The dollar fell after the latest set of opinion poll data for the US presidential elections showed no clear advantage between Kamala Harris and Donald Trump. Oil rose after OPEC+ postponed the production increase.

Article content

(Bloomberg) — The dollar weakened as the latest set of US presidential election polling data showed no clear advantage between Kamala Harris and Donald Trump. Oil rose after OPEC+ postponed the production increase.

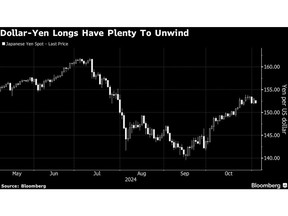

The US currency fell against the yen, pound sterling, euro, Mexican peso, Australian dollar and New Zealand dollar in early trading, after strengthening on Friday as Treasury yields rose.

Advertisement 2

Article content

Shares in Australia rose while Hong Kong stock futures fell slightly. US stock futures remained flat, after rising on Friday following strong earnings from companies such as Amazon.com and Intel Corp. Japanese markets are closed for the holiday, which means there will be no trading of Treasuries during Asian business hours.

The weakness of the US currency was a signal to some that investors may be losing confidence in Donald Trump’s victory. One element of the so-called Trump trade favors rising Treasury yields and a stronger US dollar.

“As much as there was something in the ‘Trump trade’ last week, it has seen some pullback this morning,” said Ray Attrill, head of FX strategy at National Australia Bank Limited in Sydney.

Wall Street tried not to rely too much on jobs data on Friday that showed US hiring advanced at the slowest pace since 2020 in October while the unemployment rate remained low. The numbers were distorted by severe hurricanes and major strikes. The jobs report is the last major data point before the election.

Polls released Sunday show Harris and Trump poised for a photo finish, with voters narrowly split nationally and across pivotal swing states that will decide the election. One Des Moines Register poll showed Harris leading 47% to 44% in Iowa, a state Trump won in each of his previous elections. This is likely an anomaly, but it suggests the vice president could make inroads with white voters in the Midwest.

Article content

Advertisement 3

Article content

In Australia, Westpac Banking Corp increased its share buybacks to A$2 billion (US$1.3 billion) and reported earnings that beat estimates. Stocks fell.

Oil, gold

West Texas Intermediate crude, the US crude benchmark, rose more than 1% early Monday, extending the range of a daily advance to four. OPEC+ agreed to postpone its December production increase by one month, the second delay to its plans to revive supply as prices continue to struggle amid a fragile economic outlook.

Gold prices stabilized at $2,734 per ounce. The price of the precious metal declined in the past two trading sessions after reaching a record high last week.

Data scheduled for release in Asia on Monday includes HSBC manufacturing PMI numbers for India and an interest rate decision in Pakistan.

In China, officials unveiled steps to attract foreign money just days before the US elections, raising concerns about the impact of Donald Trump’s return to the White House on the world’s second-largest economy. Foreign individuals are now allowed to provide capital to publicly traded companies as strategic investors, the China Securities Regulatory Commission, the Ministry of Commerce and four other regulators said in a statement late Friday.

Advertisement 4

Article content

Elsewhere in China, the Standing Committee of the National People’s Congress meets in Beijing from Monday to Friday, as investors watch for any approval of fiscal stimulus to revive the slowing economy.

Main events this week:

- HSBC India Manufacturing PMI, Monday

- US factory orders on Monday

- Eurozone HCOB manufacturing PMI, Monday

- The Standing Committee of the National People’s Congress of China will meet until November 8, Monday

- Australian interest rate decision, Tuesday

- China Caixin Services PMI, Tuesday

- Indonesia GDP, Tuesday

- Consumer Price Index in the Philippines, Tuesday

- Consumer price index in South Korea, Tuesday

- US Trade, ISM Services Index, Tuesday

- US presidential elections, Tuesday

- Interest rate decision in Brazil, Wednesday

- Unemployment in New Zealand, Wednesday

- Interest rate decision in Poland, Wednesday

- Taiwan Consumer Price Index, Wednesday

- Vietnam CPI, Trade, Industrial Production, Wednesday

- European Central Bank President Christine Lagarde speaks on Wednesday

- Chinese trade, foreign exchange reserves, Thursday

- Retail sales in the euro zone, Thursday

- Mexico Consumer Price Index, Thursday

- Interest rate decision in Norway, Thursday

- Interest rate decision in Peru, Thursday

- Sweden interest rate decision, CPI, Thursday

- Bank of England interest rate decision, Thursday

- Fed interest rate decision, initial jobless claims, productivity, Thursday

- Inflation in Brazil, Friday

- Employment Canada, Friday

- Chile CPI, Friday

- Taiwan Trade, Friday

- Consumer confidence index from the University of Michigan, Friday

- Fed Governor Michelle Bowman speaks on Friday

Advertisement 5

Article content

Some key movements in the markets:

Stocks

- S&P 500 futures were little changed as of 8:32 a.m. Tokyo time

- Hang Seng futures fell 0.2%

- Australia’s S&P/ASX 200 rose 0.3%.

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%.

- The euro rose 0.4 percent to $1.0876

- The Japanese yen rose 0.5 percent to 152.36 yen to the dollar

- The yuan in external transactions rose 0.4% to 7.1126 yuan to the dollar

Cryptocurrencies

- Bitcoin fell 0.6% to $68,704.91

- Ethereum fell 0.6% to $2,453.12

Bonds

- The 10-year Australian bond yield was little changed at 4.54%.

Goods

- West Texas Intermediate crude rose 1.5% to $70.53 a barrel

- There was little change in spot gold

This story was produced with assistance from Bloomberg Automation.

Article content

Comments are closed, but trackbacks and pingbacks are open.