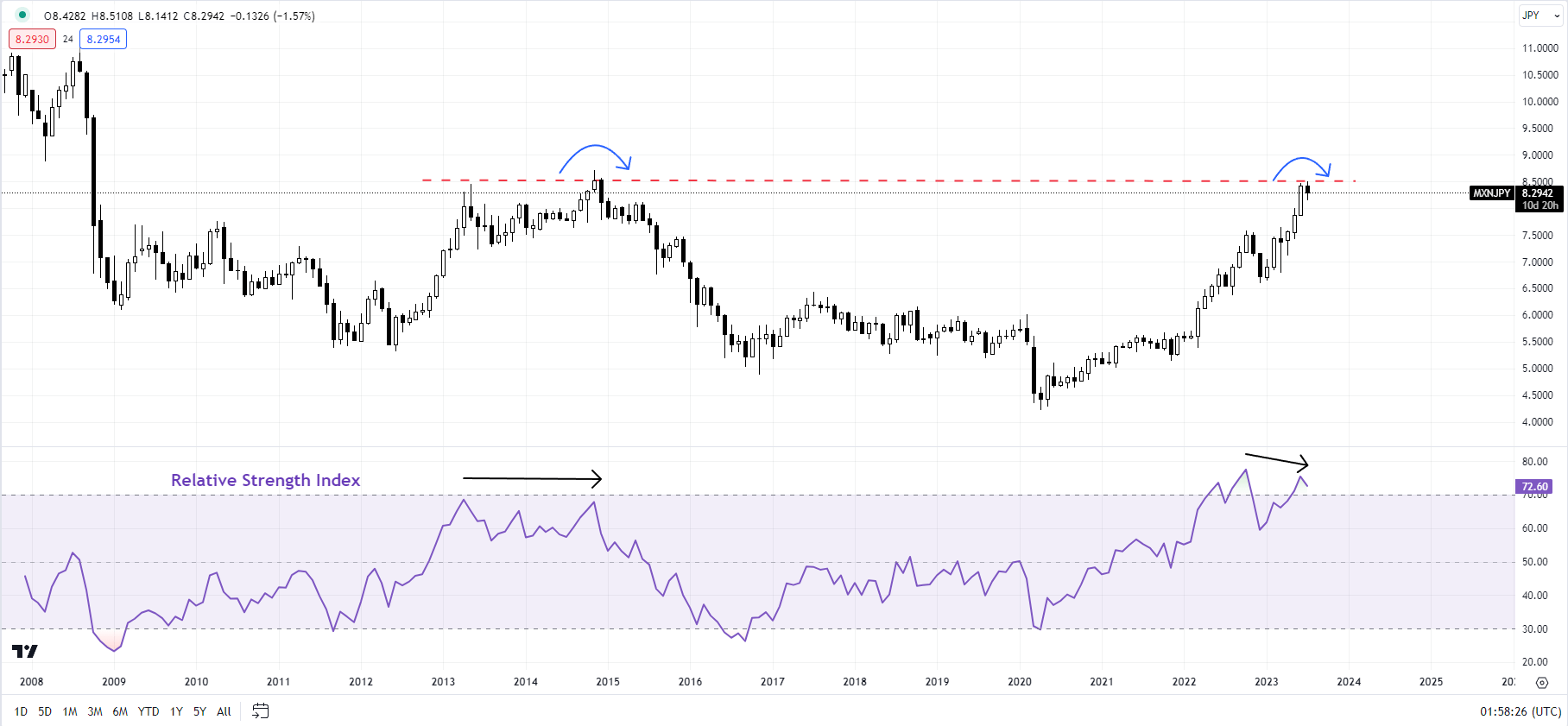

MXN/JPY Monthly Chart

Chart by Manish Gradi using TradingView

MXN/JPY: Fatigue rally

Negative Momentum Divergence (price rally correlated with the 14-month RSI pause) suggests that MXN/JPY’s multi-month rally is losing momentum as it is testing a major hurdle at the 2014 high of 8.72. At the very least, there is likely to be some kind of consolidation especially given the low diversification of the market. For more details, see “Japanese Yen Bearish Cracks Emerge; USD/JPY, CAD/JPY, MXN/JPY Rate Settings,” published on July 10. A decline towards the 89-day moving average (now at around 7.85) cannot be ruled out.

Recommended by Manish Grady

Get your free EUR forecast

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish