GBP/USD, EUR/USD Prices, Analysis, and Charts

- The US dollar is little changed, and so to are US rate expectations.

- US CPI may provide the catalyst for the next move.

Download our brand new Q1 USD Quarterly Forecast

Recommended by Nick Cawley

Get Your Free USD Forecast

The US dollar is little changed in opening trade Wednesday, leaving a range of USD pairs in limbo. The US dollar index is seen consolidating its recent move higher, and with no guidance from the rates market, this is likely to remain the case until the latest US inflation report is released on Thursday at 13:30 UK.

For all market-moving data releases and events, see the real-time DailyFX Economic Calendar

Financial markets are still pricing in a total of 150 basis points of US interest rate cuts this year, with the first 25 basis point move forecast at the March 20th FOMC meeting.

CME Fed Watch Tool

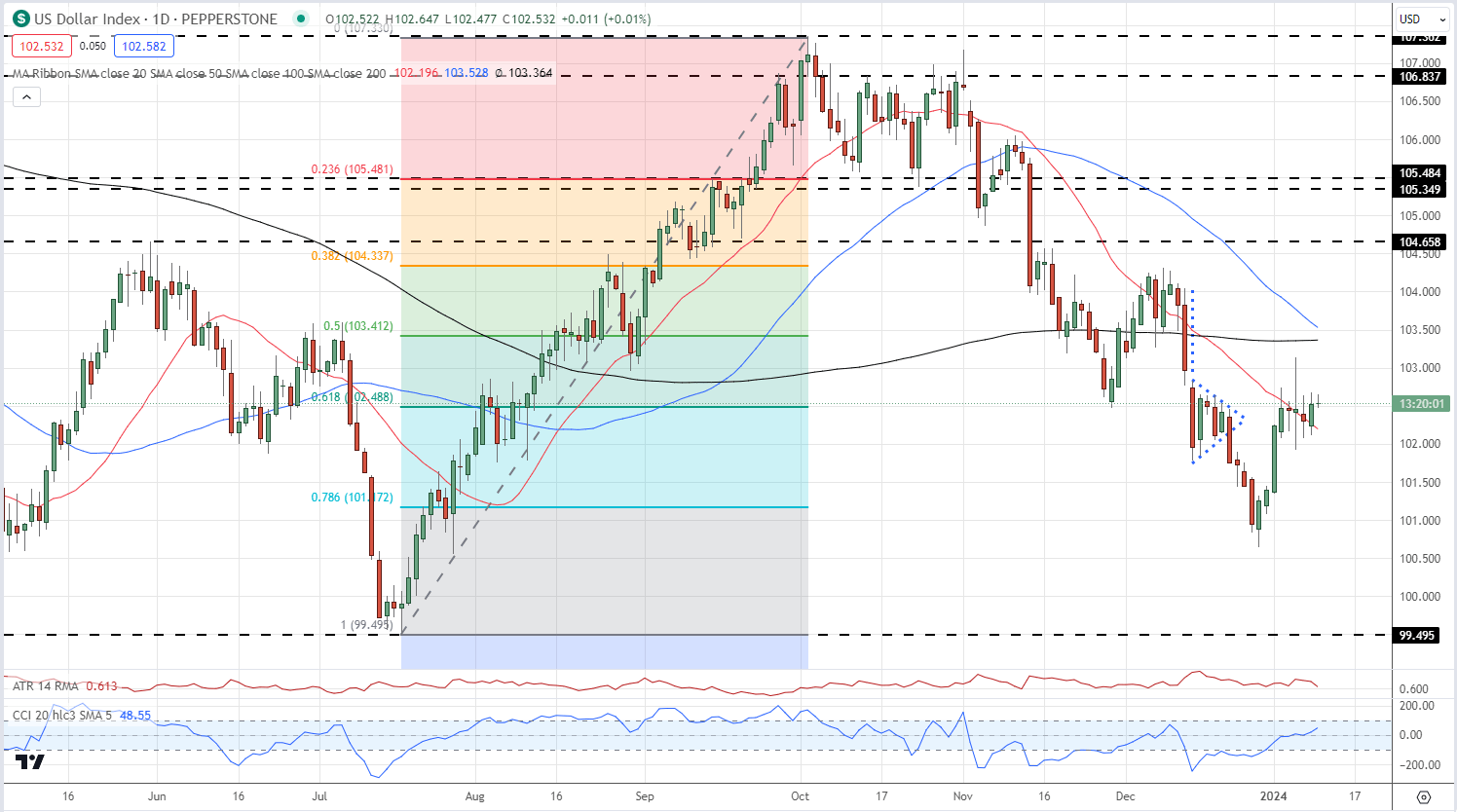

The US dollar index chart shows the greenback in a short-term consolidation phase and is constrained by last Friday’s jobs report candle. The daily chart does show a conflicting set of moving averages with the 20-day sma currently supporting the dollar index, while the 50-/200-day sma is seen setting up a negative ‘death cross’ in the coming days. The dollar index is also sitting on the 61.8% Fibonacci retracement of the mid-July to early-October move, while the CCI indicator is pointing higher but remains in neutral territory.

