You may or may not have heard the term ‘”ICT”’ thrown around in the forex trading websites, blogs, and communities.

This term has been around in the industry for many years but gained a huge amount of traction in the last 2-3 years.

ICT means Inner Circle Trading.

Inner Circle Trading is owned and operated by a well-known trader Michael Huddlestone, who has over 20 years of experience in trading the markets.

In this article, we’ll look at the history of ICT, how you can use this trading style, and everything you need to know! So, let’s get into it!

ICT Trading In Forex

The ICT trading methodologies and strategies were very much the first of their kind in the online retail trading space.

Previously, there were more or less just technical price action traders, fundamental traders, and traders trying to leverage supply and demand.

However, the ICT methodologies manage to capture all of these different elements cohesively.

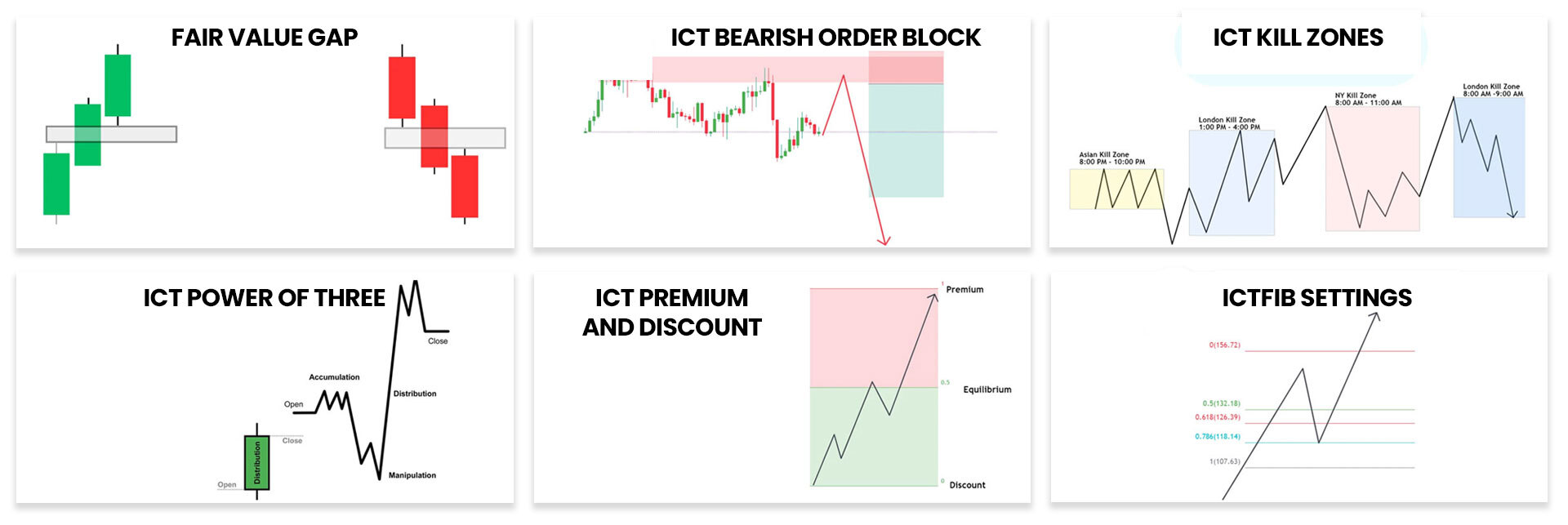

The methodologies essentially rely on finding great prices, using institutional footprints within the markets to follow what Michael believes the market movers are doing.

These strategies are executed at certain times of the trading sessions, to ensure trading volume is high enough to move price swiftly. There is a “killzone” in the trading sessions where ICT traders like to place their trades.

The methods utilize, in essence, supply and demand within the markets but in a much more intelligent way than the retail industry has ever seen before.

This all sounds great, in principle and we’ve seen traders claim to be able to do this and read institutional order flow time and time again but ICT is the first group of traders that seem to be able to back up their claims.

The strategies are still subjective, which can make it harder to find profitability, however, there are enough ‘rules’ and methodologies for traders to build fairly robust rule-based systems from this style.

ICT Trading Strategy – The Silver Bullet

There are a number of trading strategies that ICT teaches, arming traders for all kinds of times and situations within the market.

