Future outlook for the USD/JPY pair:

- US dollar / Japanese yen Jumps after the US PMI data surprises to the upside

- strong The economic activity Boosts Treasury yields across the curve, reviving expectations of ‘higher-for-longer’ interest rates

- Standard & Poor’s Composite global PMI prints at 53.5 vs. 52.3 in March, business activity may start to pick up

Recommended by Diego Coleman

Get a free Japanese Yen forecast

Most read: Sterling Price Forecast – Signs of a bullish impulse reversal ahead of a busy week

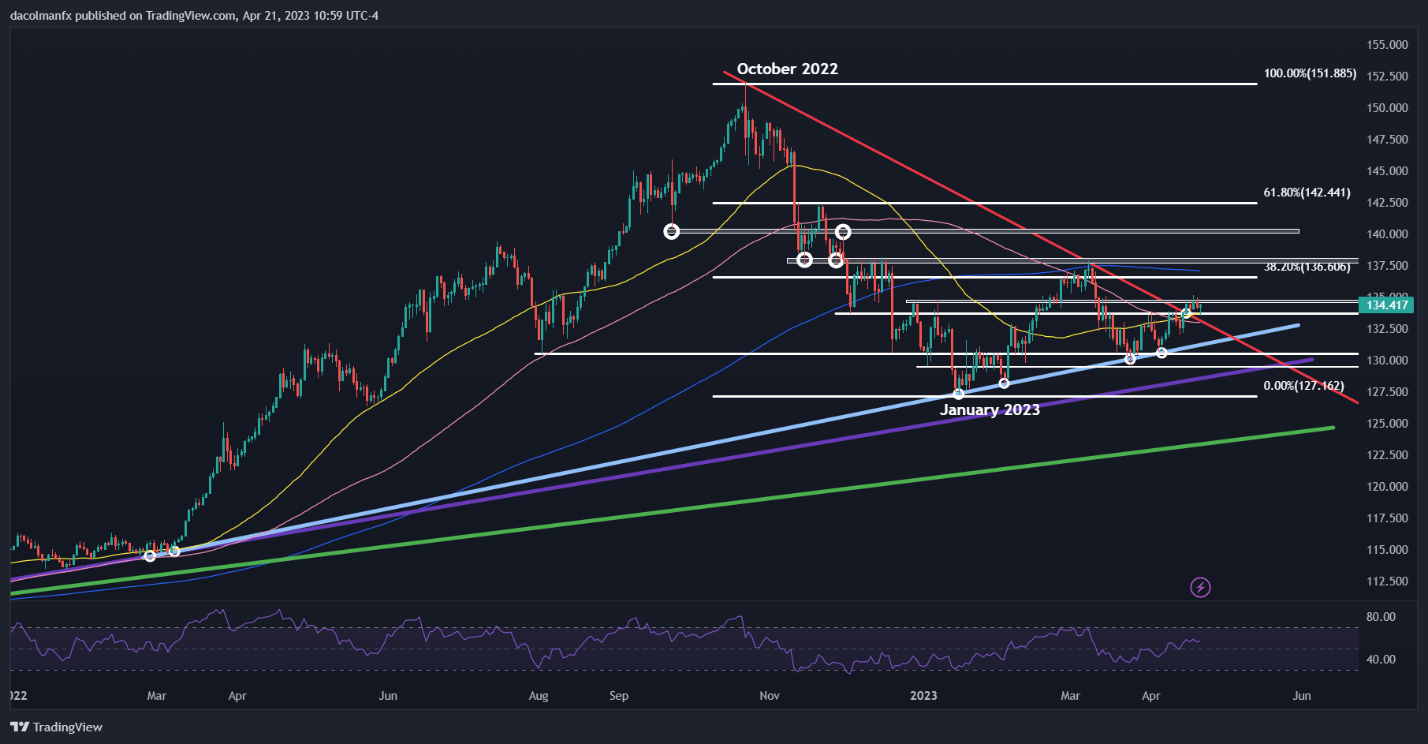

USD/JPY was losing ground early Friday morning, but took a 180-degree turn and reversed sharply higher shortly after US markets opened, buoyed by better-than-expected US economic data. The chart below shows how the pair jumped from 133.55 to 134.35 in a matter of minutes.

USD/JPY 5-minute chart

source: TradingView

For context, the US S&P Flash Composite PMI posted 53.5 in April from 52.3 previously, with services business activity rising to 53.7 from 52.6 and industrial production rising to 50.4 from 49.2 one month earlier. Both sub-indices for the PMI surprised to the upside compared to consensus estimates.

