Key points of the US jobs and jobs report:

- The US added 253,000 jobs in April, beating the median forecast of 180,000 new jobs.

- The unemployment rate fell to 3.4%, matching January’s reading, which was the lowest in 50 years.

- The positive data continued as average hourly earnings increased more than expected as well, likely to add to concerns about inflation.

- Learn more about price actionAnd chart patterns And Moving averagescheck the Education section of DailyFX.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

US employment accelerated through April as the economy added 253k jobs in April 2023, beating expectations of 180k and after a revised 165k in March. According to the US Bureau of Labor Statistics, employment continued to trend upward in professional and business services, health care, recreation and hospitality, and social assistance. It is also important to note that the overall change in total nonfarm payrolls for February and March were revised down by 78K and 71K respectively, resulting in employment for the two months being 149K lower than previously reported.

Customize and filter live economic data via DailyFX Economic calendar

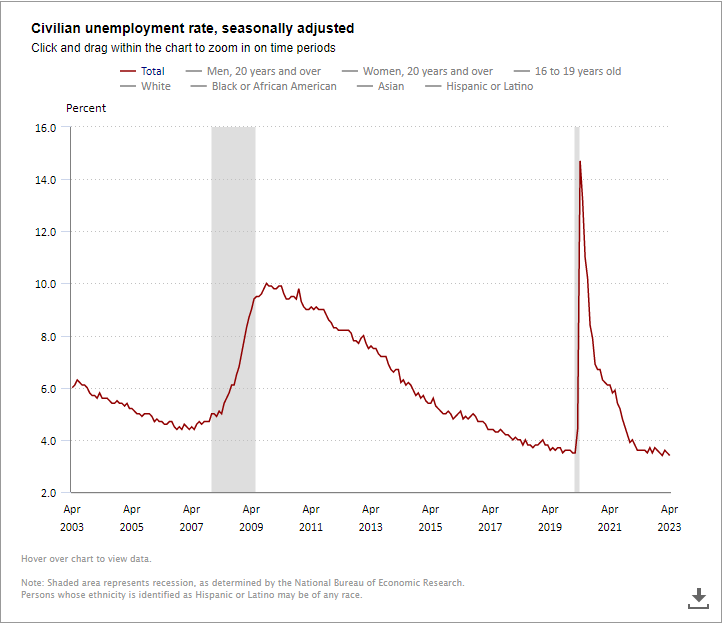

The unemployment rate, at 3.4 percent, and the number of unemployed, at 5.7 million, changed little in April. The unemployment rate matched a 50-year low in January and has ranged from 3.4% to 3.7% since March 2022. The labor force participation rate was 62.6%, and the employment-to-population ratio stood at 60.4%. unchanged in April. These measures are still below pre-pandemic levels in February 2020 (63.3 percent and 61.1 percent, respectively).

Source: BLS

Looking closely at the Employment Survey, average hourly earnings, which remains a strong measure of inflation for the Fed, rose 0.5% monthly from 0.3% in March, bringing the annual rate back to 4.4% from 4.3% previously. This print in particular does not bode well for the Federal Reserve in its fight against inflation with two inflation reports ahead of the FOMC meeting next month.

Recommended by Zain Fouda

How to trade EUR/USD

The Federal Reserve and the Way Forward

This week’s FOMC meeting did not disappoint as persistent pressure among US regional banks weighs on sentiment and fuels recession fears. Fed Chairman Powell said he sees not a recession but little growth for the US in 2023 even though some of his FOMC peers fear a recession is inevitable. The Fed chairmen’s confidence stems from the strength of the labor market and the low unemployment rate. However, given the growing tension around regional banks since the FOMC meeting, recession fears have increased and the possibility of rate cuts in 2023 (by market participants at least) has increased.

The Fed hasn’t completely ruled out further increases, but given the recent banking sector pressures, it appears that the peak has reached. As we move forward though, the jobs data will be of particular interest. If the US can keep the unemployment rate from rising so quickly, it may be able to achieve Powell’s vision of marginal growth rather than stagnation in 2023. Tighter credit conditions usually lead to higher unemployment which is why this is the key metric to move forward. The Fed’s dream scenario would be that tighter credit conditions slow the economy to cause a drop in inflation while at the same time we only see a marginal rise in the unemployment rate.

