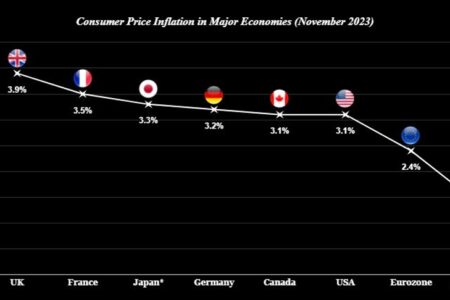

The snapshot is as per below:

* data based on October

Based on the above, it’s more so now a question of inflation persistence rather than extremely high inflation. Sure, core prices are still much higher than the snapshot we’re seeing but in general it is also reflecting a similar trend. I mean, it is quite telling when you compare it to the snapshot back in August here:

The most evident case of a drop in headline annual inflation is of course in the euro area, although much of that can be attributed to base effects as high energy prices are phased out. They were of course the most impacted by the Russia-Ukraine conflict last year.

But in general, the softer trend here is what is helping to feed the disinflation narrative and aggressive market pricing on rate cuts in recent weeks. The question now is, will we be able to see that final push towards 2% come sooner rather than later? That dynamic will be what determines the push and pull between central banks and markets for next year.