US Dollar (DXY) news and analysis

- Positive manufacturing data lifts the looted dollar

- Technical considerations for DXY: A bounce at support provides support for a pullback development

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Find out what our analysts expect in the first quarter against the US dollar

Positive manufacturing data lifts the falling dollar

In a somewhat unexpected turn, the dollar received a welcome boost after much better-than-expected data from the Empire State Manufacturing Index in New York. The index, after recording four consecutive prints below zero (indicating a contraction), rose to 10.8 when it was only expected to come in at -18.

Customize and filter live economic data via DailyFX Economic calendar

USD Basket (DXY) – Technical considerations

Manufacturing data as a whole has held back the more important services industry, but a recent rebound in New York’s Empire State variance has sent the greenback higher for the day so far, extending a decline that gained traction near the end of last week.

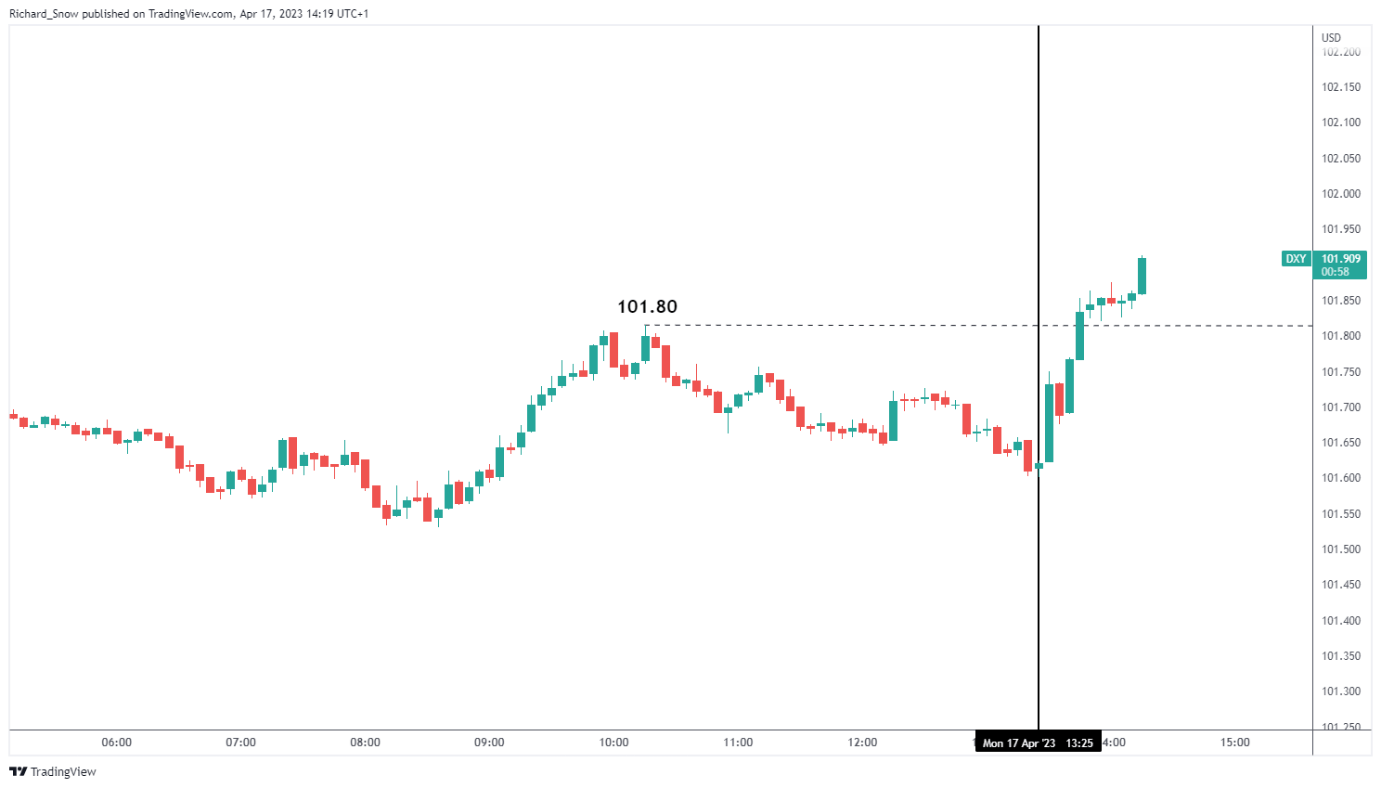

5 minute dollar basket chart

Source: TradingView, prepared by Richard Snow

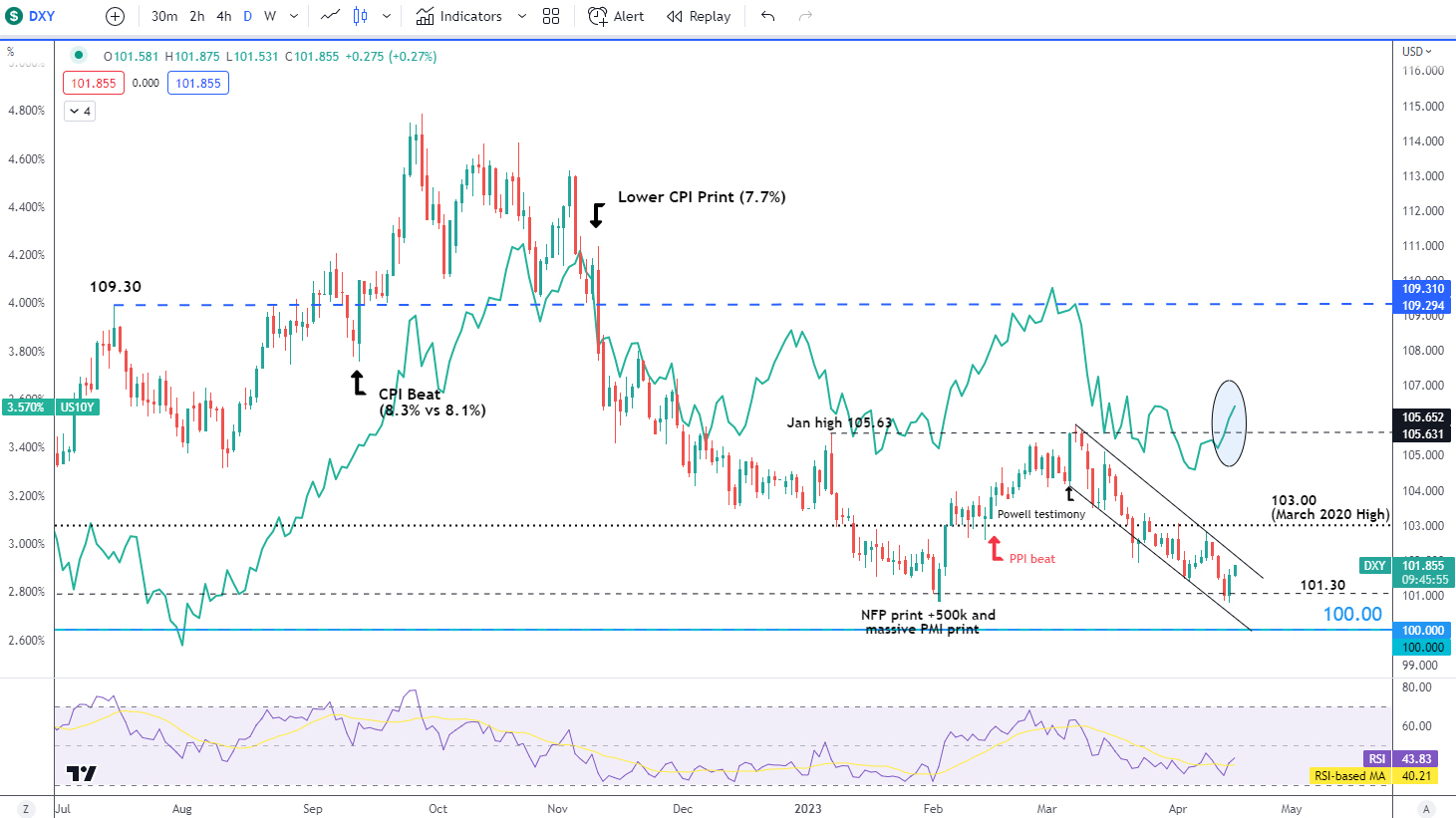

The dollar trades roughly in line with the 10-year Treasury yield and the recent move higher coincides with another hike in US interest rates. DXY remains inside the descending channel as the broader downtrend continues. However, if the reversal is in full swing, the dollar bulls will be on the lookout for a breach of an ascending channel and attempt to trade towards 103.00.

Continuation of the downtrend leads to lower levels like 101.30 and the psychologically important level 100.

