Forecasters expect a monthly report on U.S. consumer prices to show another modest increase last month, reinforcing widespread expectations of a Federal Reserve interest rate cut in September.

Article Content

(Bloomberg) — Forecasters expect a monthly report on U.S. consumer prices to show another modest increase last month, reinforcing widespread expectations for a Federal Reserve interest-rate cut in September.

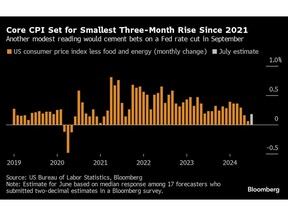

The figures, to be released by the Bureau of Labor Statistics on Wednesday, are likely to show that the consumer price index, a “core” measure excluding food and energy, both rose 0.2% in July, according to the median estimate in a Bloomberg survey.

Advertisement 2

Article Content

That reading would represent the smallest three-month increase in core inflation since early 2021, before the widespread rollout of Covid-19 vaccines spurred a surge in U.S. economic reopening.

“Bloomberg Economics expects the July CPI to be weak, driven by a long-awaited slowdown in housing rents, lower used-car prices and discounts in discretionary services categories as consumers rein in spending,” said Anna Wong, chief U.S. economist, in a preview of the numbers.

Here are the key components to watch for in the report:

Rentals

Core inflation excluding shelter largely returned to pre-pandemic levels by the end of 2023. But the rapid increases in rents in the CPI data continued through most of the first half of 2024. However, in June, they slowed sharply, recording the smallest monthly increase since mid-2021.

Economists expect this slowdown to continue in the coming months, helping to limit the overall progress in the CPI. Rents are the largest category in the index, so they have a big influence in determining the broader trend.

“The decline in primary housing stocks in June appears to be sustainable based on the Bureau of Labor Statistics’ New Rental and Private Sector Vacancies Index,” Wells Fargo economists Sarah House and Aubrey George said in a preview of the figures on Aug. 7. “We expect another 0.3% gain in July and primary housing stocks to increase by 0.25% to 0.30% month-on-month through the end of the year.”

Article Content

Advertisement 3

Article Content

Used Cars

Within the commodity components of the index, analysts remain focused on used cars in particular. Given their weight in the index, the July decline could help extend a run of declines for the broader basket of commodities, which has fallen in 12 of the past 13 months.

While a broad gauge of wholesale used-vehicle prices published by Manheim rose in July, the CPI component tends to follow only with some lag — and July’s increase was only the first since January.

“Used car auction prices are now down 26% from their peak versus 18% for CPI-based used car prices, suggesting there is room for further CPI declines,” Goldman Sachs economists Ronnie Walker and Jessica Rindels said in a preview of the figures on Aug. 12.

“We expect a modest decline in new vehicle prices, as dealer promotional incentives rebound following the end of the dealer software disruptions in June.”

Airline ticket prices

Airfare prices were a major factor in the negative surprise to the core CPI in June, where the 5% decline was the largest in a year. That helped the measure of basic utility costs excluding rents post back-to-back monthly declines for the first time since mid-2021.

Advertisement No. 4

Article Content

The July reading is a source of uncertainty, with arguments for both increases and decreases, say Citi economists Veronica Clarke and Andrew Hollenhorst.

In a preview of the report on Aug. 12, Clark and Hollenhorst wrote: “We were surprised by the weakness of airfares last year, which were even below pre-pandemic levels on a seasonal basis. We had expected some recovery in airfares this year, as the sample of flights priced according to the CPI last summer may have reflected flights with lower summer demand.”

“But with travel demand down more broadly than last year, airfares could remain weak.”

Bond Markets

Bonds rose across the board on Tuesday after U.S. data showed producer prices rose less than expected in July, with traders who have endured some dramatic volatility in recent sessions positioning themselves for big gains ahead of Wednesday’s consumer price index report.

“The market is going very dovish,” Matt Luzzetti, chief U.S. economist at Deutsche Bank, told Bloomberg Television on Tuesday after the producer price report, “expecting weak inflation numbers that will allow the Fed to start cutting interest rates.”

—With the assistance of Edward Bolingbroke.

Article Content

Comments are closed, but trackbacks and pingbacks are open.