Stocks in Asia fell early Thursday after US stocks rose to record levels as investors bet on what The return of Donald Trump To the White House would mean for the economy and the world.

Markets are also turning their attention to the Federal Reserve’s interest rate decision, scheduled for later today.

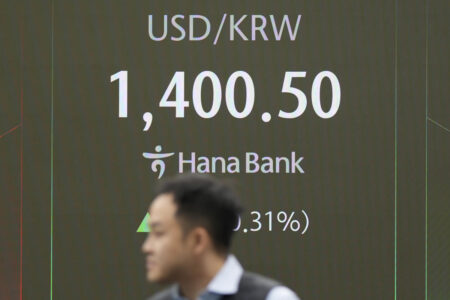

Japan’s Nikkei 225 index gave up early gains to fall 0.6% to 39,246.86, while the Kospi in Seoul fell 0.4% to 2,554.57.

Australia’s S&P/ASX 200 index fell 0.1% to 8,191.00.

Chinese stocks also fell. Hong Kong’s Hang Seng Index fell 0.7% to 20,386.36 points. The Shanghai Composite Index also fell by 0.7% to 3,359.99 points.

Trump promised to impose sweeping 60% tariffs on all Chinese imports, and raise them further if Beijing takes a step to invade the self-ruled island of Taiwan.

Investors are adding to bets made earlier on what Higher tariffs, lower tax rates, and relaxed regulation Which Trump prefers will mean. Higher tariffs on imports from China would add to this The burdens facing Beijing While struggling to revive slowing growth in the world’s second-largest economy.

Higher tariffs on imports from China, Mexico and other countries would also increase the risk of trade wars and other disruptions to the global economy.

Today, Wednesday, the American stock market witnessed a rise in Elon Musk’s shares TeslaAnd banks Bitcoin However, they all rose, as investors bet on what Donald Trump returns to the White House It will mean for the economy and world. Among the losers the market sees is the renewable energy industry and probably anyone it’s worried about High inflation.

The S&P 500 rose 2.5% to 5,929.04 points on its best day in nearly two years. The Dow Jones Industrial Average rose 3.6% to 43,729.93 points, while the Nasdaq Composite Index jumped 3% to 18,983.47 points. All three indicators topped the records recorded in recent weeks.

The impact of Trump’s second term will likely depend on whether his fellow Republicans control Congress, which is the case It’s not clear yet.

Investors believe that Trump’s policies may lead to stronger economic growth. This helps lower prices and raise Treasury yields. Trump-era tax cuts could worsen the US government deficit, increase borrowing and force revenues higher. The yield on the 10-year Treasury note jumped to 4.43% from 4.29% late Tuesday, a big move for the bond market. It’s up significantly from August, when it was less than 4%.

Investors expect the next president’s policies, especially increased tariffs, to stoke inflation and add costs to American household bills. Sharp cuts in immigration could also cripple businesses, forcing companies to raise workers’ wages faster and putting more upward pressure on prices.

Most of Wall Street’s records this year were based on expectations Upcoming interest rate cuts by the Federal Reservewith the inflation trend Back to its 2% target. Easy interest rates help boost the economy, but they can give inflation more fuel.

The Federal Reserve will announce its latest decision on interest rates on Thursday, as expectations for a cut remain, according to data from CME Group. But traders have already begun to scale back expectations about the number of cuts the Fed will deliver through the middle of next year.

In other trading early Thursday, the US dollar remained flat against the Japanese yen at 154.63. The euro fell to $1.0728 from $1.0730.

The price of US crude oil rose by 2 cents to $71.71 per barrel. The price of global benchmark Brent crude rose 24 cents to $75.16.

Bitcoin fell to $76,165 after reaching an all-time high above $76,480 on Wednesday, according to CoinDesk. Trump vowed to make the country “the world.” Cryptocapital Planet” and creating a “strategic reserve” of Bitcoin.

___

AP Business Writer Stan Choi contributed to this report.