Chancellor of the Exchequer Rachel Reeves’ first budget was greeted with cautious optimism by Britain’s business leaders, although high taxes on wages held them back from full support.

Article content

(Bloomberg) — British business leaders greeted Treasury Secretary Rachel Reeves’ first budget with cautious optimism, although high taxes on wages held them back from full support.

In a series of interviews and emailed comments, executives across a wide range of UK industries gave their view on the Chancellor’s budget.

Advertisement 2

Article content

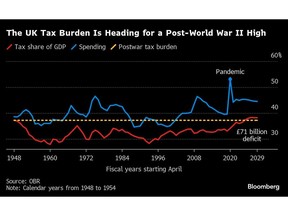

The budget will increase taxes by £40 billion ($51.5 billion) and promises sweeping investments in public services and infrastructure, leading to “one of the largest increases in spending, taxes and borrowing of any fiscal event in history,” according to Richard Hughes. Head of the government budget oversight body.

Business leaders were relieved that tougher tax increases were not being implemented, and welcomed investment in areas such as auto manufacturing, home building and clean energy.

Anne Glover, CEO of Amadeus Capital Partners

The venture capital firm’s president said the advisor’s biggest accomplishment is managing expectations ahead of what will always be a tough budget.

“What really matters now is making it easier for entrepreneurs to set up and grow their companies in the UK, especially early-stage deep tech and growth companies that will become the backbone of the industries of the future,” said Anne Glover.

She added that the government should consider encouraging or mandating pension funds to diversify their stakes into riskier assets if it wants to improve investment in technology.

Article content

Advertisement 3

Article content

Andy Palmer, Chairman of Pod Point Group

Andy Palmer, former chief executive of Aston Martin Lagonda Global Holdings Plc, welcomed a £200m investment to accelerate the rollout of more electric vehicle charging points.

“I was hoping for more, but at least it’s in the right direction,” he said. “I thought the fact that fuel duty wasn’t going up was a missed opportunity. I understand it’s politically sensitive, but I felt there was an opportunity to raise money to invest more in electric cars.”

Nick McKenzie, CEO of Green King

Pubs face difficult decisions on investment, pricing and staffing given the “significant” cost layers next year, the pub group’s chief executive said.

Nick McKenzie said: “While the reduction in recruitment fees is welcome, it is really just a drop in the ocean compared to the cost impact of lowering the threshold for National Insurance contributions and increasing the rate paid by employers.”

Mark Booth, Chairman of Highveld

The home developer’s chairman said it was an “encouraging” first budget but not extending the stamp duty holiday would hurt first-time buyers when they need all the support they can get.

Advertisement 4

Article content

He added that a commitment to appoint and train more planning officers is a good start, but clear plans are needed to ensure these reforms are not undermined by wider funding shortfalls at councils.

Andy Briggs, CEO of Phoenix Group

Andy Briggs welcomed government investment alongside the private sector, saying it would be “crucial” to boost growth. Changes in fiscal rules “make economic sense if done right,” and may allow private and government capital to work together to “stimulate” infrastructure investment.

Kelly Baker, President, Schneider Electric UK & Ireland

Kelly Baker would have liked to see some additional commitments on supporting the manufacturing supply chain and a clearer roadmap for decarbonising the commercial and industrial sectors.

She also asked whether lifting National Insurance would have the expected effect. “UK manufacturers are really struggling to recruit skilled workers as we compete in a very global economy against the EU and US,” she said. “I have to ask how increasing the cost of hiring companies will help us achieve this prosperity.”

Advertisement 5

Article content

Paul Taylor, CEO of Thought Machine

Paul Taylor said the increase in National Insurance contributions would add £800,000 to the UK cloud banking technology company’s payroll.

“Almost all tech startups run on investor capital, and this raise puts them back on their path to profitability,” he said.

He said changes in capital gains taxes would discourage talent from taking the risk of working for unprofitable startups.

Jason da Silva, Investment Director at Arbuthnot Latham

Jason da Silva said it would be very difficult for Labor to prove that the extra borrowing was a worthwhile investment, as it would likely take a long time for the benefits to be realized.

“It’s a lot of upfront spending, and hopefully it will start to stimulate GDP growth in year two or three, but if for whatever reason that doesn’t happen, that could be a very difficult situation to deal with.”

Until the consequences for the larger economy become clearer, companies may feel a little discouraged. “Labor has been talking about being pro-business, but the biggest tax increase in this budget has been on businesses. It’s like giving with one hand and taking with the other,” Da Silva said.

Advertisement 6

Article content

John Ions, CEO of Liontrust

The chief executive of the asset management company said he felt “a great deal of relief” after hearing mixed messages on the budget. “International investors may be looking at the UK as a slightly better place to invest now,” he said, noting that British stocks look cheap against other markets and provide a hedge against the US and big tech companies.

“It was a fairly benign budget,” John Ions said. “After a turbulent few years, from an investor perspective, they just want to see some stability and clarity.”

-With assistance from Philip Aldrick, Aisha S. Jani, Charles Cabell, Damian Shepherd, Louise Moon, Mark Bergen, and Jimmy Nimmo.

Article content

Comments are closed, but trackbacks and pingbacks are open.