Solana price remains stuck in a deep bear market with low volume on decentralized exchanges and open futures.

Solana (SOL) shares have been on a two-week winning streak, rising more than 33% from their August lows. However, they remain in a bear market after falling more than 30% from their year-to-date highs.

Solana trading volume on DEX drops

Its price action has mirrored that of other cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), which are all in a bear market.

Solana’s sell-off occurred as trading volume on its DEX platforms declined in the past few weeks. Data by Davey’s Call Data shows that its DEX trading volume has dropped by more than 45% in the past seven days. During this period, it handled $7.12 billion worth of transactions while Ethereum handled $8.9 billion worth of transactions.

Trading volume on the Solana DEX has been declining due to the ongoing meme coin selloff. Leading Solana meme coins like Dogwifhat (WIF), Bonk (BONK), Popcat (POPCAT), and Book of Meme have all dropped by over 50% in the past few months.

Solana has become the most popular network for creating meme coins, thanks to its high speeds and low transaction costs. The launch of Pump.fun, a meme coin generator, has made it easier to launch Solana’s meme coins.

Data shows These tokens have a combined market cap of over $425 million, with Michi, Daddy Tate, Mother Iggy, and Billy being the largest.

Meanwhile, Solana’s open interest in the futures market has stopped.

According to CoinGlass, open interest in futures on August 18 was nearly $2 billion, the same level as the previous five days. Interest is well below the July 30 peak of $3.08 billion.

The drop in open interest is likely due to the massive liquidation that occurred earlier this month as cryptocurrencies slumped.

Solana bulls suffered liquidations worth over $39 million, while short liquidations totaled $21 million on August 8.

Solana has bullish technical indicators.

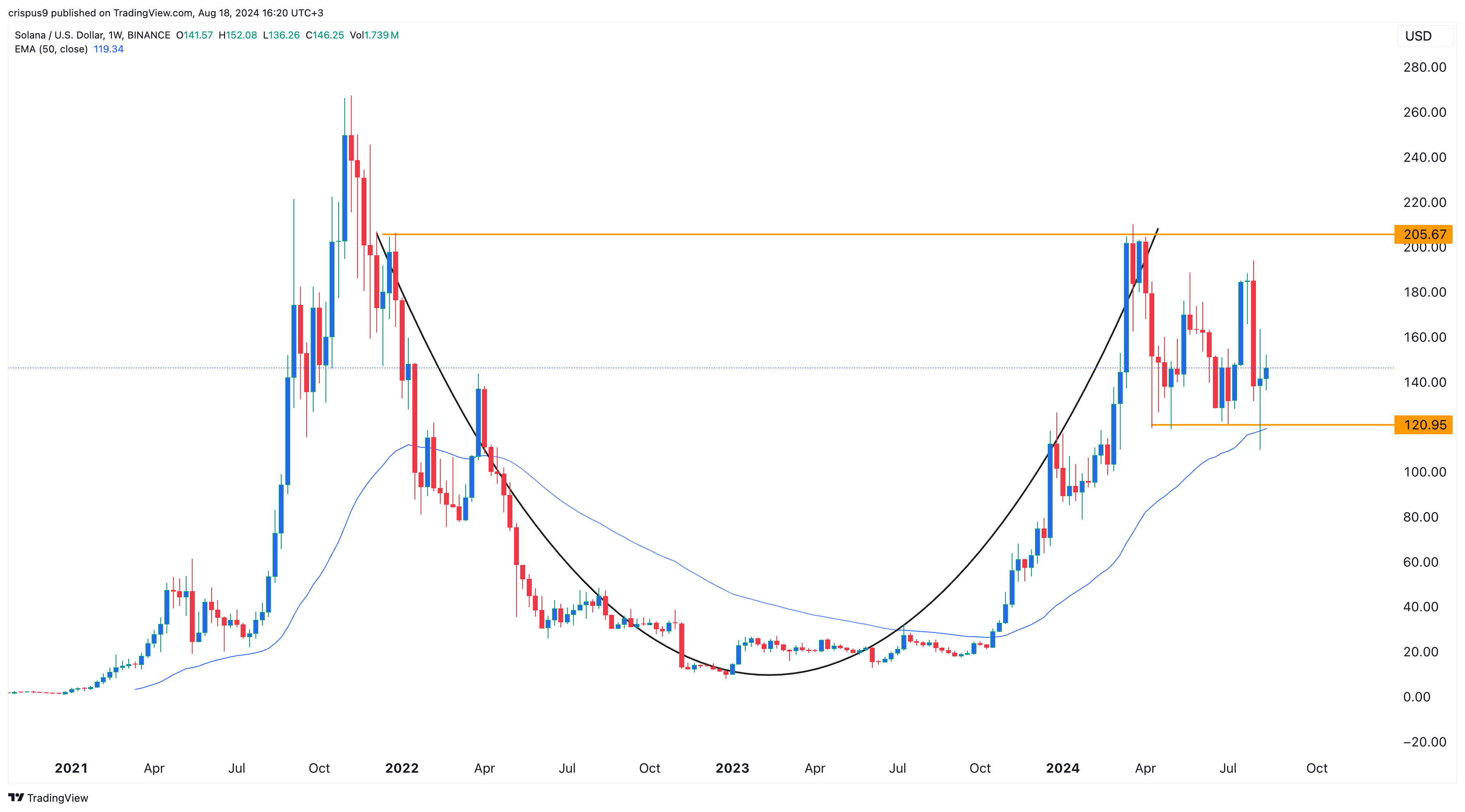

On the positive side, Solana found strong support at the 50-week moving average, having failed to move below it earlier this month.

The coin also formed a Doji pattern, which is characterized by a small body and long upper and lower shadows, and is one of the most common reversal signs in the market.

Additionally, Solana has formed a cup and handle pattern, which indicates the continuation of the uptrend. Hence, the coin may continue its upward trend in the coming weeks as buyers target the key resistance level at $180.

Comments are closed, but trackbacks and pingbacks are open.