Bitcoin rose above $69,000, marking a significant milestone after two weeks of impressive gains. Since October 10, the price has risen more than 17%, positioning itself to test the previous all-time highs of around $73,000 set in March.

This return comes at a pivotal moment. Key data from Glassnode indicates a shift in Bitcoin’s trend from negative to positive, with an important indicator pointing to a bullish rally on the horizon.

This week will be particularly crucial as the cryptocurrency market gains momentum, especially with the upcoming US presidential election on November 5th. The political landscape often influences market sentiment, and the current optimistic environment for cryptocurrencies could pave the way for further price increases.

Investors are watching Bitcoin’s movement closely, as a break above the $70,000 level could trigger significant buying pressure and possibly lead to new highs.

With technical and fundamental factors aligning, the stage is set for Bitcoin to capitalize on bullish momentum. As excitement builds, market participants are looking to see if Bitcoin is able to maintain its upward trajectory and what impact the broader economic context will have on its performance in the coming days.

Bitcoin MVRV momentum indicates an uptrend

Bitcoin is set to rise further as key data from Glassnode revealed a significant shift in momentum, with the MVRV (Market to Realized Value) ratio turning to the upside. Chief Analyst and Investor Ali Martinez We shared an infographic illustrating this positive developmentwhich indicates that the MVRV ratio has exceeded the 180-day MVRV threshold, indicating strong market dynamics.

The MVRV indicator provides insight into how overvalued or undervalued the current market is, and this recent rally suggests that Bitcoin has moved from the accumulation phase that began in March to a new expansion phase.

This bullish momentum is crucial as Bitcoin aims to break through key resistance levels and target all-time highs. A psychological barrier of $70,000 looms, and a sustained rise above this level will be crucial to maintaining the current uptrend.

As the price approaches this milestone, investors and analysts are closely monitoring market conditions and sentiment, and expect significant fluctuations as a result of increased trading activity.

The next few days will be pivotal for Bitcoin as it seeks to establish itself above these key levels. The recent shift in the MVRV ratio, coupled with positive market sentiment, paints an optimistic picture for Bitcoin.

Let’s assume that Bitcoin can continue to build on this momentum and attract new liquidity. In this case, this could soon pave the way for significant price gains, reinforcing the bullish outlook for Bitcoin and the broader cryptocurrency market.

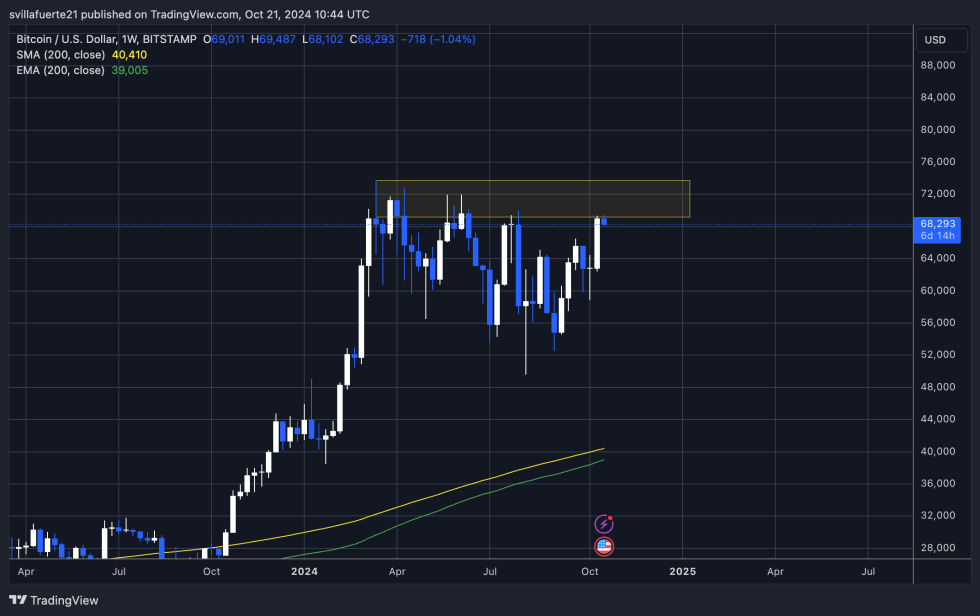

BTC rises to ATH

Bitcoin (BTC) is trading at $68,300 after a notable rise from $62,000 last week. The price is approaching the recent supply level that held it back from price discovery, with the last weekly candle closing at $69,000 – a critical level that represents an all-time high during the last cycle in 2021. The bulls are firmly in control, with the price well above average. The 200-day daily moving average, indicating further upside potential in the coming weeks.

However, there is a possibility that Bitcoin price could range below the all-time high before the upcoming elections, as many investors are preparing to either take advantage of the rise or take advantage of the decline to enter the market. These cautious sentiments are typical before significant market events, leading to speculative trading behavior.

As we progress through this week, price action will be pivotal in determining the overall market direction for the coming months. Investors are keenly watching signs of continued strength or potential pullbacks, making this a crucial period for Bitcoin as it navigates critical resistance levels.

Overall, market sentiment remains optimistic, and how BTC reacts in the coming days could set the tone for future gains.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.