-

The stock market’s once-in-a-generation buy opportunity is approaching, RBA said.

-

The investment firm pointed to expectations for anemic big tech earnings over the next year.

-

The tech bubble bursting means other areas of the market could see gains as leadership evens out.

Bearish signals are flashing for the market’s hottest group of stocks, and it’s a sign that a can’t-miss investment opportunity is on the horizon, according to Richard Bernstein Advisors.

The investment firm has been saying for months that a once-in-a-generation opportunity is coming, and it could finally be close at hand, RBA deputy CIO Dan Suzuki said.

The thesis, which the firm first proposed at the end of last year, hinges on the extreme market leadership of a handful of stocks broadening out to the wider market, with stronger gains coming for the other 493 names in the S&P 500 following a dominant stretch for the so-called Magnificent Seven.

While tech stocks have taken an outsize share of the gains in the market over the last 15 years, corporate earnings for big tech firms are set to decelerate over the next quarter, Suzuki said.

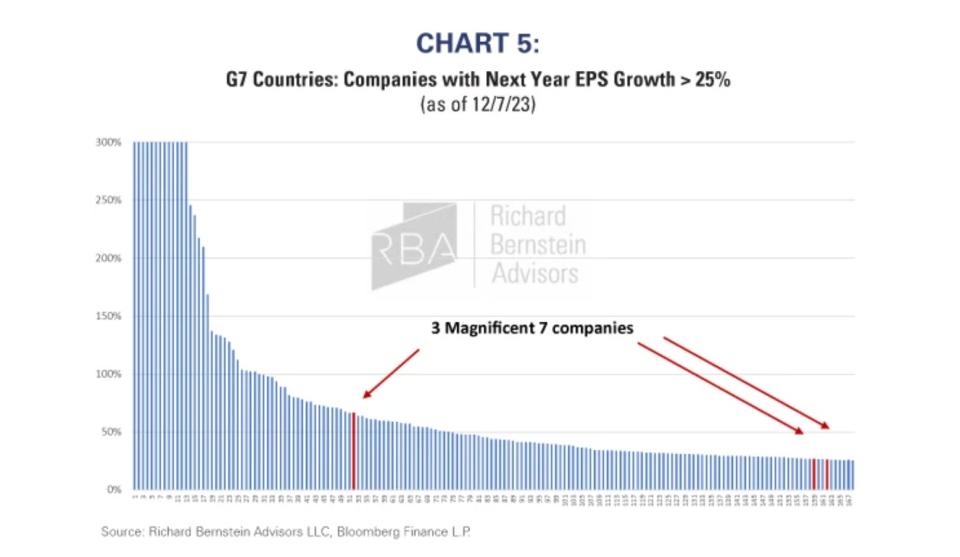

Of the Magnificent Seven – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta Platforms – only three are expected to have more than 25% earnings growth in 2024, RBA said in a recent note.

That differs from areas like small caps, industrials, energy, and emerging markets stocks, where earnings are expected to accelerate in the coming year.

Meanwhile, valuations and investor concentration in mega-cap tech firms are looking extreme, even more so than what was seen in previous stock market bubbles, according to Suzuki. The top 10 stocks in the S&P 500 now take up over 30% of the index’s total market cap, the largest share seen in over 40 years:

At this level of exuberance, those firms risk underperforming, causing investors to jump ship to other areas of the market, Suzuki said. He pointed to the dot-com bubble that burst in the early 2000s, which was followed by a decade of anemic returns.

“I think eventually you are going to see a bear market,” Suzuki said of large-cap tech stocks in an interview with Bloomberg on Friday. “I’ve gone so far as to say that I think this is a bubble, and I don’t use that term lightly. So eventually that suggests that there’s going to be a reckoning.”

But that’s actually great news for virtually every other area of the market, according to RBA, as investors will finally rotate into other stocks and send the pendulum swinging in the other direction.

While the Nasdaq cratered during the dot-com crash, under-loved sectors like energy and emerging markets actually saw “monster” returns over the following years, RBA founder Richard Bernstein told Business Insider in an interview in December.

The firm expects the same phenomenon to play out as extreme valuations of tech stocks look poised to pull back. Bernstein said he believed the Magnificent Seven stocks could end up wiping out 20%-25% of their value over the next decade, while small-caps in the Russell 2000 could gain about the same amount.

“I think that this is one of those once-in-a-generation opportunities,” Suzuki said.

Other experts on Wall Street have warned of a major correction coming to tech stocks, which have rebounded to dizzying heights as investors jump in on the hype for generative AI. Investing veteran Bill Smead called the Magnificent Seven stock boom a “speculative orgy” that could soon come to an end, leading to what he describes as a “stock market failure.”

Read the original article on Business Insider