Sinopec and TotalEnergies SE are among the companies in talks to invest in developing Al-Jafurah in Saudi Arabia, according to people familiar with the matter, as the kingdom seeks to exploit one of the world’s largest untapped gas fields.

Article content

(Bloomberg) — Sinopec and Total Energy SE are among the companies in talks to invest in developing Al-Jafurah in Saudi Arabia, according to people familiar with the matter, as the kingdom seeks to exploit one of the world’s largest untapped gas fields.

Advertising 2

This ad hasn’t been uploaded yet, but your article continues below.

Article content

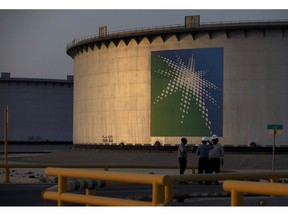

Some of the people, who asked not to be identified, said the Chinese and French energy giants are in separate discussions with Saudi Aramco about plans that could include building facilities to export the fuel as liquefied natural gas. The two sources said Aramco is seeking to raise a total of around $10 billion for the projects.

Article content

Saudi Aramco is looking for equity investors who could help fund midstream and downstream projects in the more than $100 billion Jafurah gas development project in the east of the kingdom. Bloomberg reported in December that the state-controlled company is reaching out to private equity firms and other large infrastructure investors to offer stakes in assets such as carbon capture and storage projects, pipelines and hydrogen plants. The investment bank Evercore Inc. advice to Aramco on plans.

Article content

Advertising 3

This ad hasn’t been uploaded yet, but your article continues below.

Article content

People said that talks are ongoing and no final decisions have been made. Representatives for Aramco and Total Energy did not immediately respond to a request for comment. China Petroleum & Chemical Corp. did not respond. , as Sinopec is officially known, received emailed requests for comment during the Labor Day holiday in China.

The war in Ukraine has increased demand for natural gas, led by European countries that have traditionally gotten their supplies from Russia. This has led the Gulf states to embark on ambitious plans to expand their gas production.

Saudi Arabia has some of the largest gas reserves in the world, but it has hardly exploited them in the past. Now, Jafurah is a key part of Riyadh’s strategy to diversify its exports outside of oil. The field is estimated to hold 200 trillion cubic feet of gas, and Aramco expects to start production there in 2025, reaching about 2 billion standard cubic feet per day of sales by 2030.

Advertising 4

This ad hasn’t been uploaded yet, but your article continues below.

Article content

The decision to build an LNG export terminal will be a turning point for Aramco. The company said recently that most of the gas from Jafurah and other fields will be used in the local market and to make blue hydrogen.

Since Aramco was fully nationalized in 1980, most foreign investment in the kingdom’s energy industry has been limited to end assets such as refineries and petrochemical plants. In the past, Aramco has formed joint ventures with companies including Shell plc and Total Energy to explore and drill for natural gas within its borders.

— With assistance from Stephen Stabczynski, Paul Wallace, François de Popuy, Ruth Liao, and David Stringer.

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation