Article produced by IG Senior Market Analyst Axel Rudolph

FTSE 100 slips ahead of Thursday’s BOE meeting

The FTSE 100 has reached a two-month high at 7,583 on Friday, close to its 200-day simple moving average (SMA) at 7,565 which acts as resistance with the previous resistance area, now a supportzone, at 7,543 to 7,535 being revisited. Further down lies the 7,500 mark.

A rise above 7,583 ahead of Thursday’s Bank of England (BoE) meeting would eye the September-to-December downtrend line at 7,606.

DAX Daily Chart

Source: IG, ProRealTime, prepared by Axel Rudolph

DAX 40 hits new all-time record high

The DAX 40’s strong advance from its October low over six consecutive bullish weeks is ongoing with the index hitting a new all-time record high slightly above the 16,800 mark before giving back some of its gains ahead of Tuesday’s German ZEW economic sentiment data.

It is to be noted that the Relative Strength Index (RSI) is the most overbought since January of this year, increasing the odds of a minor correction occurring into year-end instead of the traditional Santa Clause rally.

Slips may find initial support at Wednesday’s 16,729 high ahead of Friday’s 16,630 low, a slip through which would be the first sign of the swift ascent slowing.

DAX Daily Chart

source: IG, ProRealTime, prepared by Axel Rudolph

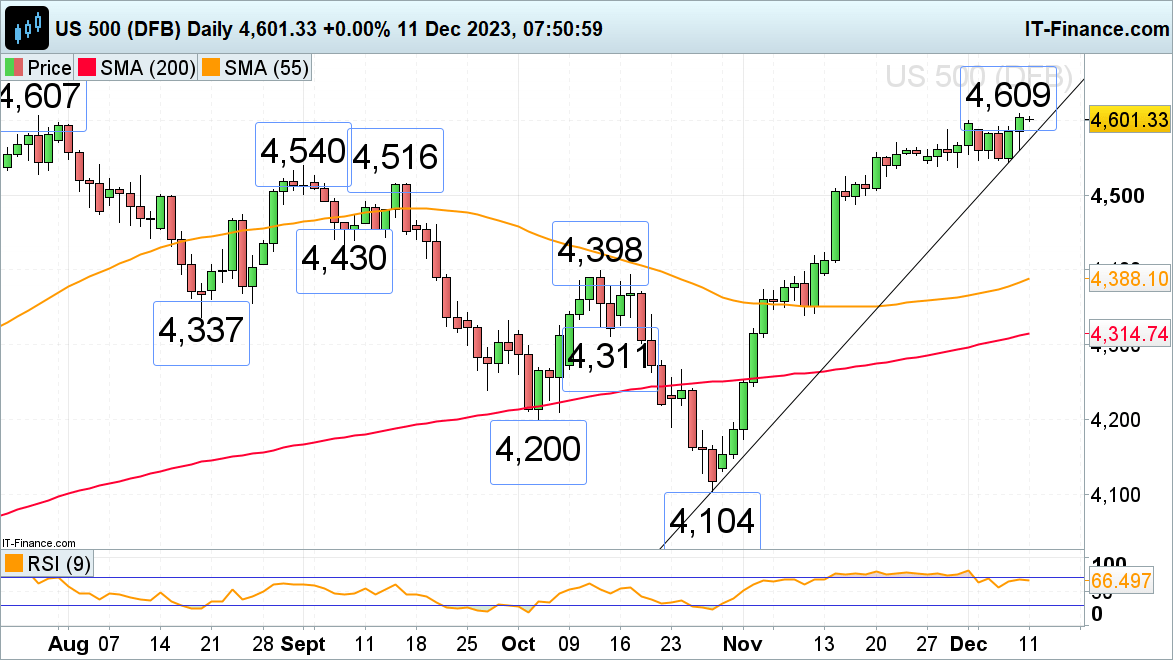

S&P 500 grapples with July peak

The S&P’s advance briefly took it to 4,609 last week, to marginally above its July peak at 4,607, both of which the index is currently grappling with ahead of Tuesday’s US inflation data and Wednesday’s Federal Reserve (Fed) meeting and interest rate decision.

Above last week’s high at 4,609 beckons the March 2022 peak at 4,637. While the last couple of weeks’ lows at 4,544 to 4,537 hold, the medium-term uptrend stays intact.

Immediate support can be seen at the 29 November high at 4,587, ahead of the 22 November high at 4,569.

Negative divergence on the Relative Strength Index (RSI) increases the odds of at least a short-term correction lower being witnessed at some stage this week.

S&P 500 Daily Chart

source: IG, ProRealTime, prepared by Axel Rudolph