It was another mixed session for commodities.

Energy: Oil saw a notable increase in trading by more than 1% while natural gas fell by almost the same amount.

Precious Metals: Gold and silver rebounded well while platinum traded down more than 2%.

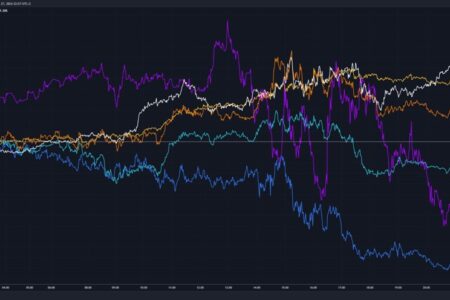

Commodity performance

Getting a solid reading on commodities has been a challenge the past few weeks, with a lot of drivers in the mix but also conflicting factors at the same time.

Copper and oil are a good example, as both have constructive supply outlooks, as well as a question mark over demand given recent data from the US and China. However, only copper seems to be reflecting concern about demand, while oil has paid little attention to this with its recent rally.

Comparison between copper and oil

Gold is another currency that has been difficult to pin down on the fundamentals. We saw a strong rebound from the key support level at 2300 yesterday, but I have very little conviction in the sustainability of the upside or downside.

Gold rises from 2300 level

For gold, it is also worth taking into account very long positions at the moment. This of course does not mean that the price will push down, but it does make the risk-reward of going higher a bit unattractive.

Gold status extended