In the rapidly expanding global Bitcoin community, Western biases often dominate the narrative, ignoring diverse stories from around the world. One such story belongs to Didier Somnok, a small business owner in the heart of Bangkok, a city known Thailand is expected to receive 22.8 million international tourists in 2023, surpassing cities such as Paris, London and New York. Although Thailand He has Thailand has seen household debt soar, reaching 16.37 trillion baht ($463 billion) or 90.8% of national GDP, up from less than 14 trillion baht in 2019.

Didier Somnocborn in Yala ProvinceWhere geopolitical conflict is a harsh reality. Located in southern Thailand One of the poorest areas of Thailand With a poverty rate of 34% compared to the national average of 6%, according to the World Bank, the country has suffered from instability. Since 2004, this unrest has continued. He has It killed more than 7,000 people and injured 13,500 others.

As the Thai proverb goes, “Reclaim the right to a better life.” In 2012, Didier left his troubled hometown for Bangkok, where the pursuit of higher education was a beacon of hope for a better life. At the time, Bitcoin and financial concepts were distant ideas in Didier’s world. Navigating the vibrant streets of Bangkok, Didier completed his master’s degree and joined the workforce, taking on a typical nine-to-five job. For a local immigrant, this was a major accomplishment. Reflecting on his journey, he recalled the words of his mentor: “When you grow up, you will have the time and money, but you will lack the energy to start a business. If you want to do it, just do it.” With that in mind, Didier quit his monotonous corporate job after a year, and began a new chapter in his life.

Didier borrowed 50,000 THB (about $1,500) from his brother to start a burger shop on the street. He chose to start a burger business because he thought it was easy to start with a small investment. Driven by his ambition and inspired by the bustling energy of Bangkok, the city that never sleeps, he spent about a year developing the recipe and started the business in 2015. For the first three to four years, he ran everything on his own as a solopreneur, and his income was less than what he earned at his corporate job. He often wondered if he had made a mistake by quitting his job to start a business that paid less. However, after five years, things started to improve. Sales at the store started to increase, and Didier started hiring employees.

“I got into cryptocurrency with greed; all I wanted was to get rich quick,” he admits. In 2017, he and his friends pooled their resources to buy three ASIC mining rigs from Bitmain to try to mine Bitcoin and altcoins like Litecoin and Dogecoin. They saw a return on their investment within six months. Didier bought his first bitcoin in early 2017 to buy these ASIC mining rigs, but he didn’t know how to wire his bitcoins, so he ended up using a bank transfer instead.

Reflecting on his early experiences, he recalls: “The first bitcoins I bought slowly turned cheap during the bull market. I was very lucky. I made almost 100% profit instantly whenever I bought something.” Despite not knowing anything about cryptocurrencies, he gained confidence and became a major cheap trader, paying little attention to bitcoin.

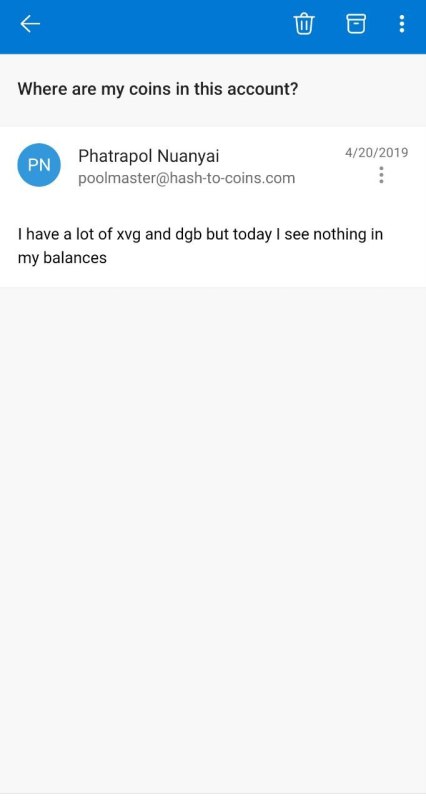

In mid-2017, he learned about leverage and trading. His profits skyrocketed due to leverage. Although luck was not always on his side forever, in early 2018, the market crashed, and he lost more than 1 million Thai baht (about $30,000), while his initial capital was about 100,000 Thai baht (about $3,000). Moreover, he also lost his shitcoins from the mining pool. He kept all his shitcoins in the custody of the mining pool, and one day, when he checked his account, all his shitcoins, worth $10,000, were gone. The notice on the “Hash-to-Coin” mining website stated that if the coins were kept with them for more than three months, they would be considered a donation.

“I lost everything,” he said, disappointed. But unlike most people, “I didn’t blame Bitcoin. I still see it as the future. I blame myself. I didn’t know anything and I was over-leveraged.” He stressed that despite his huge financial losses, his girlfriend didn’t leave him. “My girlfriend was a customer of mine. She used to come over regularly to buy burgers. I met her when I was struggling financially during my early days as an entrepreneur. She supported me and said we could get the money back.”

Determined to change his circumstances, he discovered Mr. Perea On YouTube, he started following his live streams on real Bitcoin education. This was the moment he started to truly understand what Bitcoin and cryptocurrencies were. With this unique knowledge, he began to see Bitcoin as a saving technology and not just a trading tool. Over the course of three years, Didier recovered from his losses and emerged stronger. He became friends with Mr. Perea, and together they founded a company called shift to the right To develop Bitcoin content in Thai through multiple social media channels, including: our With one of the popular hashtags #siamstr. As a team, they translated “Bitcoin Standard“And”Fiat Standard“into Thai, and both became bestsellers in Thailand. They organized the first Bitcoin Conference Thailand In 2023 they are now preparing for the next In September 2024.

Didier now accepts bitcoin as a form of payment at his flagship burger shop, one of four different locations. He uses a Satoshi wallet to process these payments. Within a year of implementing this initiative, he received more than 3 million satoshis in payments, although he initially expected to see more bitcoin transactions. In his market, some of the small business owners in the neighborhood sometimes ask him about bitcoin when they notice the big bitcoin poster in his store. Although they often lose interest once he explains it to them, according to his many unsuccessful experiments. Instead, he now focuses his energy on the internet, where he can have a greater impact on people willing to embrace innovation.

In 2022, almost 8.4 million people in Thailand, or 12% of the country’s population, have used cryptocurrencies. Suggests By 2028, that number will rise to around 17.67 million, representing 25% of the population. During our conversation, Didier claimed that there are around 50,000 Bitcoin users in Thailand and speculated that the Thai government might interfere with Bitcoin adoption, perhaps requiring the use of KYC wallets because it doesn’t like money systems it can’t control. In the worst-case scenario, Didier remains firm: he will continue to advocate for Bitcoin with his friends. “It’s not an option, it’s the only way to survive,” he stressed.

This is a guest post by our guest, Win Ko Ko Aung. The opinions expressed here are entirely his own and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.