DECEMBER NONFARM PAYROLLS REPORT

- The U.S. Bureau of Labor Statistics will release the December employment survey on Friday

- U.S. employers are forecast to have hired 150,000 workers last month, following a gain of 199,000 jobs in November

- The strength or weakness of the labor market will likely guide the Fed’s next steps in terms of monetary policy

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Wavers Ahead of US Jobs Data, Tech Setups on USD/JPY, AUD/USD, Gold

Wall Street will be on high alert on Friday morning when the U.S. Bureau of Labor Statistics unveils December employment data. The upcoming report is likely to attract a lot of attention because of its potential impact on the Fed’s monetary policy outlook and the timing of the first rate cut, so it would not be surprising to see increased volatility across most assets heading into the weekend.

In terms of estimates, U.S. employers are forecast to have hired 150,000 people last month following a gain of 199,000 jobs in November. Separately, the household survey is expected to show that the unemployment rate ticked up to 3.8 % from 3.7 % previously, indicating a better balance between supply and demand for workers.

Focusing on wages, average hourly earnings are seen rising 0.3% m-o-m, bringing the annual rate to 3.9% from 4.0% in the preceding period, a small but welcome directional improvement for the U.S. central bank.

The Federal Reserve places particular emphasis on pay growth for its implications on inflationary patterns, so traders should keep an eye on whether the overall trend continues to move toward a level consistent with CPI convergence toward the 2.0% target on a sustained basis over the medium term.

Improve your trading skills. Get your hands on the U.S. dollar‘s Q1 forecast today for exclusive insights into important fundamental drivers worth watching in the coming months!

Recommended by Diego Colman

Get Your Free USD Forecast

EXPECTATIONS FOR UPCOMING JOBS REPORT

Source: DailyFX Economic Calendar

For an extensive overview of gold’s medium-term prospects, which incorporate insights from fundamental and technical analysis, download our Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free Gold Forecast

POSSIBLE SCENARIOS

The Fed embraced a dovish posture at its December gathering, signaling that it would reduce borrowing costs a few times in 2024, but did not completely abandon its tightening bias. In any case, the overarching message was that the institution would rely heavily on data when formulating future decisions. Despite the noncommittal posture, markets ran away with the pivot, pricing in a deep easing cycle for this year.

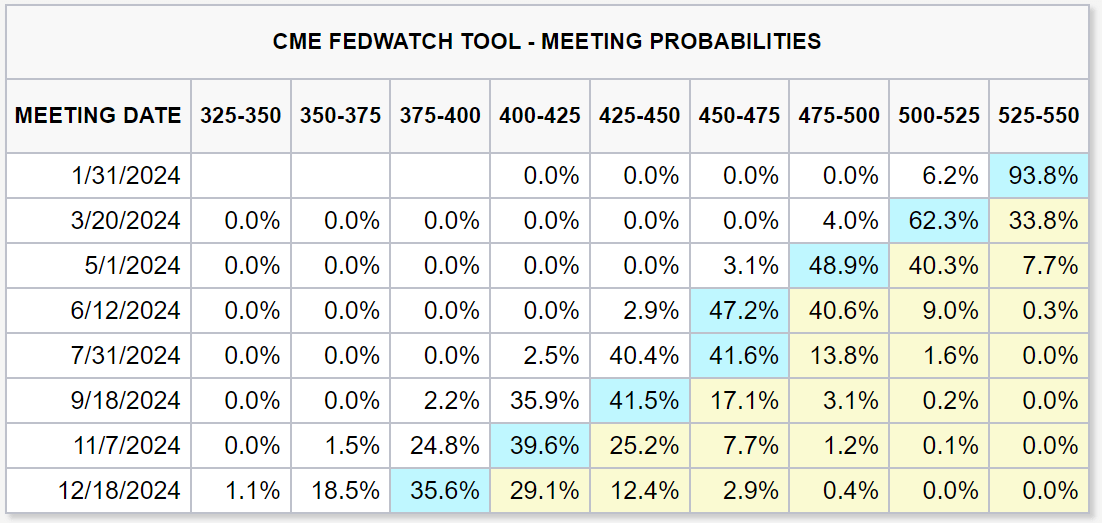

Looking at implied probabilities, the odds of a quarter-point rate cut at the March FOMC meeting stands at 62%, down slightly from last week’s 72%. If hiring surprises to the upside and wages pressures accelerate, the prospects for the easing cycle to begin in the first quarter will diminish further, creating the right conditions for Treasury yields and the U.S. dollar to prolong their recovery. This outcome is likely to weigh on gold prices and the equity market.

If you’re looking for an in-depth analysis of U.S. equity indices, our first-quarter stock market trading forecast is packed with great fundamental and technical insights. Get it now!

Recommended by Diego Colman

Get Your Free Equities Forecast

FED MEETING PROBABILITIES

Source: FedWatch Tool

In a scenario of sluggish job growth and further moderation in average hourly earnings, the Fed’s policy outlook is likely to shift in a more dovish direction, boosting bets of a rate cut in March and exerting downward pressure on yields and the greenback. In these circumstances, gold prices and risk assets, such as technology stocks, could rally strongly. Any NFP figure below 100,000 but still positive could have this impact on markets.