Financial markets are mixed as traders prepare for the Federal Open Market Committee decision later this week while Chinese banks remain closed for the Mid-Autumn Holiday.

So far, the US dollar is heading towards its lowest levels this year while gold is hovering near its all-time highs.

Find out the latest headlines moving the markets:

Headlines:

-

Chinese data points It came out on Saturday and was mostly disappointing:

- Industrial production in August: 4.5% y/y (4.7% expected, 5.1% previously)

- Retail sales fell another 2.1% year-on-year (vs. 2.5% expected) in August after a 2.7% decline in July.

- Fixed asset investment up 3.4% y/y in August (3.5% expected, 3.6% previously)

- The unemployment rate rose from 5.2% to 5.3% in August.

- Over the weekend, Another assassination attempt on former President Trump In Florida

- Russian President Putin orders military to increase strength by 180,000 to 1.5 million

- Bank of Canada Governor Macklem He stressed his readiness to cut interest rates faster if downside risks increased.

- New Zealand services index improves to 45.5 from 45.2 in August; July reading revised up from 44.6; employment rises to highest since March

- Israeli Prime Minister Netanyahu has issued a warning to Houthi rebels in Yemen after they fired a missile into the country on Monday.

- Swiss PPI August: 0.2% MoM (0.1% expected, 0.0% previous)

- Rightmove: Average new selling prices for UK sellers rose 0.8% month-on-month in September after falling 1.5% in August

- European Central Bank Chief Economist Philip Lane He said the central bank should continue to gradually reduce interest rates.

- The euro area’s international trade surplus in goods in July amounted to €21.2 billion compared to €6.7 billion in July 2024; exports of goods to the rest of the world increased by 10.2% year-on-year while imports rose by 4.0% year-on-year

- Canadian Manufacturing Sales in July: 1.4% MoM vs. 1.7% MoM in June

- Chinese banks remain closed for Mid-Autumn Festival

Price movement in the broad market:

Dollar Index, Gold, S&P 500, Oil, 10-Year US Treasury Yield, Bitcoin Chart by TradingView

Most asset classes saw mild volatility at the start of this trading week, as Chinese markets were closed for the Mid-Autumn Festival.

Bitcoin and the US dollar fell throughout the day while gold traded near record highs as investors were likely to play it safe ahead of the Federal Open Market Committee decision. Even US stock indices ended on a mixed note, with the Dow Jones and S&P 500 closing in the green while the Nasdaq closed down 0.47%.

But crude oil was an exception, with the commodity starting to fall, likely due to pessimistic Chinese data released over the weekend and its impact on global demand. However, the energy commodity quickly rallied due to geopolitical tensions, with Israel issuing a strong warning to the Houthis after the rebels fired a missile into the country.

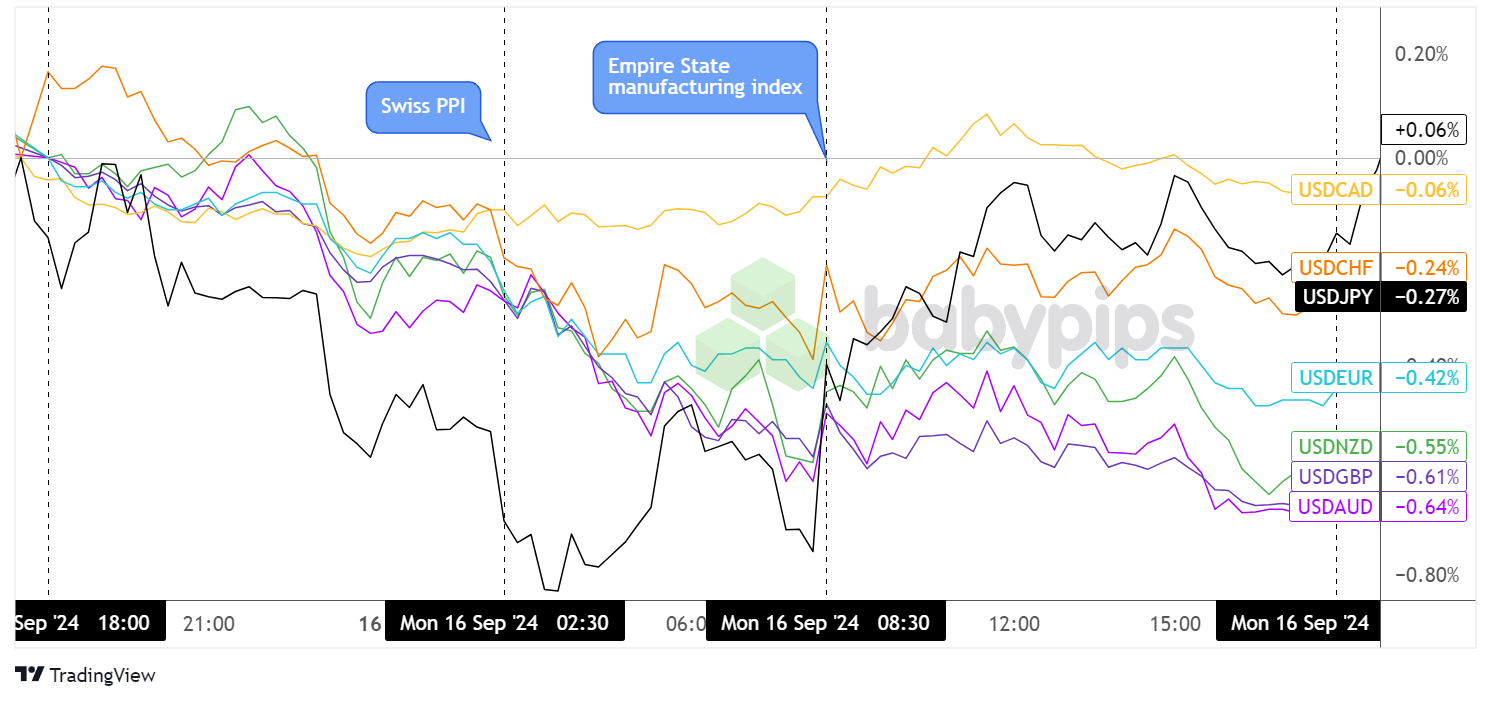

Forex Market Behavior: US Dollar vs Major Currencies:

US Dollar Overlay Against Major Currencies Chart by TradingView

It’s a different story in the forex market, where volatility was present throughout the day, with the US currency having a rough start against its peers.

Although Japanese markets were off on Monday, the USD/JPY pair continued to fall to a 12-month low, only to rally after the Empire State Manufacturing Index came in much stronger than expected.

The USD/CAD pair also rose after the release, as the Canadian dollar was unable to benefit from anti-dollar moves and higher crude oil prices likely due to another set of dovish comments from Bank of Canada Governor Macklem over the weekend.

The US dollar soon resumed its downward trajectory against most of its peers, especially the Australian, New Zealand and British pounds, pushing the US dollar index close to its lowest levels since the beginning of the year.

Potential catalysts coming up on the economic calendar:

- ZEW Economic Sentiment Index for Germany and Eurozone at 9:00 am GMT

- Canada Consumer Price Index Report 12:30 PM GMT

- US Retail Sales Data 12:30 PM GMT

- US Industrial Production and Capacity Utilization at 1:15 PM GMT

- FOMC Member Logan Speaks at 2:00 AM GMT

- New Zealand GDT Dairy Auction Coming

- Japan Core Machinery Orders and Trade Balance at 11:50 PM GMT

We have two main drivers of the market today, which are: Canada inflation figures And the US retail sales report.

It is best to keep a close eye on further CAD weakness if CPI readings come in below estimates and confirm the Bank of Canada’s dovish bias. Be sure to factor in potential shifts in Fed rate cut expectations based on U.S. consumer spending data.

Don’t forget to check out our new Forex Correlation Calculator!

Comments are closed, but trackbacks and pingbacks are open.