The dollar itself remains weak as we hover near year-to-date lows. The ECB is expected to continue to rally with other central banks such as the Reserve Bank of Australia hitting a hawkish tone recently and markets unconvinced by the banking sector, the dollar could be in for a tough summer.

Market reaction

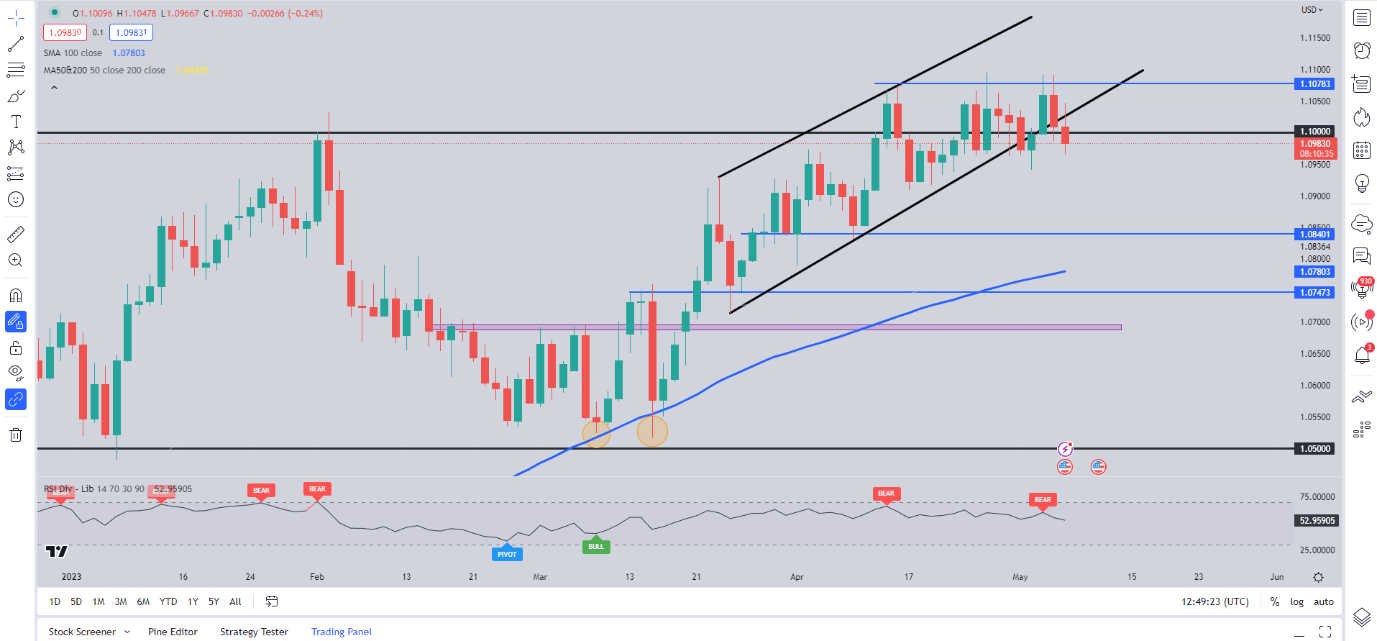

EURUSD daily chart

Source: TradingView, prepared by Zain Fouda

Initial reactions to the EURUSD saw the dollar strengthen and gain nearly 30 pips back below the 1.1000 level.

Looking at the bigger picture, EURUSD fell from year-to-date highs yesterday despite the hawkish tone from the European Central Bank. The weekly time frame was overbought earlier in the week as the H4 time frame made a lower high yesterday. Looking at the daily chart above, you can see that we closed below the bullish channel for the second time. There might be bearish pressure for EURUSD but 1.0900 could prove too strong as an insurmountable hurdle.

Key levels worth seeing:

support areas

areas of resistance

– By Zain Fouda for DailyFX.com

Connect with Zain and follow her on Twitter: @tweet

Comments are closed.