EUR/USD, PRICE FORECAST:

MOST READ: Oil Price Forecast: WTI Slips as OPEC+ Voluntary Cuts Fail to Convince

The Euro continued its slide today falling toward the 1.0850 as the DXX continued its advance in the European and early parts of the US session. The US Dollar for its part appears to be benefitting following comments from Fed policymakers yesterday with the Fed Chair himself scheduled to speak later today. Will we see a bout of volatility ahead of the weekend?

Recommended by Zain Vawda

How to Trade EUR/USD

US MANUFACTURING DATA AND EU DATA

The mix of data released yesterday has kept EURUSD bulls largely subdued. The inflation print similarly weighing on the Euro and thus dragging EURUSD lower. According to the flash estimates published by Eurostat on Thursday, the Eurozone Harmonised Index of Consumer Prices (HICP) decelerated more than anticipated, to 2.4% YoY in November from 2.9% in the previous month. The Core HICP increased by 3.6% on an annual basis during the reported month, down from October’s final print of 4.2% and missing market expectations for a 3.9% rise. The news saw market participants increase their optimism around rate cuts from the ECB in 2024 (Traders fully price 125bps of ECB interest-rate cuts in 2024) which further harmed the chance of the Euro holding the high ground.

US data showed further easing from US consumer spending as market participants appear to be tightening their belts ahead of the festive season. Today we had manufacturing data out of the US with both the S&P Global and ISM PMI data which came out a short while ago. The S&P Global PMI number was in line with estimates but comments from S&P Economist Williamson the data hints at little if any contribution from the goods producing sector in Q4. Not surprising as Q4 growth in the US is not expected to be anywhere close to the blockbuster Q3 number.

Source: S&P Global PMI

The ISM Manufacturing PMI data missed estimates as the manufacturing sector contracted for a 13th consecutive month. The print came in at 46.7 while the overall economy continued in contraction for a second month after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. Another sign that the slowdown has is beginning to take hold?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FED POLICYMAKERS AND LOOKING AHEAD TO NEXT WEEK

Before we look at next week, we do have a speech from Fed Chair Powell later today. We also heard some comments a short while ago from policymaker Goolsbee who sounded rather confident that the Fed are on the right path and winning the inflation battle.

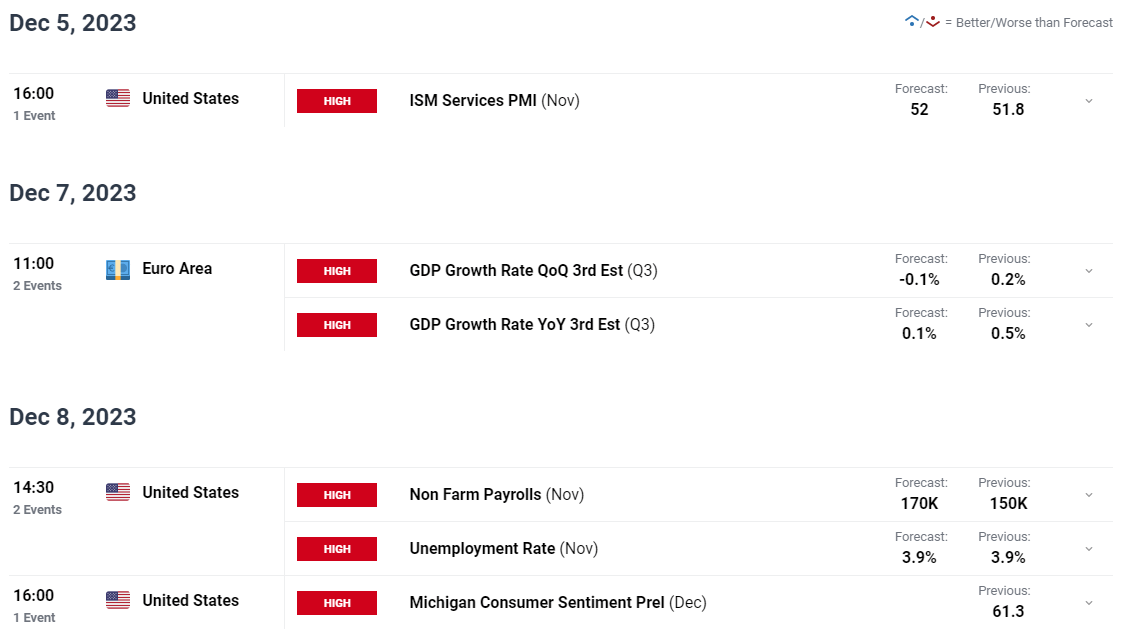

Heading into next week and the early part of the week could see EURUSD being driven mostly by market sentiment. High impact data releases will also start filtering through from Wednesday and thus we could be in for some low volatility until then, something which became a theme this week until US data was released.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

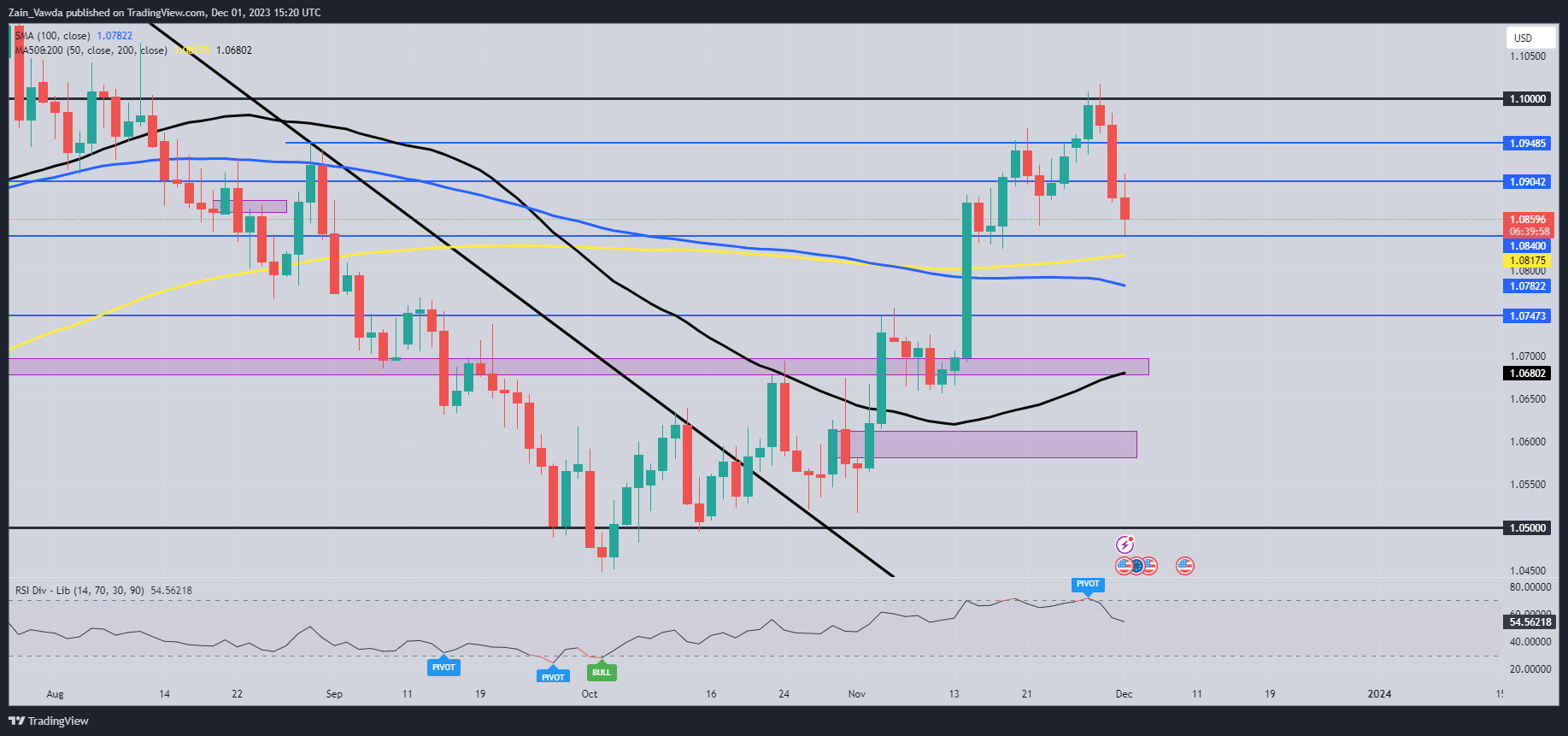

Looking at EURUSD and the technical picture and we have had a perfect rejection of the 1.1000 psychological level before the ensuing selloff which has gathered pace. We have just tapped into an area of support around the 1.0840 mark with a short-term retracement either today or Monday looking likely. A move higher here will bring resistance at 1.0904 and 1.0950 into play and these as mentioned above, provide a better risk to reward ratio.

A bounce here will only serve to provide potential shorts with a better risk to reward as EURUSD eyes a test of the 200-day MA. A break lower will bring the 1.0782 and 1.0747 support areas into focus.

EUR/USD Daily Chart – December 1, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently split on EURUSD with 51% of traders short. Of interest though is the change in the daily long positions which is up 14%. Is this a sign that a retracement may be imminent?

To Get the Full IG Client Sentiment Breakdown as well as Tips, Please Download the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 2% | -11% | -5% |

| Weekly | 16% | -20% | -6% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda