EUR/USD Forecast – Prices, Charts, and Analysis

- German economic sentiment at its highest level since March.

- EUR/USD tests 1.0800, US CPI released later in today’s session.

Most Read: Euro Price Forecast: Colossal Data Filled Week for EUR/USD

Download our Free Guide on How to Trade Economic Releases

Recommended by Nick Cawley

Trading Forex News: The Strategy

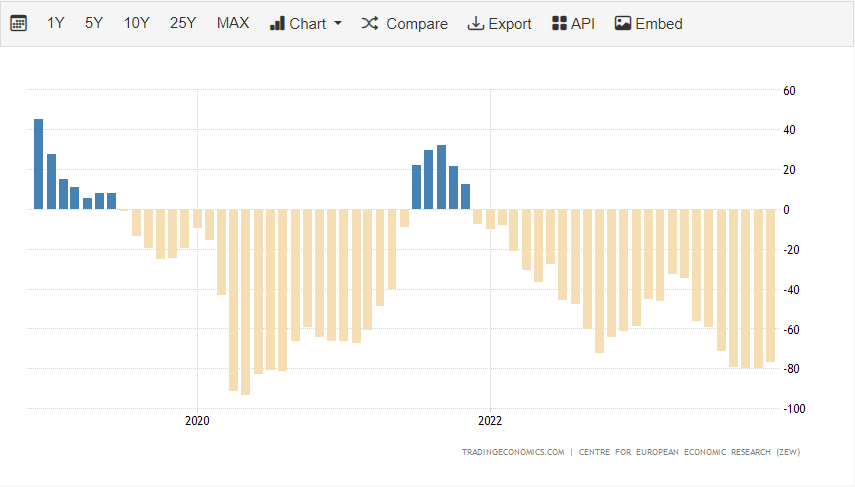

The latest ZEW report painted a slightly better picture for the German and Euro Area economy with economic sentiment picking up to a multi-month high. Both readings beat market forecasts. German current conditions improved slightly from November but remain close to a historically low level compared to readings over the past five years.

German ZEW Current Conditions

Recommended by Nick Cawley

How to Trade EUR/USD

The latest US inflation report will be released this afternoon with the core reading (y/y) expected to remain unchanged at 4%, while the annual headline reading is expected to tick 0.1% lower to 3.1%. While this report can move markets sharply, any move today will be tempered ahead of Wednesday’s FOMC meeting and Thursday’s ECB policy decision. Both central banks are fully expected to leave all policy levers untouched but the post-release press conferences may give the market more insight into the conditions needed for both central banks to start cutting interest rates.

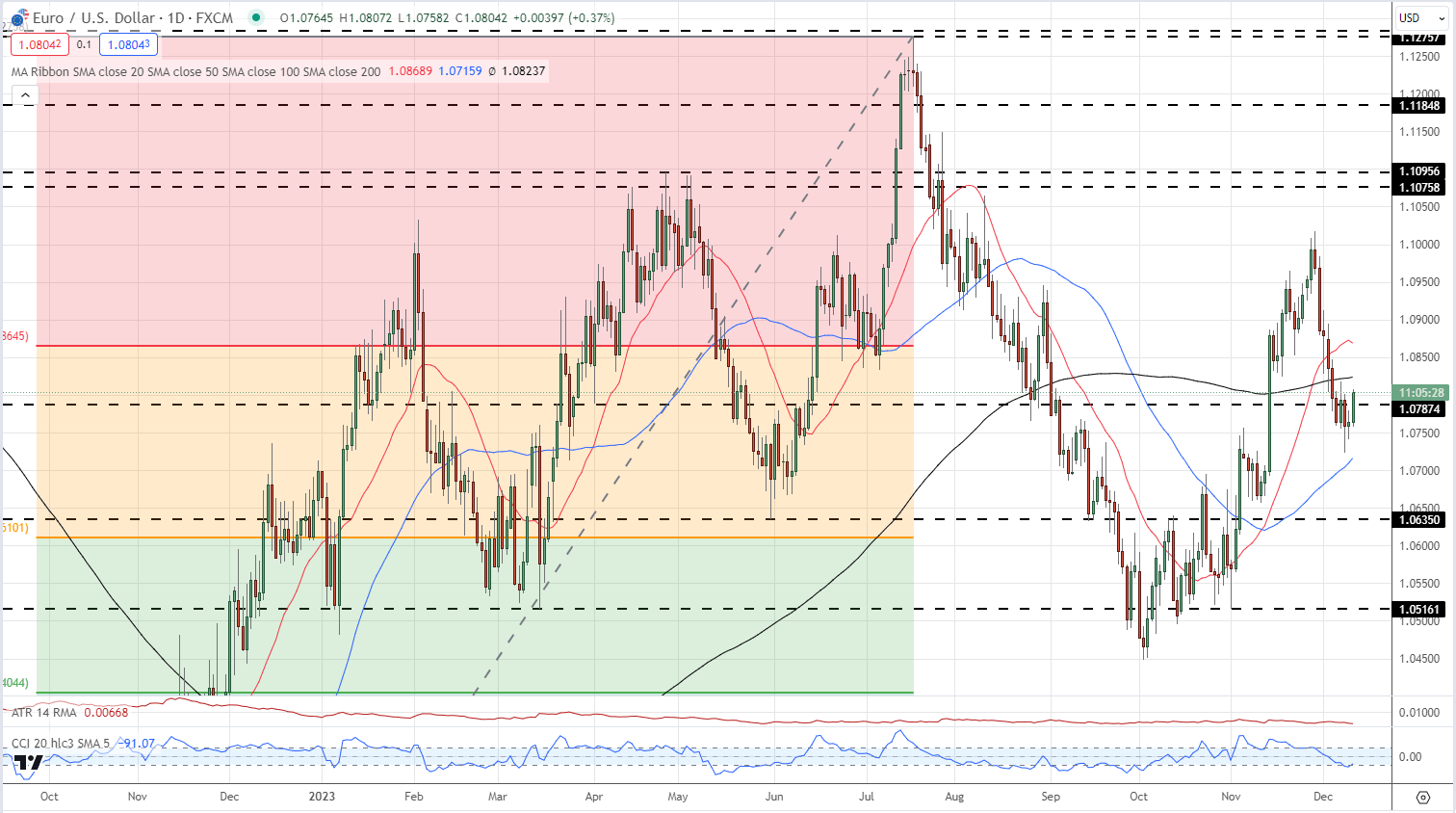

EUR/USD is currently trading on either side of 1.0800 and will likely remain that way ahead of the upcoming economic events. The move to the 1.0800 level is due to a combination of Euro strength and US dollar weakness, although both can change quickly in thin market conditions. Support for the pair starts at 1.0724 (last Friday’s multi-week low) ahead of 1.0716 (50-day sma). Resistance is seen at 1.0824 (200-day sma) ahead of the 23.6% Fibonacci retracement level at 1.0866.

EUR/USD Daily Chart

Chart Using TradingView

IG Retail trader data shows 56.90% of traders are net-long with the ratio of traders long to short at 1.32 to 1.The number of traders net-long is 2.78% higher than yesterday and 14.25% higher than last week, while the number of traders net-short is 4.72% higher than yesterday and 13.39% lower than last week.

To See What This Means for EUR/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | -2% | 4% | 0% |

| Weekly | 11% | -14% | -2% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.