US Dollar (DXY) price, chart and analysis

- Federal Reserve Fund futures indicate that US interest rates will be cut by 75 basis points by the end of 2023.

- The US may run out of money by early June.

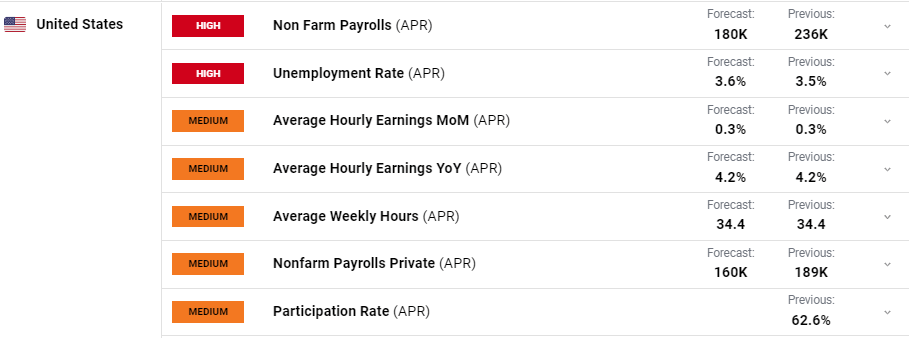

- The US Jobs Report (NFP) was released at 12:30 GMT.

Recommended by Nick Cooley

Get free forecasts in US dollars

The United States has ended the cycle of rate hikes and will embark on a strict rate-cutting cycle from late July, and rates are expected to drop by 175 basis points at the beginning of May next year if the latest CME FedWatch tool The odds of meeting play out. Rates are seen unchanged at the next meeting and then cut by 25 basis points at three of the four remaining meetings this year. In addition to additional cuts of 25 basis points next year, current market prices are showing an even sharper drop of 50 basis points at the next March meeting. While these odds are constantly changing, the current view points to lower rates for much longer into the future.

The United States may not be able to pay its bills in the coming period unless Congress agrees to raise the US debt ceiling soon. US Treasury Secretary Janet Yellen recently warned that the government could run out of money on June 1, leading to a possible default. While these debt ceiling debates happen on a regular basis — the debt ceiling has been raised 20 times since 2001 — there is usually an outcome where Republicans and Democrats find common ground. Concerns about the deadlock in the debt limit can be seen in the latest round of US Treasury bill sales. Yesterday’s sale of $50 billion of 4-week T-bills – maturing June 6 – produced an all-time record yield of 5.84% as investors demanded more returns for the risks associated with a potential default date.

Recommended by Nick Cooley

Traits of successful traders

Risk sentiment is currently giving the USD a supportive hand as fears of contagion in the US regional banking sector mount. The last banks in the spotlight, PacWest Bancorp and Western Alliance Bancorp fell 50% and 38% respectively yesterday as concerns mounted about another round of deposit outflows. Other safe-haven assets, including gold and the Japanese yen, were also in demand.

Next on the US data docket is the latest US Jobs Report (NFP) which was released at 12:30 GMT today. The US job market remains strong with an unemployment rate at or near a multi-decade low, and that’s supporting wages across the board.

See all market-influencing data releases and economic events in real time DailyFX calendar

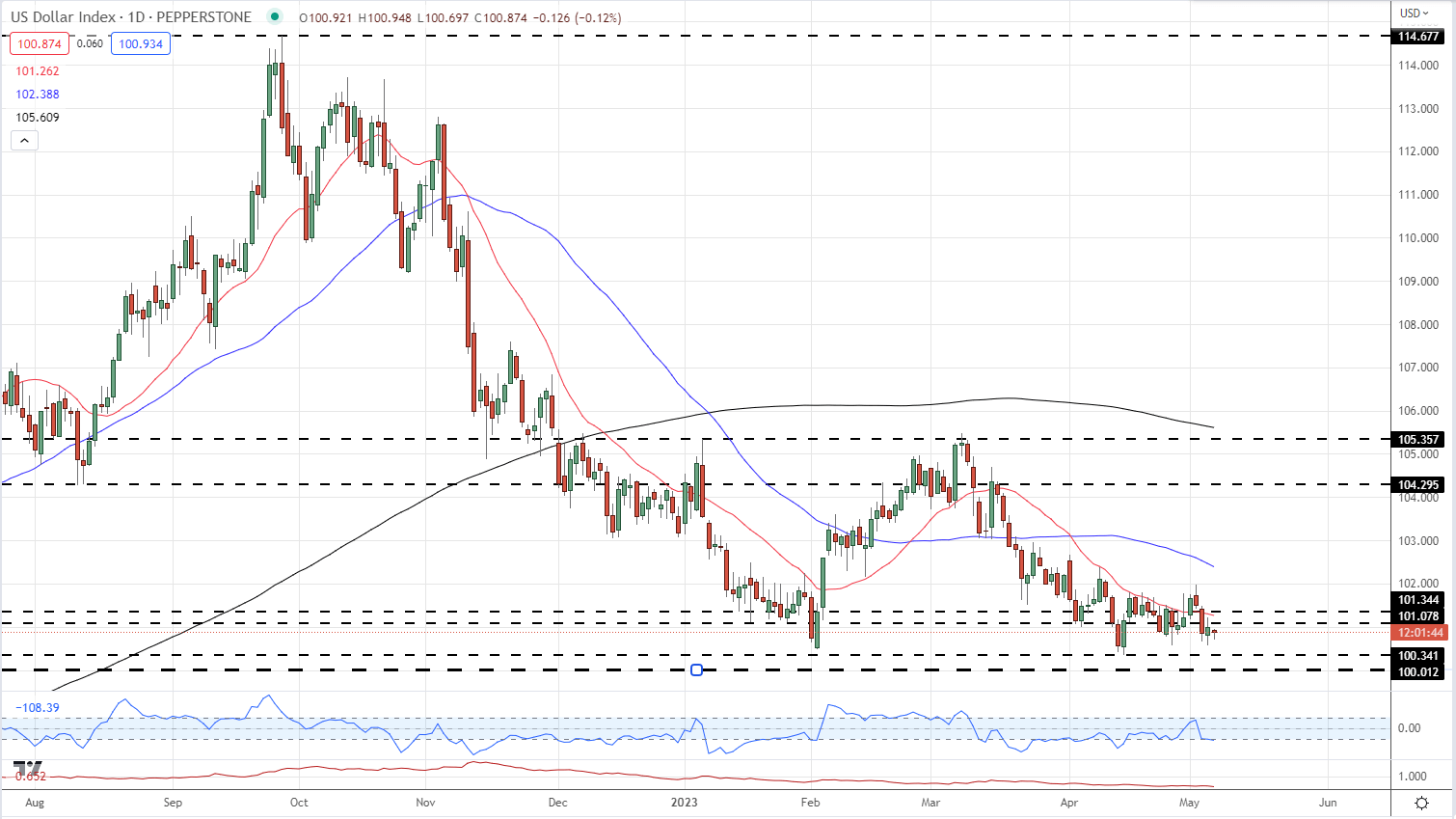

The USD is still stuck in a sideways trading range for the past month even though the overall technical setup points to lower prices ahead. All three moving averages are in a negative setting while the 20-day moving average continues to prevent any bullish breakout. The low of Apr 14th at 100.34 is the first level of horizontal support followed by the big support level at 100.

Daily price chart of USD (DXY) – May 5, 2023

Chart via TradingView

what is your opinion of U.S. dollar Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.

Comments are closed.