American Economic Calendar

source: DailyFX

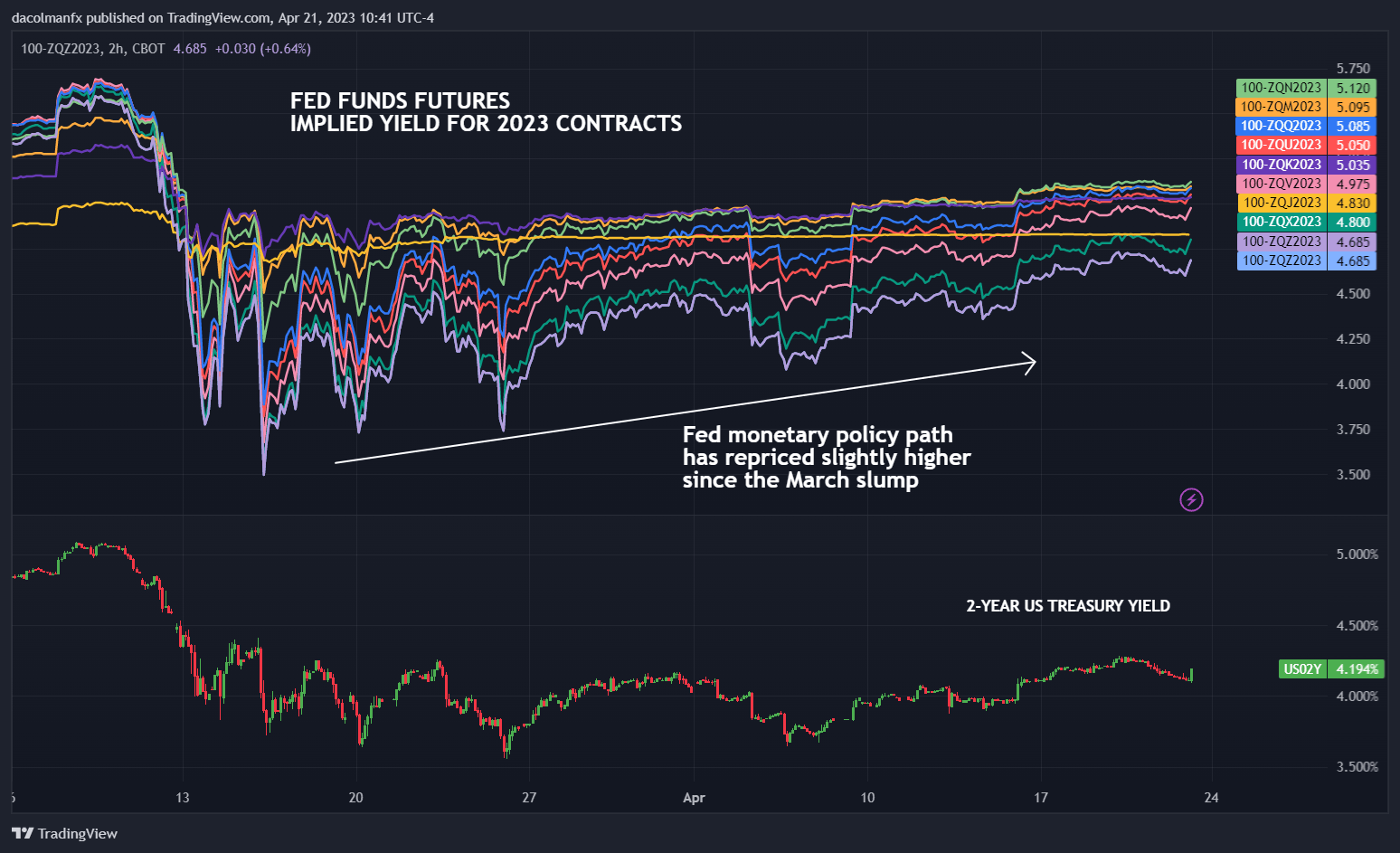

Resilient macro results buoyed US Treasury rates, especially those at the front end of the curve, as traders repriced the Federal Financial Market Committee’s monetary policy path slightly higher compared to the day before, as shown in the chart below, which shows several Reserve Fund futures contracts. FedEx 2023 with its implied yield trending in an upward direction.

Recommended by Diego Coleman

Get free forecasts in US dollars

Reserve funds futures for 2023

source: TradingView

The strong performance of the US economy despite several headwinds suggests that the country may be able to avoid a hard landing and that inflation will remain high for a while longer. This, in turn, may prevent the Fed from cutting interest rates too soon. While the outlook is fluid and subject to unexpected changes, the stars seem to align with some US dollar strength, at least in the near term.

In the current environment, USD/JPY will face fewer hurdles to extend its recent rebound, as initial resistance was seen at 134.75, followed by 136.60, 38.2% Fib retracement of the Oct 2022/Jan 2023 decline. In the event of a pullback, the first support to consider is seen at 133.75 / 133.65 and 131.50 thereafter.

|

change in |

Longs |

Shorts |

Hey |

| Daily | -11% | -5% | -8% |

| weekly | -2% | 0% | 0% |

Comments are closed.