GBP/USD, DXY PRICE, CHARTS AND ANALYSIS:

- GBP/USD Looks to Recover Yesterdays Losses and Holds Above the 100-Day MA Ahead of US Data.

- Price Action Remains Choppy as Cable Eyes Clarity from US Data. Will September Provide More Clarity?

- IG Client Sentiment Shows Retail Traders are Net Long on Cable. As We Take a Contrarian View to Client Sentiment at DailyFX, Are We in for Further Downside?

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Read More: US Dollar Forecast: Will Fed Chair Powell Inject Further Momentum at Jackson Hole?

GBPUSD has found support at the 100-day MA as the DXY also takes a pause ahead of a key batch of US data releases later today. Cable had been enjoying a renaissance this week as the DXY itself came under selling pressure in the early part of the week. Yesterday we saw a recovery by the DXY which dragged Cable toward the 100-day MA.

Recommended by Zain Vawda

Forex for Beginners

DOLLAR INDEX (DXY) AND US DATA DOMINATE

The Dollar index has been driving price action in Cable this week as we have a lack of high impact UK data releases. The Dollar Index has faced selling pressure this week as US data has largely missed estimates, increasing hopes that the Federal Reserve hiking cycle may be at an end.

As mentioned in my weekly forecast on the dollar I did see the potential for a DXY retracement this week. However, it is important to note that data remains the driving force and continues to overshadow the technical picture at times.

Dollar Index (DXY) Daily Chart

Source: TradingView, Chart Created by Zain Vawda

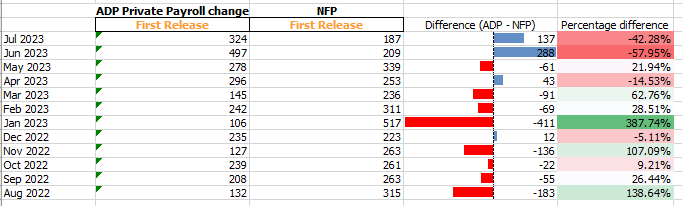

Given the data out of the US thus far we have seen signs that the labor market may finally be cooling. Labor data in particular has shown signs of cooling with yesterday’s ADP print missing estimates and coming in far below the July print in what was the weakest number since March 2023. Now just for some clarity the ADP is not always an accurate gauge of the NFP number as we have seen so far this year with the differences quite significant. The Sheet below provides some insight into the difference over the past 12 months or so.

*Note: Data is based on first releases, not taking any revision to the numbers into account. Even with the revisions however the data remains remarkably different.

Source: Data from Refinitiv, Sheet Created by Richard Snow.

Having said that it is important to note that the ADP release this week is consistent with the pace of job creation before the pandemic. “After two years of exceptional gains tied to the recovery, we’re moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede,” said Nela Richardson, chief economist, ADP.

Tips and Tricks to Trade GBP/USD, Download Your Free Guide Below.

Recommended by Zain Vawda

How to Trade GBP/USD

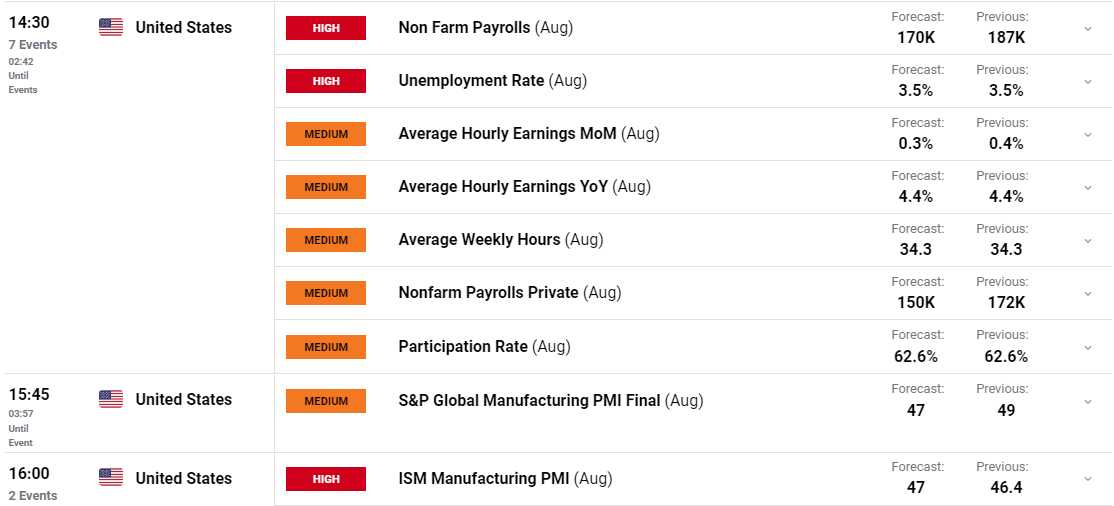

The consensus for today’s NFP print is 170k with a number exceeding that as well as any increase in average earning and unemployment holding steady could reignite the interest of Dollar bulls. We will likely see rate hike bets ramped up once more while a miss to the downside on the data will likely see further selling pressure on the DXY and thus help Cable continue its recent rally.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

