Gold Price (XAU/USD) Charts and Analysis:

Recommended by Zain Fouda

How to trade gold

Read more: EUR/USD and GBP/USD look to rebound on Monday’s liquidity drop after US debt deal

Gold prices fell in Asian trading as the Dollar Index (DXY) hit new highs this morning. XAU/USD has since found support at the 100-day moving average around the $1936/oz handle at the start of the European session.

Dollar index and debt ceiling deal

And given yesterday’s bank holiday in the US and UK, market participants will be closely watching the reaction to the US Debt Ceiling Agreement (in principle). Of course, this deal still needs to be approved by both the White House and Republican congressional leaders before the bill reaches US President Biden’s desk. US Treasury Secretary Yellen on Friday introduced a new date for a possible default default, giving policymakers more wiggle room as the date was moved from June 1 to June 5.

A lot is likely to go wrong in the meantime, but more important will be the reaction from the markets today, which may provide a gauge of what to expect ahead of the US jobs data on Friday. The US dollar has also received renewed support recently as the odds of a Fed rate hike to the Fed’s June meeting increase. Markets are now pricing in about a 56% chance of a 25 basis point rally in June, up from 28% a week ago. US jobs and jobs data awaits this week and may increase the odds of a rate hike if the labor market continues its resilient trend.

Source: CME FedWatch

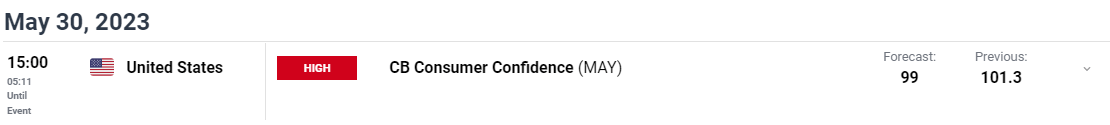

There is not much on the agenda today as sentiment is expected to continue to drive market movements. The highlight of the economic calendar comes in the form of CB Consumer Confidence data from the US.

For all the economic data and events that move the market, see DailyFX calendar

Golden technical outlook and final thoughts

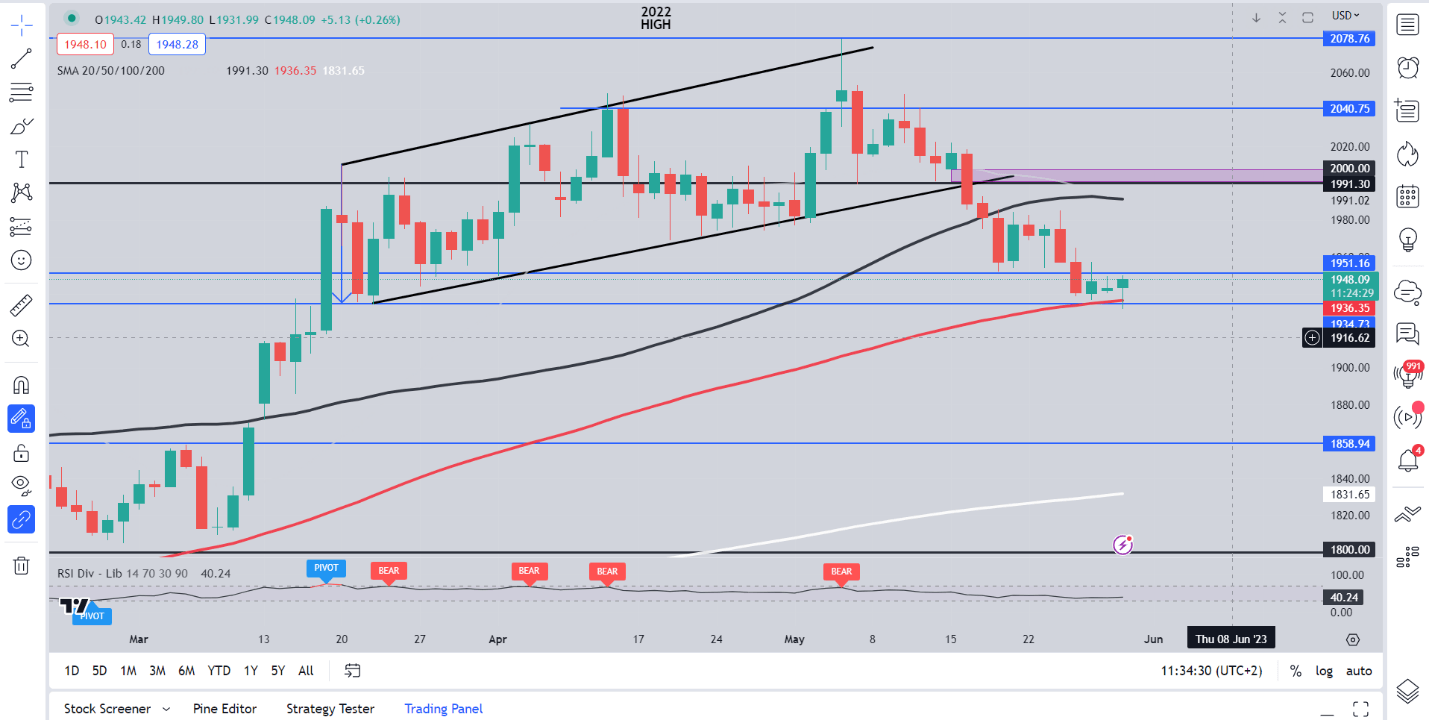

From a technical perspective, gold price action has been hinting at further declines for a while as improving sentiment and a strong dollar made the perfect combination. However, yesterday’s daily candlestick closed as an inverted hammer indicating a potential turnaround and bounce to the upside today.

After falling in the Asian session, the European session saw the Dollar Index (DXY) pull back slightly with XAUUSD bouncing off the 100-day moving average to trade at $1945 an ounce at the time of writing. A continuation of the rebound this morning would face the $1950 level for resistance before looking for resistance around $1957 and $1970 respectively. The 50 day EMA is currently sitting around the $1991 handle in case the bulls take over the market and the rally gains traction.

Alternatively, a break below the 100-day EMA around the $1936 level could send the price back to the $1925 handle before reversing towards the psychological $1900 level. Gold is interesting given that a debt ceiling deal could see safe-haven demand dissipate, weighing on the precious metal. On the other hand, dollar weakness could support more upside, as bulls and bears are likely to continue scrambling for positions.

Key intraday levels to watch

Support levels:

- 1936 (100 day MA)

- 1925

- 1900

resistance levels:

Gold (XAU/USD) Daily chart – May 30, 2023

Source: TradingView, chart by Zain Fouda

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Written by: Zain Fouda, Markets Writer DailyFX.com

Connect with Zain and follow her on Twitter: @employee