Asian stocks were set for losses after U.S. indexes posted their worst day since the Aug. 5 market crash, as concerns over growth and monetary policy combined to burn through riskier assets.

Article Content

(Bloomberg) — Asian stocks were set for losses after U.S. indexes posted their worst day since the Aug. 5 market crash, as concerns about growth and monetary policy combined to burn through riskier assets.

Stock futures in Australia, Hong Kong and Japan fell, with Tokyo pointing to a 3% loss. U.S. futures were down in early trading after the S&P 500 fell more than 2%, with Nvidia Corp. leading a sharp decline in technology stocks. Meanwhile, the yen jumped, a closely watched manufacturing index again missed expectations, and oil fell on concerns about weak global demand.

Advertisement 2

This ad has not yet loaded, but your article continues below.

Article Content

Wall Street’s VIX fear index soared. Treasury yields fell as traders held on to bets on an unusually large half-point rate cut by the Federal Reserve this year. The dollar index rose for a fifth session, its longest winning streak since April.

The S&P 500 and Nasdaq 100 had their worst starts to September since 2015 and 2002, respectively. With inflation expectations stabilizing, attention has shifted to the health of the economy, where signs of weakness could prompt faster monetary easing. While interest rate cuts tend to be a good omen for stocks, that’s not usually the case when the Fed is rushing to prevent a recession.

Traders expect the Fed to cut interest rates by more than two full percentage points over the next 12 months — the biggest rate cut outside a recession since the 1980s. Ian Lyngen and Phil Hartman of BMO Capital Markets said the fear after the recent surge in unemployment was leaving traders “on edge” ahead of Friday’s payrolls data.

“This week’s jobs report, while not the only deciding factor, is likely to be a major factor in the Fed’s decision between cutting rates by 25 or 50 basis points,” said Jason Pride and Michael Reynolds of Glenmede. “Even modest signals in this week’s jobs report could be a key decision point in whether the Fed takes a more dovish or aggressive approach.”

Article Content

Advertisement 3

This ad has not yet loaded, but your article continues below.

Article Content

The S&P 500 fell to about 5,530 points while the Nasdaq 100 lost more than 3% as Nvidia stock plunged 9.5% — wiping out $279 billion in a single day for a U.S. stock. The U.S. Justice Department has sent subpoenas to Nvidia and other companies as it seeks evidence that the chipmaker violated antitrust laws.

The yield on the 10-year U.S. Treasury note fell seven basis points to 3.83 percent. A record number of large companies tapped the bond market, taking advantage of low borrowing costs. The yen rose after Bank of Japan Governor Kazuo Ueda reiterated that the central bank will continue to raise interest rates if the economy and prices perform as expected.

At the start of a busy week of economic data, a report showed that manufacturing activity in the United States contracted in August for the fifth straight month.

Companies that have been left behind in the U.S. stock rally could get a boost if Friday’s jobs data provides evidence of the economy’s resilience, says a Morgan Stanley strategist who predicted a market correction last month. The stronger-than-expected jobs numbers are likely to give investors “greater confidence that growth risks have receded,” Michael Wilson wrote.

Advertisement No. 4

This ad has not yet loaded, but your article continues below.

Article Content

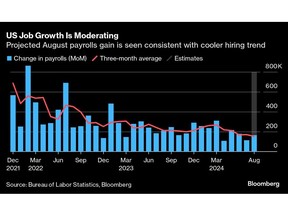

The August jobs report is expected to show the world’s largest economy added about 165,000 jobs, based on the median estimate in a Bloomberg survey of economists.

While average job growth over the past three months has exceeded the modest gain of 114,000 jobs in July, it is expected to slow to just over 150,000 jobs — the smallest since the start of 2021. The unemployment rate is likely to fall in August to 4.2% from 4.3%.

While the Fed has finally decided to cut rates, extending the 25 basis point rate cuts doesn’t seem to be doing the trick, says Neil Dutta of Renaissance Macro Research. Under this scenario, it will take a long time to get the federal funds rate back to neutral, and in the process, we will continue to tighten policy, leaving open downside risks to growth.

“This confusing scenario is likely to increase the risk of higher unemployment. So if the unemployment rate does not reach 50% in September, they will have to reach 50% later this year,” he said.

The company’s most prominent achievements:

- Boeing shares fell after Wells Fargo & Co. cut its recommendation on the aircraft maker to a sell, saying it was difficult to see any upside in the shares.

- Vice President Kamala Harris joined President Joe Biden in announcing that United States Steel Corp. should remain domestically owned and operated, the latest headwind to the company’s proposed sale to Japan-based Nippon Steel Corp.

- Deutsche Bank cut its recommendation on JPMorgan Chase & Co. from buy to hold, while Bank of America Corp. and Wells Fargo & Co. were upgraded based on a change in preferences within the banking sector.

- The German government is planning to reduce its stake in Commerzbank AG, taking advantage of a recent surge in its shares to begin the exit from the bank it rescued more than a decade ago.

- The European Union’s top court has ruled that Illumina Inc.’s $7 billion acquisition of cancer-detection company Grail Inc. should not have been investigated by the bloc, according to a ruling that undermines the bloc’s attempts to scrutinize more global deals.

- Cathay Pacific Airways’ inspections of its fleet of Airbus SE A350 aircraft are focusing on deformed or deteriorating fuel lines in the wide-body aircraft’s engines, after discovering a problem that caused several flights to be cancelled as engineers replaced the parts.

Advertisement No. 5

This ad has not yet loaded, but your article continues below.

Article Content

Main events this week:

- China Services PMI, Wednesday

- HCOB Euro Area PMI and PPI services, Wednesday

- Canada Interest Rate Decision, Wednesday

- US Job Opportunities, Factory Orders, Beige Book, Wednesday

- Eurozone Retail Sales, Thursday

- US Initial Jobless Claims, ADP Employment, ISM Services Index, Thursday

- Eurozone GDP, Friday

- US Non-Farm Payrolls, Friday

- Federal Reserve Board Member John Williams Speaks Friday

Some key movements in the markets:

Stocks

- S&P 500 futures were down 0.1% at 7:29 a.m. in Tokyo; the S&P 500 was down 2.1%

- Nasdaq 100 futures were down 0.1%, while the Nasdaq 100 futures were down 3.1%.

- Nikkei 225 futures fell 3%.

- Hang Seng futures fell 0.6%.

- S&P/ASX 200 futures fell 1.2%

Currencies

- The Bloomberg Dollar Index fell 0.1%.

- The euro was little changed at $1.1042.

- The Japanese yen was little changed at 145.54 yen to the dollar.

Cryptocurrencies

- Bitcoin fell 0.3% to $58,028.73

- Ether was little changed at $2,464.58.

Bonds

- The yield on the 10-year US Treasury note fell seven basis points to 3.83%.

Goods

- West Texas Intermediate crude was little changed.

- Spot gold was little changed.

This story was produced with the help of Bloomberg Automation.

—With the help of Rita Nazareth.

Article Content