Death Cross: What is it and How to Identify it When Trading?

US Dollar Index Daily Chart

Learn how to trade the top three Forex pairs

Recommended by Nick Cawley

Recommended by Nick Cawley

How To Trade The Top Three Most Liquid Forex Pairs

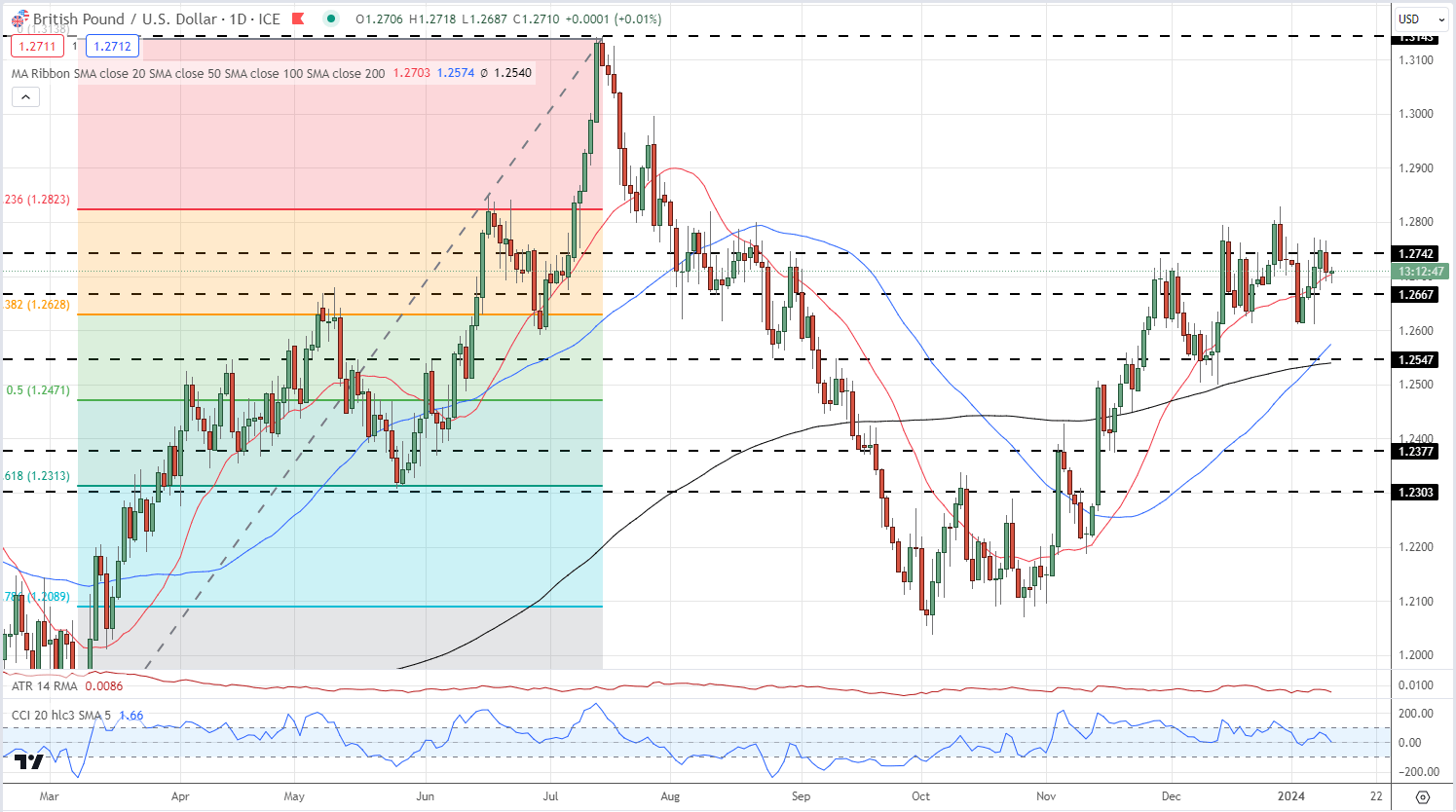

GBP/USD is keeping hold of its recent gains and remains within touching distance of making a fresh multi-month high (1.2828). The 20-day sma is trying to act as support, while the 50-/200-day moving averages made a bullish ‘golden cross’ late last week. The CCI indicator is neutral. Initial support is seen at 1.2667 ahead of 38.2% Fibonacci retracement at 1.2630. A break above 1.2828 would leave 1.3000 as the next target.

