With not many high-level economic releases, markets focused on the Fed's speech and other asset-specific catalysts.

What headlines caught traders' attention on Monday?

We have deets!

Titles:

- The markets of Switzerland, Germany, France and Canada are on holiday

- Correct movement: Average property prices coming to market in the UK Up 0.8% m/m in May (vs. 1.1% previously) as spring season momentum exerts upward pressure

- As expected, The People's Bank of China kept key interest rates on one-year and five-year loans unchanged At 3.45% and 3.95% respectively in May

- Higher education activity index in Japan It unexpectedly fell 2.4% in March after rising 2.2% the previous month

- Iran confirmed the death of President Ebrahim RaisiForeign Minister Hossein Amir Abdollahian and other high-ranking officials following a helicopter crash

- In a letter, Deputy Governor of the Bank of England, Ben Broadbent Implied interest rates could be cut “over the summer” if data continues to match their expectations

- FOMC voting member Rafael Bostic He said “it will take some time” before the Fed is confident that inflation is on track to reach 2% and that the “new steady state” of interest rates is likely to be “higher than people have known for the past decade.”

- FOMC voting member Philip Jefferson “It is too early to know whether the recent slowdown in disinflation will last for a long time,” he said.

- FOMC voting member Michael Barr He said that inflation data for the first quarter of 2024 was “disappointing” and that they “need to allow our restrictive policy some additional time to continue its work.”

- FOMC Voting Member Loretta Mester He said inflation was “a little stronger than I expected” and now sees fewer than three rate cuts in 2024.

- Westpac: Australia – Consumer Sentiment It fell 0.3% to 82.2 in May as concerns about persistent inflation offset optimism from the federal budget.

Broad market price movement:

Dollar Index, Gold, S&P 500, Oil, 10-Year US Yields, Bitcoin Overlay Chart by TradingView

With no high-level data releases and most European markets on holiday, major financial assets were either trading in ranges or taking their cues from asset-specific catalysts.

Spot gold hit a new record high of $2,450 late in the Asian session with more traders anticipating the possibility of at least two rate cuts from the Federal Reserve this year following last week's weak inflation data.

Crude oil prices also traded higher due to the death of Iran's president and the emerging health concerns of Saudi Arabia's king, but the rise was temporary as there were no immediate signs of disruption to oil supply flows.

Meanwhile, Bitcoin (BTC/USD) continued its upward march above $70,000. There were no immediate headlines, but optimism about a potential Ethereum (ETH/USD) spot ETF may have sent Bitcoin prices higher.

Forex market behavior: US dollar against major currencies

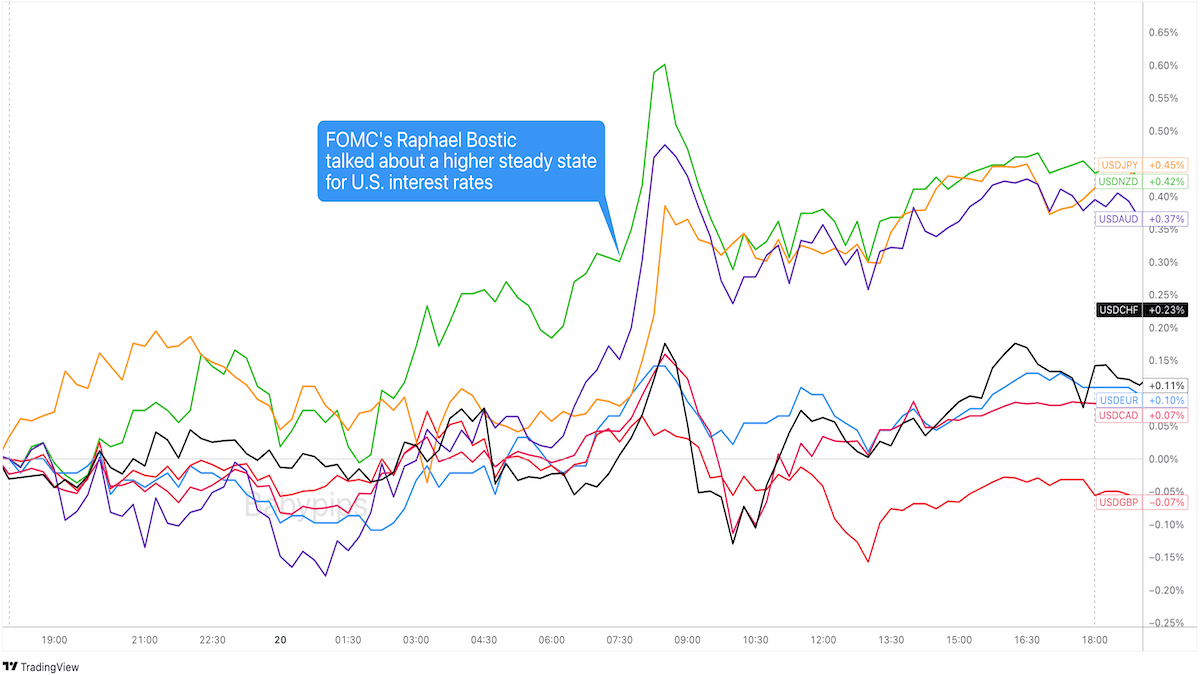

Overlay of the US dollar against major currencies Chart by TradingView

The US dollar traded in ranges in the Asian and early European sessions before a speech by FOMC voting member Rafael Bostic caused US 10-year yields to rise and encouraged demand for the US dollar.

Aside from stressing his bias for just one rate cut this year, Bostic spoke of a “new steady state” for US interest rates that could be “stable.”Higher than people have known over the past decade“.

Other Fed members' speeches throughout the day also leaned toward waiting a little longer before cutting interest rates this year.

Potential catalysts coming on the economic calendar:

- ECB President Lagarde will deliver a speech at 8:00 AM GMT

- Current Eurozone trade balance at 9:00 AM GMT

- CBI Industrial Orders Forecast in Germany at 10:00 AM GMT

- Inflation will be announced in Canada at 12:30 PM GMT

- FOMC voting member Christopher Waller will deliver a speech at 1:00 PM GMT

- FOMC voting member Thomas Barkin will deliver a speech at 1:00 PM GMT

- FOMC voting member John Williams will speak at 1:05 PM GMT

- FOMC voting member Rafael Bostic will deliver a speech at 1:10 p.m. GMT.

- FOMC voting member Michael Barr will deliver a speech at 3:45 PM GMT

- Bank of England Governor Andrew Bailey will deliver a speech at 5:00 PM GMT

- Core machinery orders in Japan will be announced at 11:50 PM GMT

- Japan Trade Balance at 11:50 PM GMT. RBNZ Policy Decision at 2:00 AM GMT, will be released at 3:00 AM GMT (22 May)

Fed members will once again dominate the headlines during the US session but they won't sleep on the other major currencies as ECB President Lagarde and Bank of England Governor Bailey take center stage and Canada drops its latest inflation reports!

Are you looking for your own place to record your market observations and trading statistics? If so, check out TRADEZELLA! It's easy to use

A blogging tool that can lead to valuable insights about performance and strategy! You can easily add your thoughts, plans and track your psychological state with each trade. Click here to see if this is right for you!Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe using our affiliate links, it helps us maintain and improve our content, much of which is free and available to everyone – including Pipsology School! We appreciate your support and hope you find our content and services useful. Thank you!