One of these strategies is the well-known ‘silver bullet’ strategy. This strategy provides a very high win rate and typically a great risk-to-reward ratio for traders.

The strategy must be taken during a period of high market volume. For example, this is typically 10 am-11 am ET, but 3 am-4 am ET also works.

Once we have the timing, you need to find your trade confluences.

You’re looking for a price to breach the high or low of the previous one-hour candle in either direction. Once complete, you’ll be looking to trade back into the candle range.

Once complete, you need to create your bias and find an entry into the trade, using the order confluences that ICT teaches – finding an entry shouldn’t be hard!

Then you set your stop loss, take profit, and let the trade play out.

It’s important to assess a range of influencing factors when playing your take profit. These things include:

- Daily highs and lows

- Session highs and lows

- Weekly highs and lows

- Returning to NWOG

- Movement away from NWOG

Backtest this trading strategy and let us know how you get on!

It’s one of the simplest and best-covered strategies on YouTube when looking at ICT strategies.

Where Did ICT Trading Methodologies Come From?

ICT-style trading has grown increasingly popular over the last few years, with Michael consistently publishing a huge amount of value on YouTube.

After some years, this got the attention of some larger ‘influencers’ within the online trading community. These influencers abandoned their existing trading strategies, most of which were support and resistance-based, and moved over to learning from Inner Circle Trading.

With their large followings, this led to ICT trading becoming a well-known style within the online retail trading space, with thousands of traders flocking to learn the strategies.

Michael has posted thousands of YouTube videos, trading various sessions and banking a great amount of profits with pinpoint accuracy of the market.

The accuracy and level of understanding of how banks are moving money through the forex markets are what drew many traders to jump on board and try to learn this method of trading.

Where Can You Learn The ICT Trading Style?

You may be wondering where you can learn the ICT trading methodologies. Luckily, you have a few options as to where you can actually learn from!

The first option and arguably the best option is to learn directly from Michael over at Inner Circle Trading. After all, this is his logic and methodologies that are being used so it makes sense to learn directly from him!

The downside to learning from Michael, from what we are told, is the content is not laid out in an easy-to-digest manner, meaning it takes traders a very long time to learn and actually figure out how the methodologies can be applied within the markets.

The second option is to learn from some of Michaels’s students who have gone on to become profitable traders and create courses of their own.

The theory is that they have already made all of the mistakes you’re going to make and can deliver the course in a more digestible manner.

Ultimately, learning from ICT themselves will most likely be the best move, it just won’t be a very quick process.

Is ICT Trading Profitable?

The million-dollar question – is the ICT trading strategy actually profitable?

Well, there is no straightforward answer to this.

The ‘strategies’ Michael teaches are more methodologies than anything, not complete strategies most of the time.

It takes traders hundreds, if not thousands of hours of piecing together and digesting their content to make sense of it and create a profitable trading strategy.

The point is, that the ICT trading methodology is profitable for some traders but will not be profitable for many.

This is just the nature of learning a trading strategy that can be seen by some as subjective or manual. Trader A will most likely always have slightly different trading results from Trader B.

So, yes, the ICT methods are profitable if you refine, backtest, and study them over the course of many months.

If you’re expecting to just copy and paste the strategies and become profitable overnight, this won’t be happening.

Does ICT Trading Work For Prop Firm Funding?

So, you’re thinking about getting funded by a prop firm like The5ers – can the ICT trading strategies get you there?

The answer is yes, in theory!

If you can apply the methodologies and become a profitable trader, it’s a great fit for what most prop firms are looking for.

The strategies teach using tight stop losses, sensible risk management, trailing stops and not holding over the weekend/overnight, etc.

These are all going to fit nicely into the ruleset offered by most prop firms.

In fact, we have many funded traders that use these approaches in their trading, whilst trading our capital!

In Summary – What Is ICT Trading In Forex?

In conclusion, ICT is a trading methodology coined by Michael Huddleston, a well-known forex trader with over 20 years of experience in the space.

The strategy and methodologies rely on finding great prices, using opportune timing and institutional order flow to scalp the market with a high risk to reward and a very high win rate.

These strategies have grown in popularity and led to many traders becoming prop firm funded!