The Golden Cross

GBP/USD Daily Chart

IG retail trader data shows 50.30% of traders are net-long with the ratio of traders long to short at 1.01 to 1.The number of traders net-long is 16.90% higher than yesterday and 11.84% lower than last week, while the number of traders net-short is 12.70% lower than yesterday and 20.19% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

See how daily and weekly sentiment changes can affect GBP/USD price action

| Change in | Longs | Shorts | OI |

| Daily | 11% | -6% | 2% |

| Weekly | -12% | 22% | 3% |

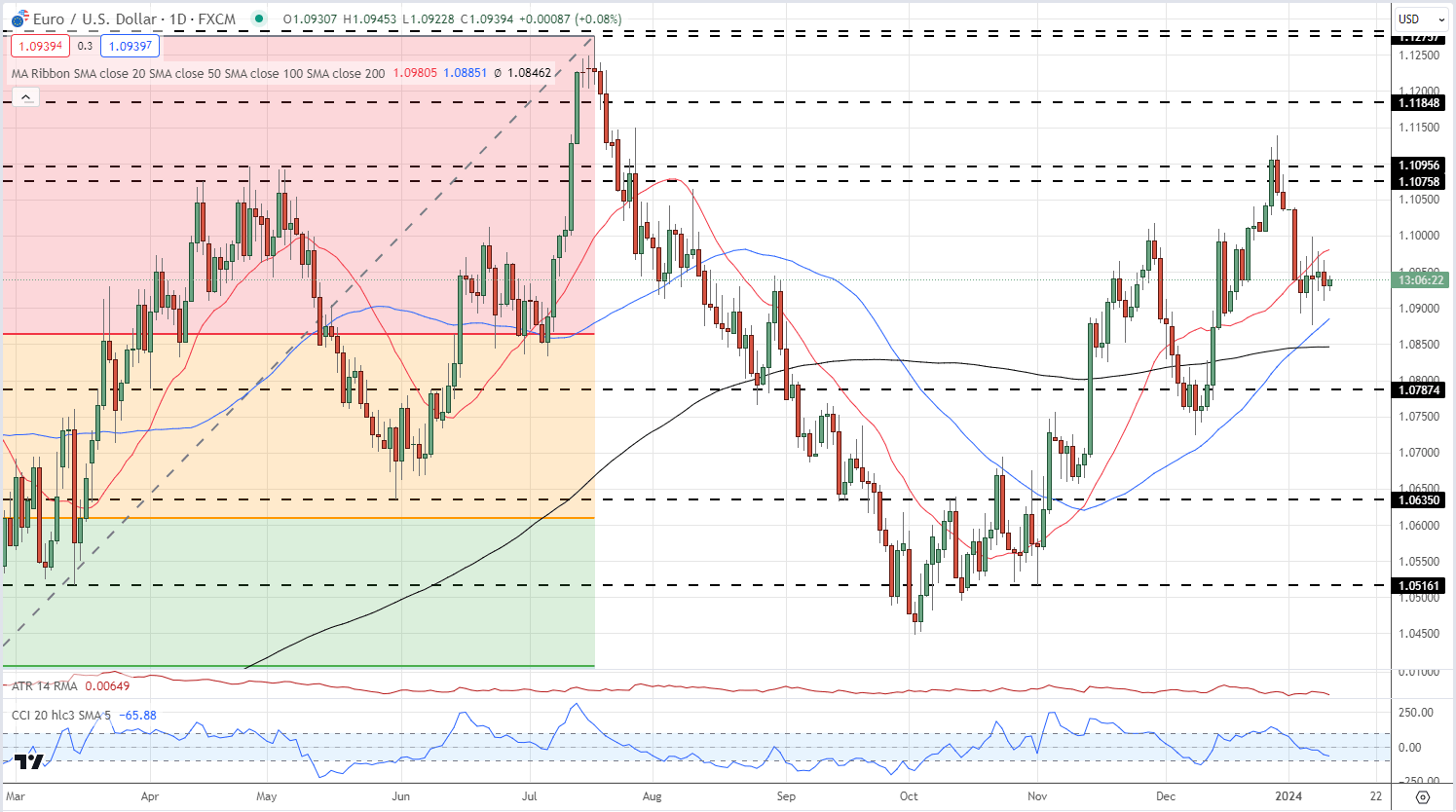

The EUR/USD chart is mixed with the current spot price stuck between the 20- and the 50-/200-day moving averages. As with GBP/USD a ‘golden cross’ was made last week, providing support for the pair, while the CCI indicator is neutral. Initial support is seen around 1.0900.

EUR/USD Daily Chart

All Charts using TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.