This article is also available in Spanish.

In analysis subscriber On X, cryptocurrency analyst Patrick H. of CryptelligenceX outlines seven reasons why investors should be optimistic about Bitcoin’s price trajectory this week. “How can anyone be bearish here?! Bitcoin broke the weekly downtrend, closed above key levels, and some people are still demanding less than $40k?! Sorry bears, you clearly missed the fundamental changes that happened over the two weeks The last two.

#1 Mt.Gox Bitcoin Payment Deadline Extension

Defunct exchange Mt.Gox applied to change the payment deadline, which was approved by the court. The new deadline to recover remaining creditors’ funds has now been set on October 31, 2025, a full year later than the previously scheduled date of October 2024. This extension removes immediate market selling pressure for approximately 44,905 Bitcoin (about $2.9 billion), which had been Expected to flood the market.

#2 Economic stimulus in China

China is scheduled to issue bonds worth $325 billion to stimulate its economy. At the same time, cryptocurrency exchange OKX has launched a fully licensed trading platform in the UAE, providing a legal means for Chinese investors to participate in cryptocurrency trading under the jurisdiction of the UAE. Patrick H. is expected to… “Chinese money will enter cryptocurrencies in the fourth quarter.”

Related reading

#3 Decrease in Bitcoin exchange reserves

Bitcoin exchange reserves continue to dwindle as institutional investors and whales accumulate the cryptocurrency at unprecedented rates. This trend indicates a shortage of supply on exchanges, which, combined with increased demand, can lead to a supply shock. “This will ultimately lead to a supply shock, causing prices to rise in time,” the analyst notes.

#4 Rise in Whales Accumulating Bitcoin

On-chain data reveals that new Bitcoin whales are accumulating assets like never before. Ki Young Joo, CEO and founder of CryptoQuant, recently commented: “The current market volatility is just a game in the futures market. Real whales are moving the market through spot trading and OTC markets. That’s why on-chain data is so crucial.”

Related reading

He added that these new whales are unlikely to be sold until significant liquidity from retail investors enters the market. “Look at how aggressively the new whales are accumulating Bitcoin; this market has never seen such accumulation before,” he asserted. “It is worth noting that the lack of correlation with spot flows of US ETFs suggests that these could be strategic institutional accumulations.”

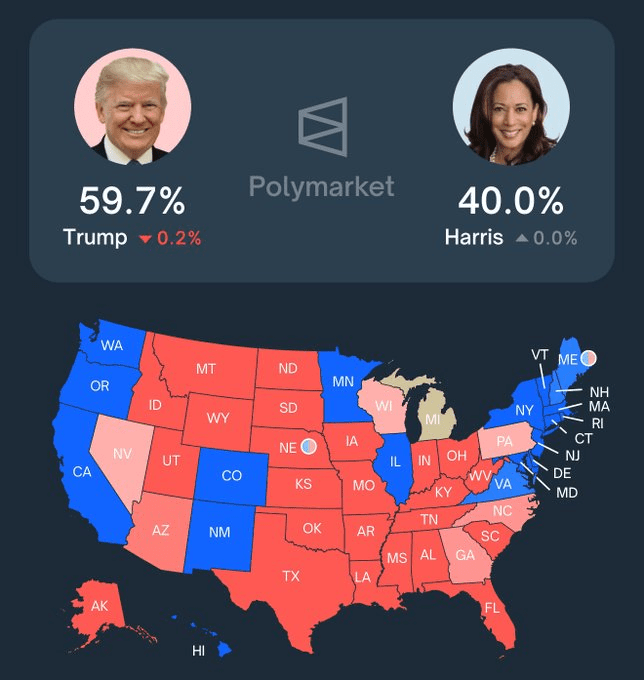

#5 Trump leads the polls

Political forecasts indicate that former US President Donald Trump enjoys support in swing states ahead of the upcoming elections. According to the latest PolMarket data, Trump is expected to win all seven key swing states. Patrick H. mentions Readers that “Trump is pro-crypto; Elon Musk will lead the Department of Government Efficiency (DOGE).

#6 S&P 500 as leader

The S&P 500 is trading at an all-time high, which historically indicates positive momentum for Bitcoin and cryptocurrencies. “There has never been a time in history when the Bitcoin and altcoin markets could not catch up with the performance of the S&P 500,” notes Patrick H., dismissing doubts, saying, “But this time is different”… Yes, for sure.” The relationship between traditional markets and cryptocurrencies indicates Crypto indicated that bullish trends in stocks could extend to the Bitcoin and cryptocurrency sector.

#7 Seasonality

Historically, the fourth quarter (Q4) has been the most bullish period for Bitcoin, especially in the first half of the year. “The Bitcoin and cryptocurrency market tends to outperform all asset classes within half a year,” the analyst says.

In support of these fundamental reasons, technical analysis also paints a positive picture for Bitcoin. Patrick H. highlights Highlight that Bitcoin has closed above the weekly downtrend line, indicating a potential reversal from bearish momentum to bullish momentum. Furthermore, the cryptocurrency is holding firmly above the 50-week Exponential Moving Average (EMA), a crucial support level. In addition, the Moving Average Convergence Divergence (MACD) indicator made a bullish crossover for the first time since April, often interpreted as a buy signal.

“Yes, there will be dips every now and then. But from now on, dips are to buy as the market structure has clearly shifted from bearish to bullish,” Patrick concludes.

At press time, Bitcoin was trading at $68,397.

Featured image created with DALL.E, a chart from TradingView.com