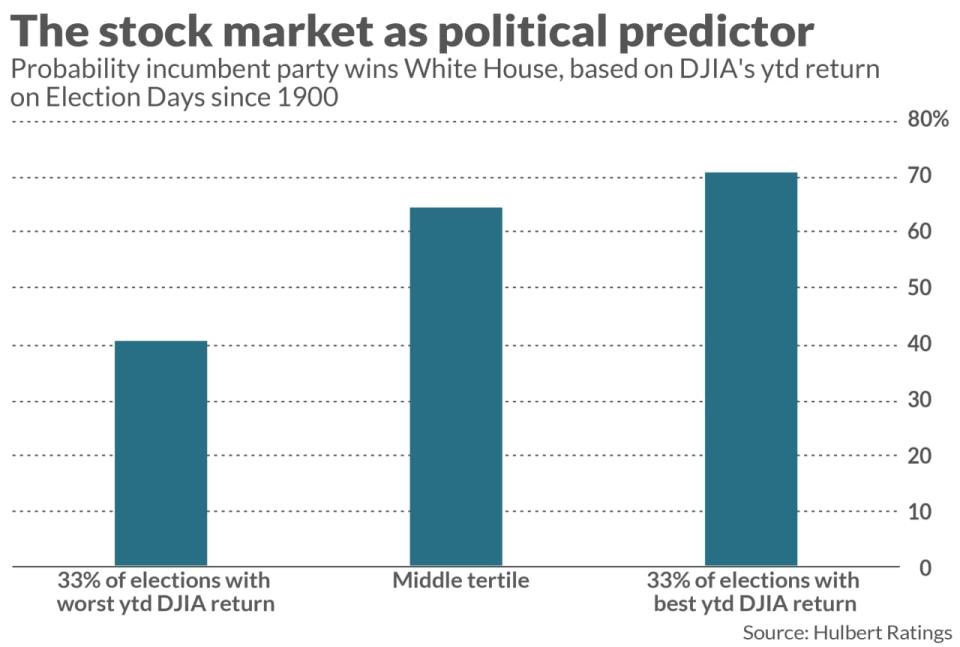

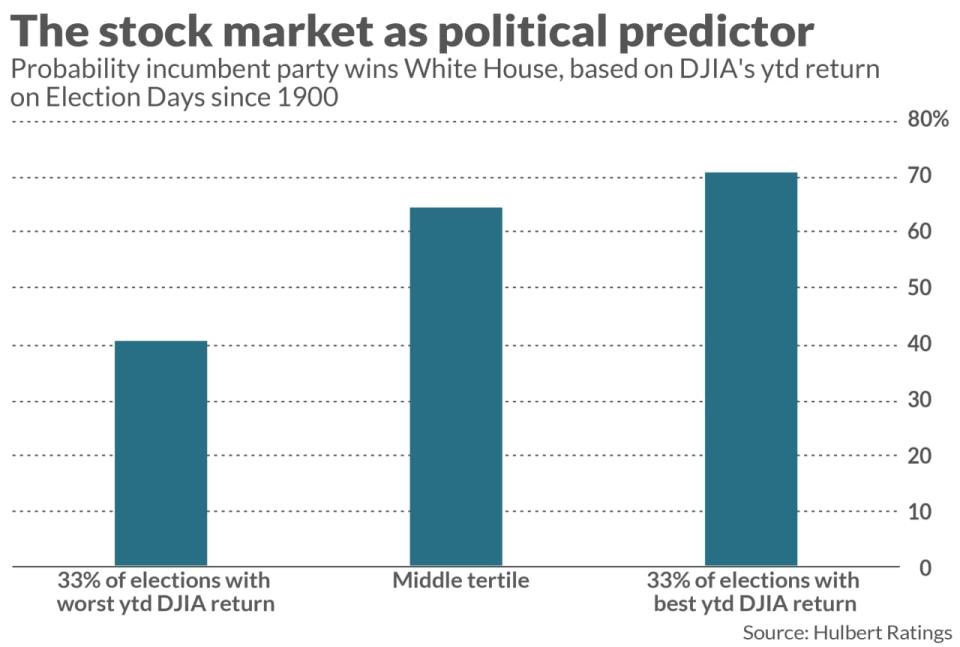

There is a 64% chance that Kamala Harris will win the presidential election in November, given the strong performance of the stock market since the beginning of the year.

This is moderately higher than the 58% probability I mentioned in Column last MayThe reason for this is that the stock market is higher now than it was then, and there is a close relationship between the performance of the stock market in an election year and the chances of the party in power retaining the White House.

Most Read from MarketWatch

Read more Economic and political news

Many readers have urged me to update this column, now that President Biden has dropped out of the race and Kamala Harris is the presumptive Democratic nominee. But the change in candidates doesn’t affect the statistical conclusion, which is based on the party in power, not the candidate. The only input to my simple statistical model is the year-to-date return of the Dow Jones Industrial Average, which is higher today than it was three months ago.

It is important to put this model’s conclusion in context. For one thing, it is by no means a guarantee. In 2016, for example, the stock market on Election Day was up modestly year-to-date, and the incumbent party still lost. In any case, it is entirely possible that the stock market will fall between now and Election Day, and thus the probabilities my model currently calculates will be reduced. For example, the odds of Harris winning will fall below 50% if the annualized return of the Dow Jones Industrial Average on Election Day is negative.

On the other hand, the stock market has a stronger statistical record than many other indicators I’ve analyzed, such as the economy (as measured by GDP), the Conference Board’s Consumer Confidence Index, and the University of Michigan’s Survey of Consumer Opinions. Look at the accompanying chart, which was constructed by dividing every election year since 1900 into thirds, based on the annual return of the Dow Jones Industrial Average on Election Day. Notice that the party in power’s chances of winning increase with each third.

But what about the electronic futures and betting markets? Since they’ve only been around for a few presidential election cycles, there’s not enough data to tell whether they have a better track record than the stock market. However, I do note that these markets are currently putting similar odds on a Harris win as my stock market model. Harris Contract at PredictIt.orgFor example, it gives her a 58% chance of winning.

Comments are closed, but trackbacks and pingbacks are open.