-

A once-in-a-generation opportunity is coming for the stock market, according to investment chief Richard Bernstein.

-

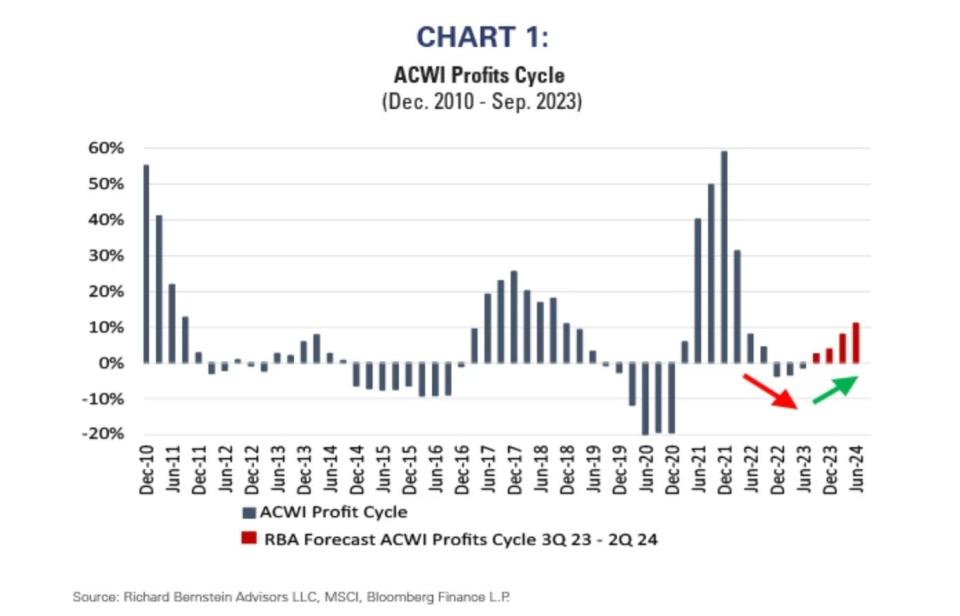

That’s because profits are about to accelerate for companies throughout the stock market.

-

It could usher in a decade of sagging returns for current market leaders, and huge gains for the rest of the market.

Brace for a big investing opportunity that’s about to come for stocks — and not in an area of the market investors may be expecting.

That’s according to Richard Bernstein, the CIO of Richard Bernstein Advisors, a $16 billion asset manager.

He argues that while the Magnificent Seven mega-cap firms have dominated the S&P 500’s gains in 2023, less high-profile stocks are now primed to see big returns over the next decade.

That coming pendulum swing in market leadership is a “once-in-a-generation” buying opportunity brewing among forgotten and under-loved areas of the market, Bernstein says. Speaking with Insider, Bernstein said he sees it similar to a period like the 2000s, when the biggest leaders in the S&P 500 shed value while underdog sectors like energy and emerging markets saw “monster returns.”

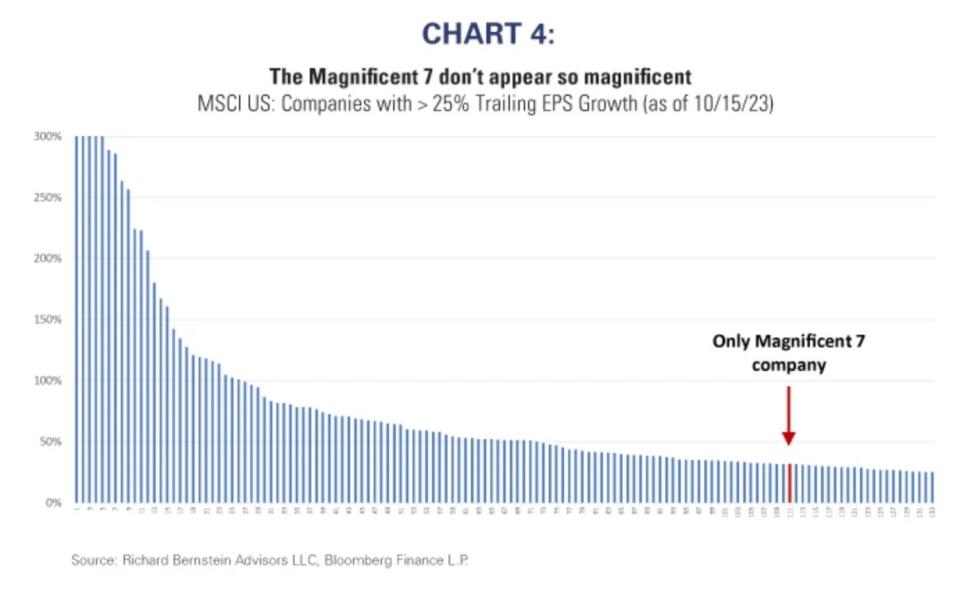

“Despite profits growth becoming more abundant, investors generally continue to focus on the so-called Magnificent 7 stocks. Such narrow leadership seems totally unjustified and their extreme valuations suggest a once-in-a-generation investment opportunity in virtually anything other than those 7 stocks,” he wrote in a note this week.

So what makes this time different from other periods of changing market leadership?

Bernstein — who was previously the chief investment strategist at Merrill Lynch — says his expectation for a stock boom isn’t to be mistaken with something like the two years of the pandemic market rally, which featured narrow leadership by so-called reopening names, similar to what’s now happening with the Magnificent 7. His thesis hinges on a broader swath of the market getting a lift by a resilient economy and surging corporate profitability.

“Are there really only seven growth stories in the entire global equity market? And then, the second way to say it is, are these seven really the best growth stories in the entire global equity market? The answer to both of those questions is no,” he said.

Of the 130 US companies that saw at least 25% earnings growth in the 12 months through October 15, Amazon was the only Magnificent 7 stock represented.

Meanwhile, profits at companies throughout the rest of the market are on the rise, which puts investors in a position to ditch super-expensive mega-cap stocks for more attractively priced shares. Corporate profits look to have hit a trough in 2023 and are heading up into 2024, according to MSCI All Country World Index data.

“Because growth is starting to accelerate, it makes less and less sense to pay a premium for growth. History suggests that investors become comparison shoppers for growth as it becomes more abundant, so a movement toward the broader and cheaper market seems consistent with history,” RBA added in the note.

Bernstein predicts the enormous gains enjoyed by mega-cap stocks will be whittled down as investors flock to more attractively priced areas of the market, such as small-cap and mid-cap stocks. The Magnificent Seven firms wiping out 20%-25% of their value while the Russell 2000 gains 20%-25% over the next decade would be realistic, in his view.

“They’re so depressed on the other side of the seesaw that you can get huge returns,” Bernstein said, adding that RBA was overweight in virtually every area of the market other than the Magnificent Seven stocks.

Bernstein isn’t alone in his bullishness. Other forecasters are pointing to big gains ahead for the broader market. In a note this week, Bank of America analysts said that an indicator with a nearly 100% track record is flashing signs that the S&P 500 is in for a 16% gain in 2024. Historical trends also point to strong profits ahead of investors as the stock market sees a rare bullish pattern of gains and losses this year.

Read the original article on Business Insider