Earnings season is upon us, and the US stock market’s furious $9 trillion rally in 2024 may be facing its biggest test of the year.

Article content

(Bloomberg) — Earnings season is here, and the U.S. stock market’s furious $9 trillion rally in 2024 is facing its biggest test of the year.

Strategists expect companies in the S&P 500 to post their weakest results in the past four quarters, with just a 4.3% increase in third-quarter profits compared to last year, Bloomberg Intelligence data shows. In mid-June, expectations were for an increase of 8.4%, and in the second quarter growth rose to 14%.

Advertisement 2

Article content

Despite the shrinking outlook, the S&P 500 hit another record high on Friday, rising 22% into 2024, its best start since 1997. Investors who continue to bid up stock prices may be onto something, because it appears… There is scope for a reduction in share prices. There will be an upside earnings surprise if these downgraded forecasts turn out to be too bleak. It happened in the first quarter, when expectations were for 3.8% growth, and growth turned out to be 7.9%.

“Analysts lowered EPS estimates more than usual when reporting, which could lead to a higher beat rate and better stock performance during the quarter,” said Ross Mayfield, investment strategist at Baird.

Earnings season unofficially kicked off on Friday, led by leading financial firms JPMorgan Chase & Co. and Wells Fargo & Co. and BlackRock Inc. More major companies will report results next week, including Citigroup Inc. and Netflix Inc. and J.B. Hunt Transport Services Inc. .

Here’s a look at five key themes to watch as the results roll in:

Artificial intelligence is slowing down

The bulk of the growth in S&P 500 earnings continues to come from big technology companies that are seen as the main beneficiaries of the development of artificial intelligence. The so-called Magnificent Seven companies — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Meta Platforms Inc. and Tesla Inc. — are expected to achieve success. – An increase in its profits by 18% in 2019. Third quarter. Their problem is that the rate of increase is slowing, down from more than 30% in 2023, according to BI.

Article content

Advertisement 3

Article content

Relative to the rest of the S&P 500, earnings are expected to rise 1.8% in the July-September period, the second straight quarterly increase, albeit barely, BI data show. They registered 9.1% growth in the second quarter.

However, earnings for the S&P’s “other 493” companies are expected to accelerate significantly from here, with double-digit gains expected in the first quarter of 2025, according to data compiled by BI.

“Stock picker’s paradise”

Investors should expect some big swings in individual stocks that don’t show up in the broader index.

The options market is pricing in the largest implied average move following results at the individual stock level since 2021, when Bank of America Corp. began collecting the data. But index-level implied volatility is relatively weak, a sign that this earnings season could be a “stock picker’s paradise,” the firm’s strategists, including Osung Kwon, wrote in a note to clients on Tuesday.

Three of the 11 S&P 500 sectors — technology, communications services and health care — are expected to post earnings expansions of more than 10%. On the other hand, the energy group is expected to report a decline of more than 20%. The sector saw the largest drop in earnings estimates among 11 industry groups as crude oil prices fell last quarter, according to Gina Martin-Adams, chief equity strategist at BI.

Advertisement 4

Article content

It’s all about margins

Wall Street professionals will closely monitor profit margins, a key measure of how effectively companies extract profits from their sales.

Net income margins are expected to decline to about 12.9%, lower than the 13.1% recorded in the second quarter but slightly higher than the 12.8% in the third quarter of 2023, data compiled by BI show. This slight decline reflects the challenges some companies face in passing on input costs to customers, as wage pressures remain in many low-productivity industries that are difficult to automate.

BI data shows profit margins will be weakest for energy and property stocks. But if we look more broadly, it is expected to rebound in the coming quarters.

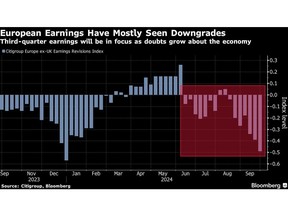

Volatile European markets

In Europe, this earnings season could mark a turning point for the Stoxx 600 Index, which is hovering near record levels.

Analysts lowered earnings estimates entering the third quarter, with a Citigroup index showing downgrades outnumbering upgrades since mid-June. At the same time, regional economies are experiencing weak growth, and Germany, the major industrial power, expects a contraction for a second year.

Advertisement 5

Article content

While lower earnings estimates lower the bar for companies to beat expectations, expectations for 2025 remain high and any guidance on weak consumer demand could force them lower, which could spill over into stock prices. A slew of high-profile companies, including Swedish clothing stores Hennes & Mauritz AB and Volkswagen AG, have issued profit warnings in recent weeks. A weak recovery in China is likely to weigh on the profits of luxury goods makers such as LVMH.

Focus on elections

With the US presidential election just weeks away, investors will be listening to risk signals on economic policy, trade and other political issues from corporate executives. Bank of America data indicates that about 110 companies mentioned the word “elections” in second-quarter earnings calls, up 62% from four years ago.

History suggests that corporate investment activity accelerates after the US presidential election, which could be a catalyst for companies to unleash capital in the coming quarters, especially given low interest rates, according to Bank of America’s Kuhn. But it may also delay some expansion plans and other expenses.

“A lot of capital investing these days is tied to AI, and the election is unlikely to limit that much, if at all,” said Jeff Buchbinder, chief equity strategist at LPL Financial. “However, now that we are so close to the election, some traditional capital commitments are likely to be delayed due to political uncertainty.”

Article content

Comments are closed, but trackbacks and pingbacks are open.