GOLD PRICE (XAU/USD) FORECAST

- Gold prices stall after encountering trendline resistance near $1,950 ahead of a high-impact event on Friday: the release of the latest U.S. jobs report

- Total nonfarm payrolls for August are forecast to have risen by 170,000, following July’s 187,000 increase

- This article looks at XAU/USD’s key technical levels to watch in the coming days

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Setups – Key Price Levels for USD/JPY, USD/CAD & USD/MXN Ahead of US Jobs Data

Gold prices (XAU/USD) lacked directional conviction on Thursday, moving between small gains and losses around the $1,940 threshold, in a trading session characterized by limited volatility across many assets ahead of a high-impact event for financial markets just before the weekend: the release of the latest U.S. jobs report.

During the Jackson Hole Symposium, Fed Chair Powell noted that inflation remains too high and called for more vigilance, but indicated that the FOMC will “proceed carefully” in any further moves after having already delivered 525 basis points of tightening since 2022. This cautious stance means one thing: the institution will lean heavily on data.

The pivot toward a data-centric strategy elevates the role of incoming economic information to a paramount status. For this reason, the next employment survey will take on added importance. Within this context, a robust report has the potential to nudge policymakers towards one or two additional rate hikes, while lackluster figures could prompt them to embrace a more dovish posture.

Focusing on Friday’s event, total non-farm payrolls for August are forecast to have risen by 170,000, following the 187,000-gain recorded in July. Meanwhile, nominal wages are seen increasing 0.3% on a monthly basis, resulting in the yearly reading holding steady at 4.4%, a figure that is still too high and could be incompatible with a sustained convergence of inflation towards 2%.

Unlock the secrets of successful precious metals trading. Download the “How to Trade Gold” guide today

Recommended by Diego Colman

How to Trade Gold

Related: US Jobs Report Preview: Decoding How Gold, US Dollar and Yields Might React

UPCOMING NFP REPORT

Source: DailyFX Economic Calendar

When considering potential scenarios, the string of disappointing macro indicators in recent days, including JOLTS, consumer confidence, and private sector hiring, has heightened uncertainty about the outlook. If the NFP figures validate the trend of economic weakness, interest rate expectations could drift lower, weighing on yields and on U.S. dollar. This could be quite bullish for gold prices.

In the event of better-than-expected results, there may be limited room for a strong rally in yields and greenback, barring a massive upside surprise in the numbers, as traders may be reluctant to fully embrace the narrative of persistent economic strength due to conflicting signals emitted by other indicators.

To understand how positioning data may affect market trends, download the sentiment guide and empower your gold trading

| Change in | Longs | Shorts | OI |

| Daily | -2% | 5% | 0% |

| Weekly | -15% | 42% | -1% |

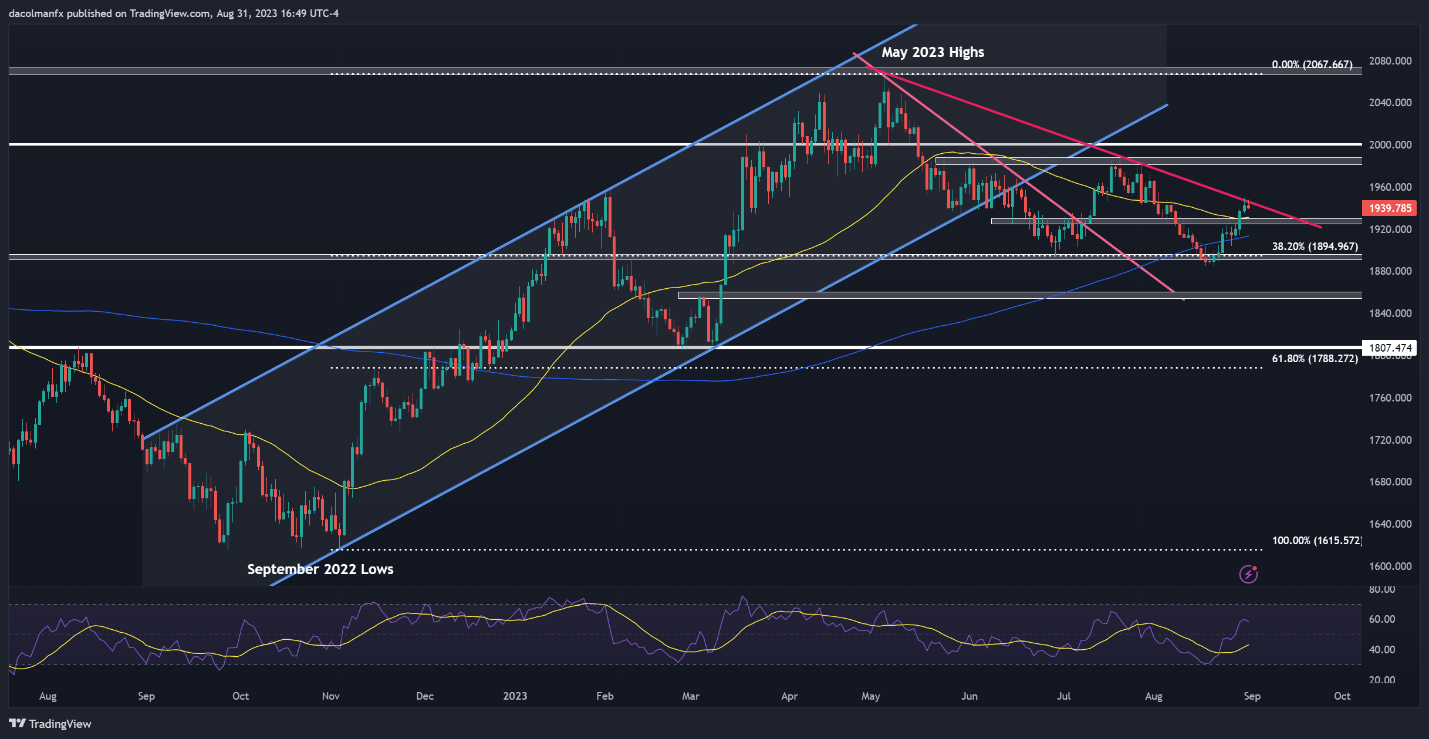

GOLD PRICE TECHNICAL ANALYSIS

Gold rose in the latter part of August, reclaiming both its 200-day and 50-day simple moving averages. However, XAU/USD’s upward momentum faltered before the month concluded, coinciding with prices encountering short-term trendline resistance.

While the ongoing rebound remains viable, a clean break above the $1,950 barrier is necessary for renewed bullish confidence to infiltrate the precious metal market. Should this scenario play out, we could see a climb towards $1,985, followed by progression towards the psychological $2,000 mark.

On the flip side, if sellers regain the upper hand and repel prices from current levels, initial support appears at $1,930, and $1,912 thereafter, the 200-day SMA. Further down the line, the next floor to keep an eye on is located around $1,895, which corresponds to the 38.2% Fibonacci retracement of the Sept 2022/May 2023 rally.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast