At the time of writing, Bitcoin is in a bearish mood, having erased the strong gains it made last week. Although buyers are expecting the price to recover and break above $69,000, the decline has been steady, even breaking the upper range of the current consolidation.

According to spot market prices, Bitcoin is down 6% from last week’s high and about 12% from its all-time high. Shrinking prices also mean a decline from all-time lows, a bearish sign.

Bitcoin Whales Increase Purchases

Despite this confluence of bearish signals, there are hints that buyers are gathering at spot market prices. With prices breaking through the $66,000 level, the key support, according to on-chain data shared by Ki Young Ju on X, points To the force, at least considering the whale’s behavior.

While prices may be falling slowly, Joe, the CEO of CryptoQuant, notes that whales have been buying heavily in the past few weeks. Over the past month alone, 358,000 bitcoins have been moved to permanent holder addresses. These wallets tend to hold onto bitcoins and are not affected by price fluctuations, as retail traders have been when prices have fallen.

Importantly, these addresses are not tied to ETF issuers or Bitcoin miners. So far in July, BlackRock, Fidelity, and other ETF issuers, such as Bitwise, have purchased more than 53,000 Bitcoin on behalf of their clients.

The fact that the coins are moving to these wallets indicates that the whales are confident about what lies ahead and are unwilling to dump their stocks, and this comes at a time when issuers of Bitcoin ETFs are withdrawing more coins from circulation.

Mt. Gox Distribution is very popular due to BTC market

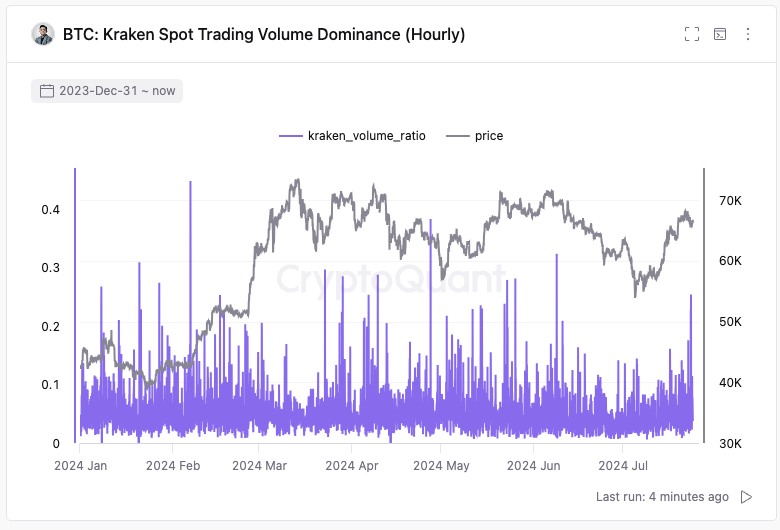

Interestingly, whales are gorging on more Bitcoin and holding onto it as cryptocurrency exchange Kraken completes the process of paying off its Mt. Gox creditors. The Bitcoin market was worried that the Mt. Gox distribution would cause a bloodbath from late June to early July.

However, given the events of the past few days, it seems that the market has handled any sell-off well without causing much volatility. In a post on X, Joe said: He said Spot trading volume and exchange flows remain normal on the Kraken platform.

Amidst this development, more users are flocking back to the cryptocurrency market. The Mt. Gox payout via Kraken coincides with marked Increase in USDT and stablecoin liquidity. Historically, any increase in USDT inflows to exchanges has preceded sharp gains in Bitcoin prices.