Talking points for US stocks:

Prediction: Neutral

- US stocks Had a solid week with Fridays losses proving the only point. Can the rally continue?

- Nasdaq 100 It looks like it’s time for a bounce with the support of the 14 day RSI now in the overbought territory.

- US debt ceiling developments key to further rise in US stocks.

Recommended by Zain Fouda

Get your free stock forecast

Read more: Debt Ceiling Blues, Part 79. What Happens If the US Defaults?

US indices week in review

US indices ended with a bit of a whimper on Friday given the impressive rally this week. Markets opened the week cautiously as the shadow of the US debt ceiling kept market participants on edge.

The S&P 500, Nasdaq 100 and Dow Jones benefited, as positive news about the debt ceiling and potential deal began to circulate. This helped the public sentiment and the stakes in particular, as a deal seemed possible by Sunday evening as reported by Republican Representative Kevin McCarthy. As the US Friday session begins, we hear from GOP debt-limit negotiator Graves who said talks are at a standstill because “the White House has become unreasonable.” These comments may explain the lackluster weekend that saw all three US indices close in the negative for the day, leaving the door open for some uncertainty in the week ahead.

Source: SYZ Group

Many analysts were cautious about the recent moves in US indices. Much of this stems from the uneven gains seen with the big tech stocks seen driving the rally. A quick look at Meta and Nvidia, which are up more than 100% this year and make up part of the top 8 SP500 stocks. Again, this was a sign that megacap technology has been the main source of strength during the recent recovery. These companies among others providing software and hardware components to the burgeoning AI field have been the biggest gainers so far and the reason for the cautious outlook.

S&P 500, NASDAQ 100, and DOW JONES forecasts for the next week

Equity indices are having an interesting week as the US debt ceiling talks are likely to come to a head while we also have some interesting risk events that could play a role as well. Mixed messages at the end of the week also threaten to spread, as US indices are likely to feel nervous. Comments from Treasury Secretary Janet Yellen on Friday hinted that the banking sector turmoil may not be over as she stated that more bank mergers may be necessary. These comments dovetail with Fed Chair Jerome Powell striking a somewhat dovish tone in his comments on Friday that saw expectations for a June rate hike cut from around 40% to 22% in what should be seen as positive for the stock market. We have the FOMC meeting minutes next week and this could give us more clarity on the Fed’s rationale going forward.

With that said, the debt ceiling impasse seems to be the main driver for the markets at the moment. Everything from the US dollar to bond and commodity yields is feeling pressure in one way or another. Given the withdrawal of the GOP negotiator on Friday, markets will no doubt start the new week on a cautious note looking at how the talks and negotiations will evolve and the resulting impact on overall market sentiment. I still believe that an agreement on the US debt ceiling will be reached before the deadline as has been the case in the past.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Economic calendar for the next week

The coming week on the calendar looks productive from a US perspective with four “high” rated data releases, and a slew of “medium” rated data releases (including a bunch of Fed speakers).

Here are four high-risk events that are “rated” for the coming week in the economic calendar:

- On Tuesday, May 24th, we have the release of the FOMC meeting minutes at 18:00 GMT.

- On Thursday, May 25th, we have quarterly GDP growth rate data (second estimate) at 12:30 GMT.

- On Friday, May 26, we also have the Fed’s preferred inflation measure for core PCE price index data at 12:30 GMT.

- On Friday, March 31st, we close out the week with the Michigan Consumer Confidence (Final) at 14:00 GMT.

For all the economic data and events that move the market, see DailyFX calendar

A very busy week for the economic calendar from a US perspective with inflation data in the form of the PCE price index likely to be the biggest event. And given the amount of Fed talk over the past week and next week, I don’t expect the FOMC meeting minutes to produce any notable shocks. Earnings season continues on Monday with a host of US companies making announcements next week. However, the biggest names will be Zoom video on Monday and of course Nvidia on Wednesday with both earnings releases expected after market close.

artistic look

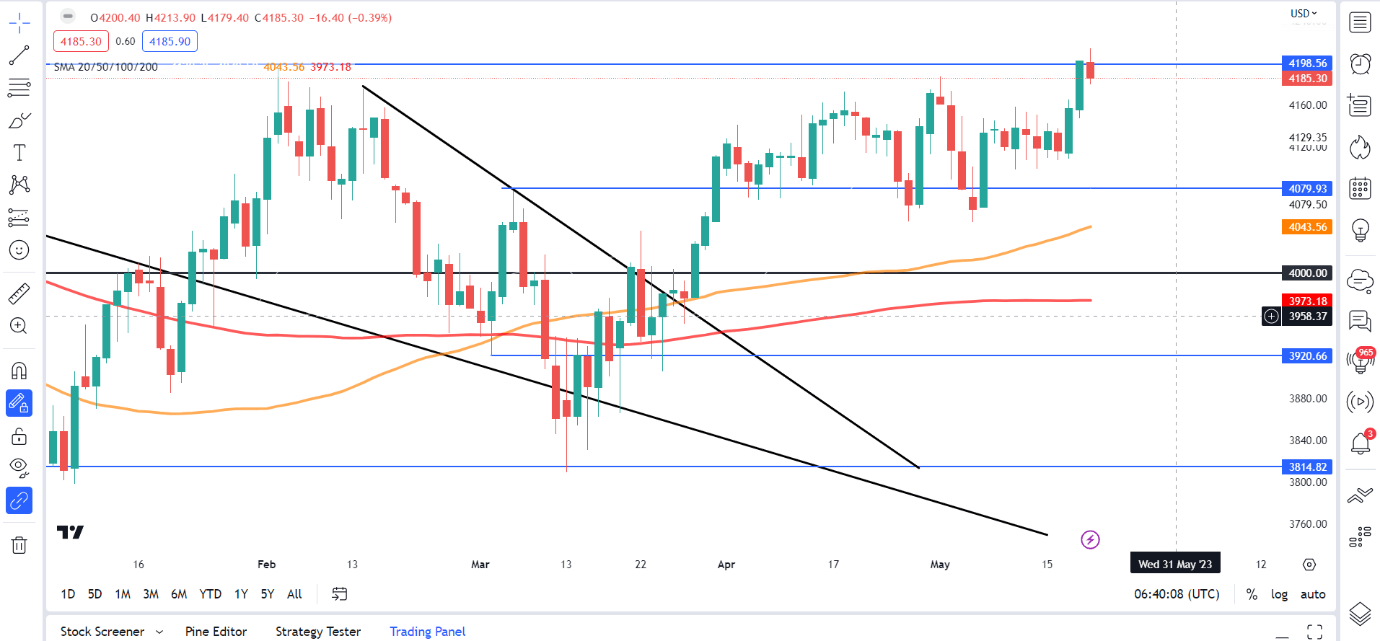

S&P 500 daily chart

Source: TradingView, prepared by Zain Fouda

From a technical perspective, the S&P finally reached the top of the range between 3800 and 4200 before pulling back slightly ahead of the weekend. The 4200 handle has proven to be a very tough nut to crack over the past 18 months. A US debt ceiling deal could facilitate a sustained break higher with immediate resistance emerging around the 4250 and 4320 handles. There is a possibility given the uncertainty heading into the new week that could facilitate a pullback before the bull returns, which would bring immediate support at 4135 into focus. Any further downside and 4100 and the 100 day moving average at 4043 become areas of focus.

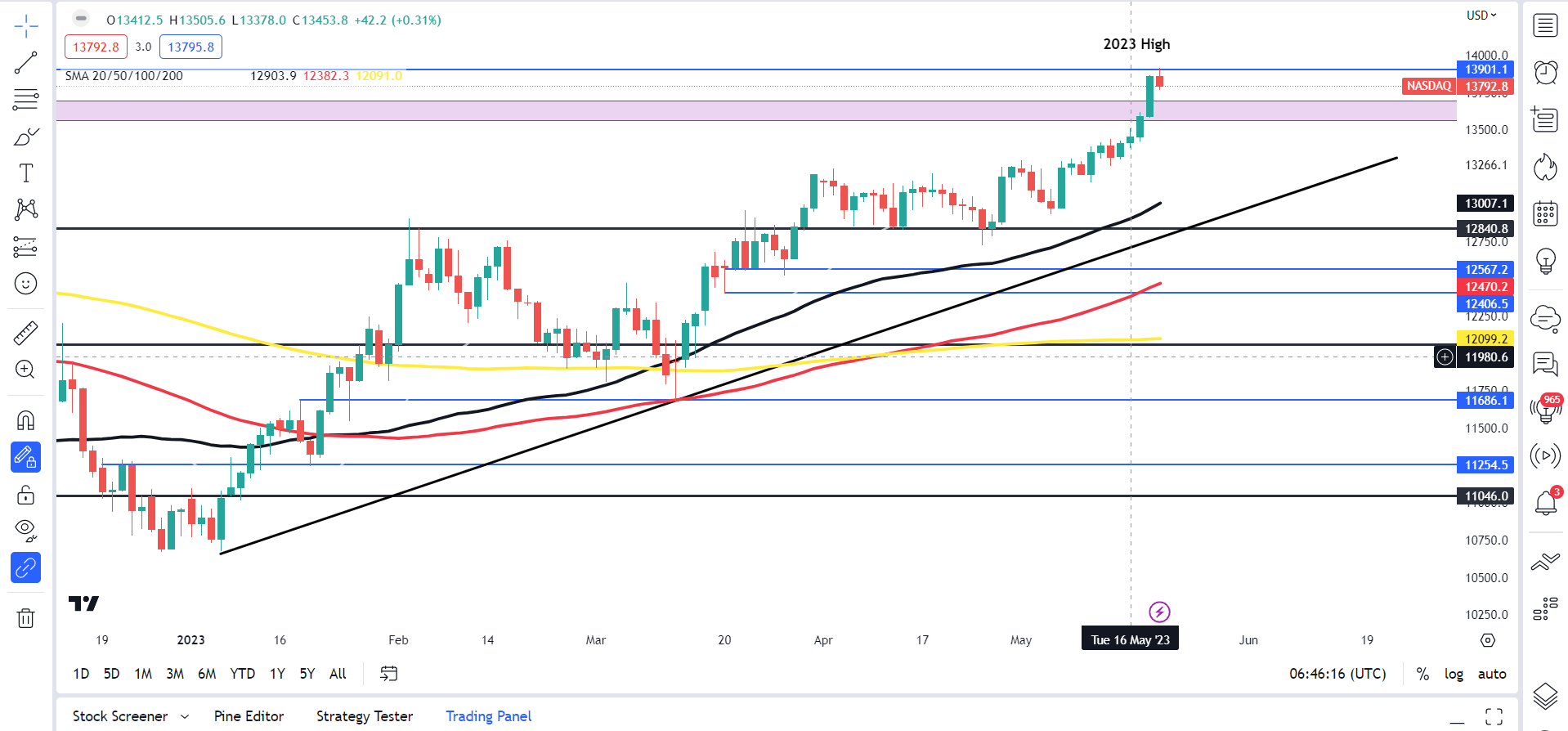

Nasdaq 100 daily chart

Source: TradingView, prepared by Zain Fouda

The NASDAQ 100, as mentioned above, continues to be a notable performer lately since it posted a low around 11,686 on March 13 (which was also the swing high on January 18). At the time, we had a golden cross with the 50 day EMA crossing above the 200 day EMA and the daily candlestick retracement of the 100 day EMA, all pointing to the recent rally from a technical perspective.

Last week we witnessed recording a new year-to-date high close to the psychological handle of 14,000, as Friday saw the Nasdaq index post its first bearish close this week. The NASDAQ may also need a catalyst to clear the psychological level of 14,000 while the 14-day RSI is also in the overbought area. I think the NASDAQ similar to the SP500 could be in a bounce early in the week ahead of any potential US debt ceiling deal.

Key levels to watch out for:

Support levels:

- 13700

- 13450

- 13021 (50-day moving average)

resistance levels:

Foundational knowledge of the trade

Understanding the stock market

Recommended by Zain Fouda

— Written by Zain Fouda L DailyFX.com

Connect with Zain and follow her on Twitter: @employee