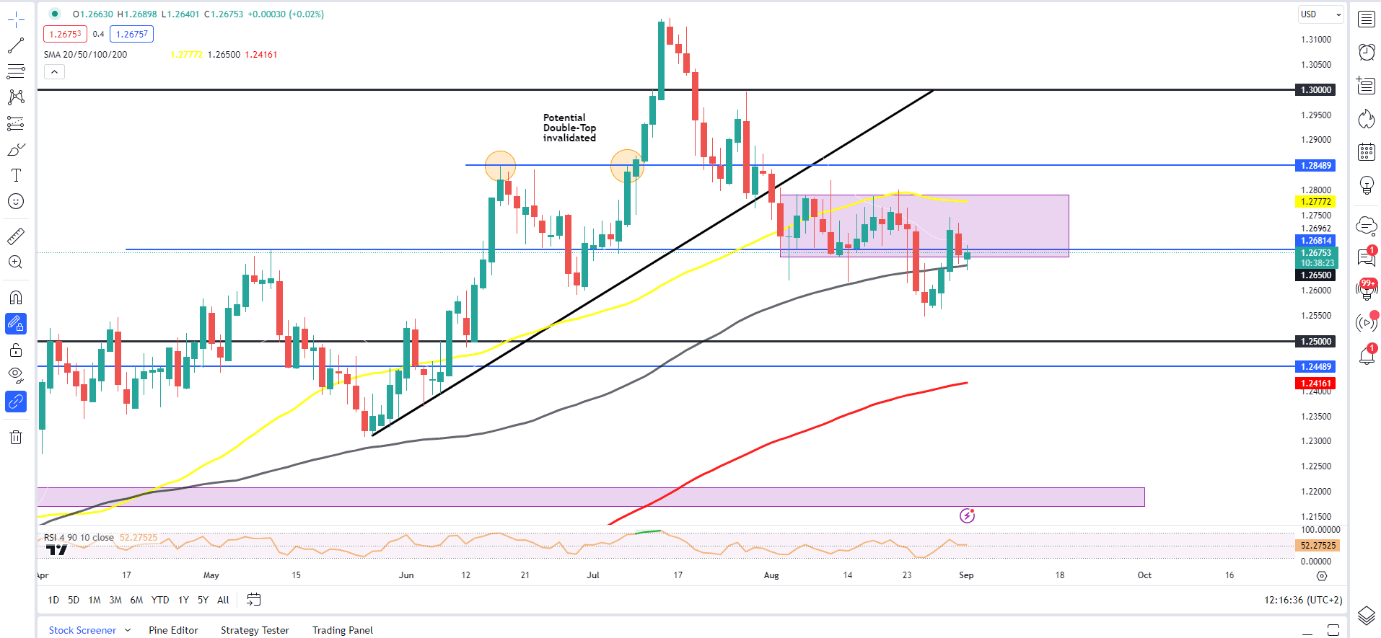

GBPUSD finally broke out of its August range at the back end of last week. Cable broke below the 100-day MA but the move proved short lived as the pair posted 3 days of gains to start the week and closed back inside the August range. This choppy price action is something I had been expecting and discussed in previous pieces as August is a notoriously choppy month for markets as a whole.

Cable is currently hugging the 100-day MA trading just above the 1.2650 mark ahead of the US data due later today. As mentioned, Cable has been largely driven by the moves of the DXY of late and I expect that to continue today. At the moment the upside faces stiff resistance around the 1.2800 handle as we have struggled at that level for the entire month of August. The 50-day MA rests around the 1.2777 mark with spike above this level likely to face selling pressure. If we do manage a move higher the next key area of resistance rests around the 1.2850 mark.

Alternatively, looking at the potential for a break to the downside and the first hurdle is the 100-day MA before the weekly low around the 1.2550 handle comes into focus. Any push beyond 1.2550 faces support at the psychological 1.2500 mark and then the 200-day MA may become an area of interest down at the 1.2416 handle.

Key Levels to Keep an Eye On:

Support levels:

- 1.2650 (100-day MA)

- 1.2550 (Weekly lows)

- 1.2500 (Psychological level)

Resistance levels:

- 1.2770 (50-day MA)

- 1.2850

- 1.3000 (psychological level)

GBP/USD Daily Chart, September 1, 2023

Source: TradingView, Chart Created by Zain Vawda

IG CLIENT SENTIMENT DATA

IG Retail Trader Sentiment shows that 55% of traders are currently NET LONG on GBPUSD.

For a more in-depth look at GBP/USD sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -14% | -3% |

| Weekly | 0% | -4% | -2% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda