-

Fundstrat’s Tom Lee expects the S&P 500 to hit 15,000 by 2030.

-

Demographic trends, millennial spending habits, and technological advancements will be key drivers.

-

Here are four charts that illustrate why Lee is bullish on the stock market.

Fundstrat CEO Tom Lee raised eyebrows last month when he made a very bullish prediction: The S&P 500 is expected to nearly triple by 2030.

In an interview with Bloomberg’s Odd Lots, Lee said he expects Standard & Poor’s 500 The index is expected to exceed 15,000 points by the end of the decade. The index was trading at 5,630 points on Friday.

“If this is a normal S&P cycle after looking at the demographics… the S&P could potentially hit 15,000 by the end of the decade,” he told me. “And to me, moving to a longer time frame, I think we’re probably heading toward that level.”

He told me in the interview that he was looking at a few charts that supported his long-term bullish outlook.

Here are four charts he shared with Business Insider that show why the bullish forecaster is already bullish on the stock market.

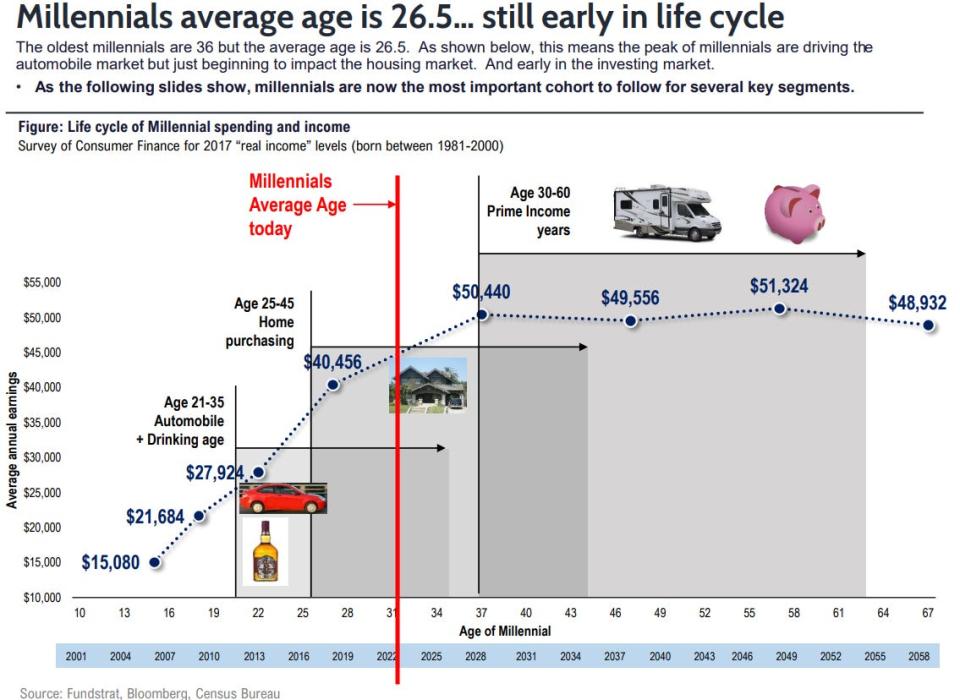

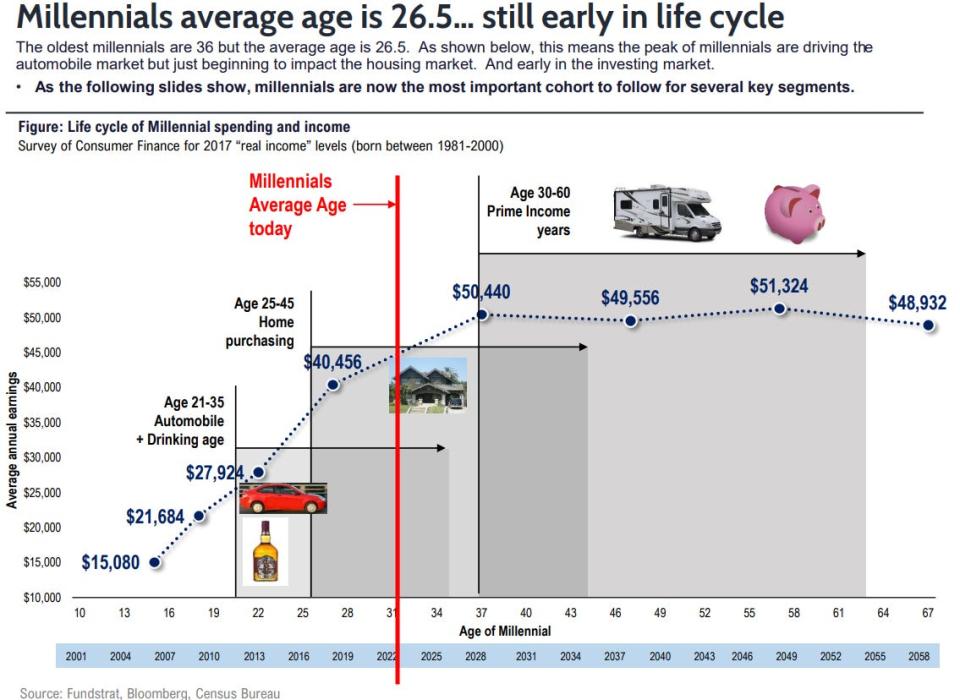

1. Thank you, Millennials.

He created the chart above for me several years ago, but his thesis remains the same. The average age of millennials is now around 31, and the global 2.5 billion-strong age group is beginning to enter its prime years of 30 to 50.

“This will be the third time stocks have entered a cycle where annual returns have been accumulating at high levels,” he told CNBC last month. “It was the roaring 20s, then it was the 50s and into the late 60s, and this is the third cycle.”

“They all coincided with an increase in the number of people aged 30 to 50, or in other words, the number of adults at peak age, and this time it was driven by millennials and Generation Z.”

“It’s a demand story. When you reach the peak of your life, between 30 and 50, the Urban Institute shows, you start borrowing more money, you make big life decisions, and that’s what drives the economy.”

2. Stock Market Peak and Demographics

The stock market has a history of peaking around the same time that the population reaches its peak age at around 50, as they approach retirement and often spend less money.

For example, when the Greatest Generation peaked in 1930, it coincided with a bear market in stocks that lasted for several years.

Now let’s jump to 1974, when the Silent Generation peaked. This happened around the same time as a painful 35% stock market correction that lasted for years.

The baby boom generation peaked in 1999, just one year before the multi-year stock market crash.

The average millennial won’t reach their prime until 2038, suggesting there’s plenty of stock market upside between now and then, according to Lee.

3. Technology will solve the global labor shortage.

He told me that spending on technology will see a huge boom in the coming years as the world suffers from a growing labor shortage.

“We have a really big opportunity for American tech companies because of AI, which is providing global digital labor, because there is a global labor shortage,” he told me. “So those two forces are coming together to create almost a decade of extraordinarily good stock returns.”

“I think a lot of dollars will be spent on American technology products because the world is short 80 million workers by the end of this decade, which means about $3 trillion in workers’ salaries are going to silicon, which means American suppliers of silicon and AI will generate $3 trillion in revenue.”

4. Money will flow into US tech stocks.

As more companies spend trillions of dollars on technology to address the global labor shortage, that could push the tech sector to make up 50% of the S&P 500.

The IT sector currently accounts for about 30% of the index.

“If American companies are growing their earnings this fast, the price-to-earnings multiple in the United States should go up,” he told me. “Capital will flow to the United States. Where else in the world do you find the best, most important technology companies? They are all basically in America.”

Read the original article on Interested in trading