Daily chart of the US Dollar (DXY) basket with the 10-year Treasury yield

Source: TradingView, prepared by Richard Snow

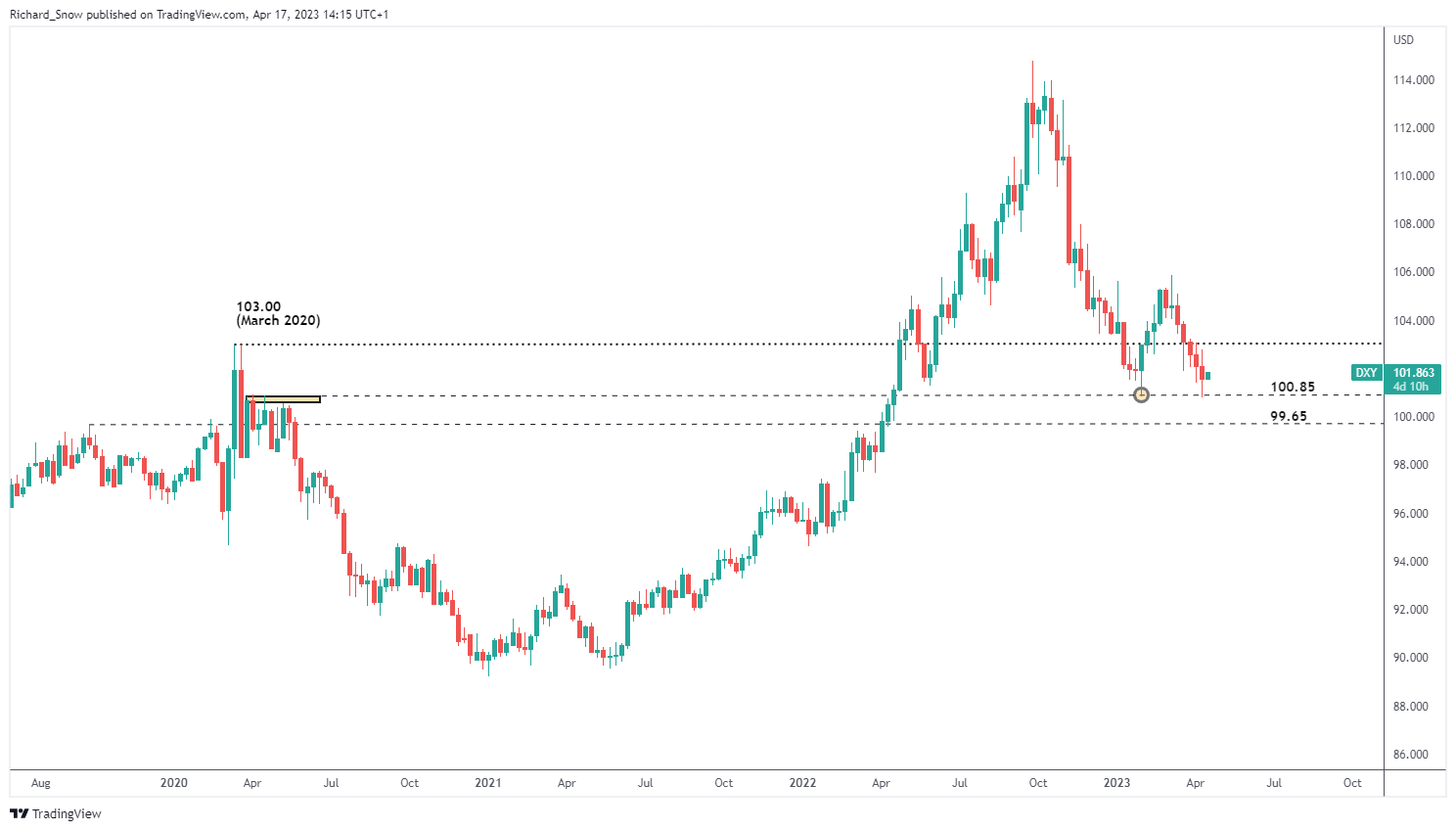

There is something to be said for a potential dollar decline like last week’s US inflation data He proved that although headline inflation fell like a stone, core inflation (headline inflation excluding more volatile items such as fuel and food) rose slightly. This has now led the markets to revise their interest rate expectations upwards, which supports at least a short dollar decline. The weekly chart below indicates that a short term reversal may be in the works as prices failed to sell off beyond 100.85 and are now trading higher.

DXY Weekly Chart

Source: TradingView, prepared by Richard Snow

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @tweet

Comments are closed.