AUDUSD, EUR, NZD – Rate Settings:

- Australian dollars Recovered some losses before RBA rate resolution.

- The rally may mitigate some of the downside risks for the Australian dollar.

- What then Australian dollar / US dollarAnd Australian / New Zealand dollarsAnd EUR/AUD?

Recommended by Manish Grady

How to trade AUD/USD

The Australian dollar recovered some losses against some of its peers as the Reserve Bank of Australia grew more skeptical about the interest rate after raising the minimum wage.

The Australian Fair Work Commission last week decided to increase workers’ pay by 5.75% on bonuses with wages tied to movement in the minimum wage and 8.6% for lower-paid employees. The rally could raise wage growth/inflation expectations, which would require higher interest rates to tackle still-high inflation.

The market is pricing in a 30% possibility of a 25bp rate hike at the RBA meeting on Tuesday, with the benchmark rate reaching 4.18% by September from the current 3.85%. However, a hike in the minimum wage implies an upside risk for interest rates, which keeps the Australian dollar supported, at least against some of its peers. Meanwhile, risk appetite received a boost after last week the US House of Representatives passed a debt ceiling bill. Going forward any stimulus from China could improve prospects for the Australian dollar.

Daily chart of the Australian dollar / US dollar

Chart by Manish Gradi using TradingView

AUD/USD: false break lower?

AUD/USD’s failure to sustain losses after breaking below crucial support on the horizontal trend line from November at around 0.6585 has raised the possibility of a false breakout. However, unless AUD/USD breaks the crucial barrier at 0.6805, the path of least resistance remains sideways to the downside. See “Aussie Dollar Looks Weak: AUD/USD, AUD/JPY, AUD/CAD Price Action,” posted on May 25.

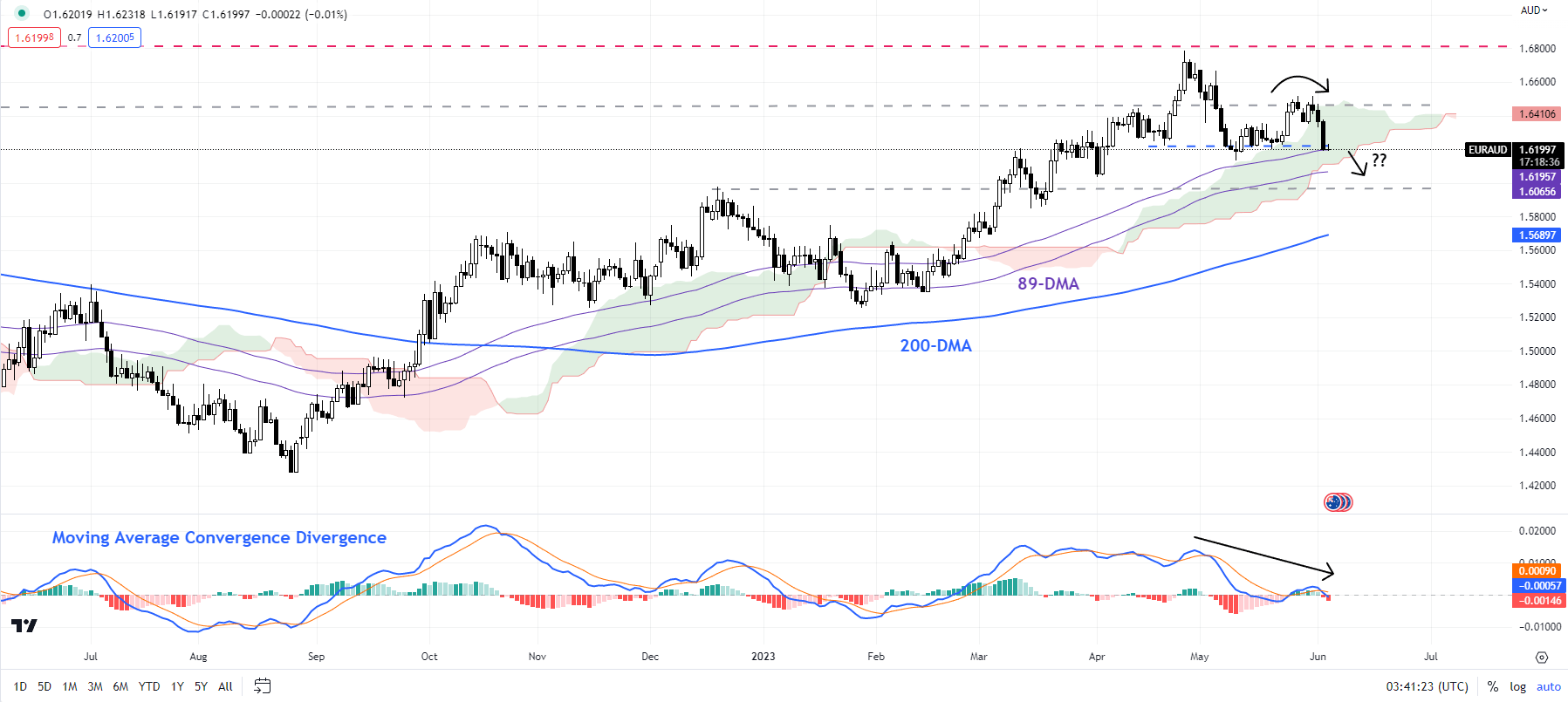

EUR/AUD daily chart

Chart by Manish Gradi using TradingView

EUR/AUD: deeper correction risks

The sharp decline in EUR/AUD last week raises the risk of a deeper downturn in the near term. This follows last month’s decline from a difficult barrier at October 2020 high of 1.6825. There is a vital cushion at the early May low of 1.6130. A break below could pave the way towards 1.5950-1.6000 (including the December high and the 89-day moving average). For further discussion, see “Australian Dollar Pre-Retail Sales: AUD/USD, EUR/AUD, GBP/AUD Rate Settings,” posted on May 23.

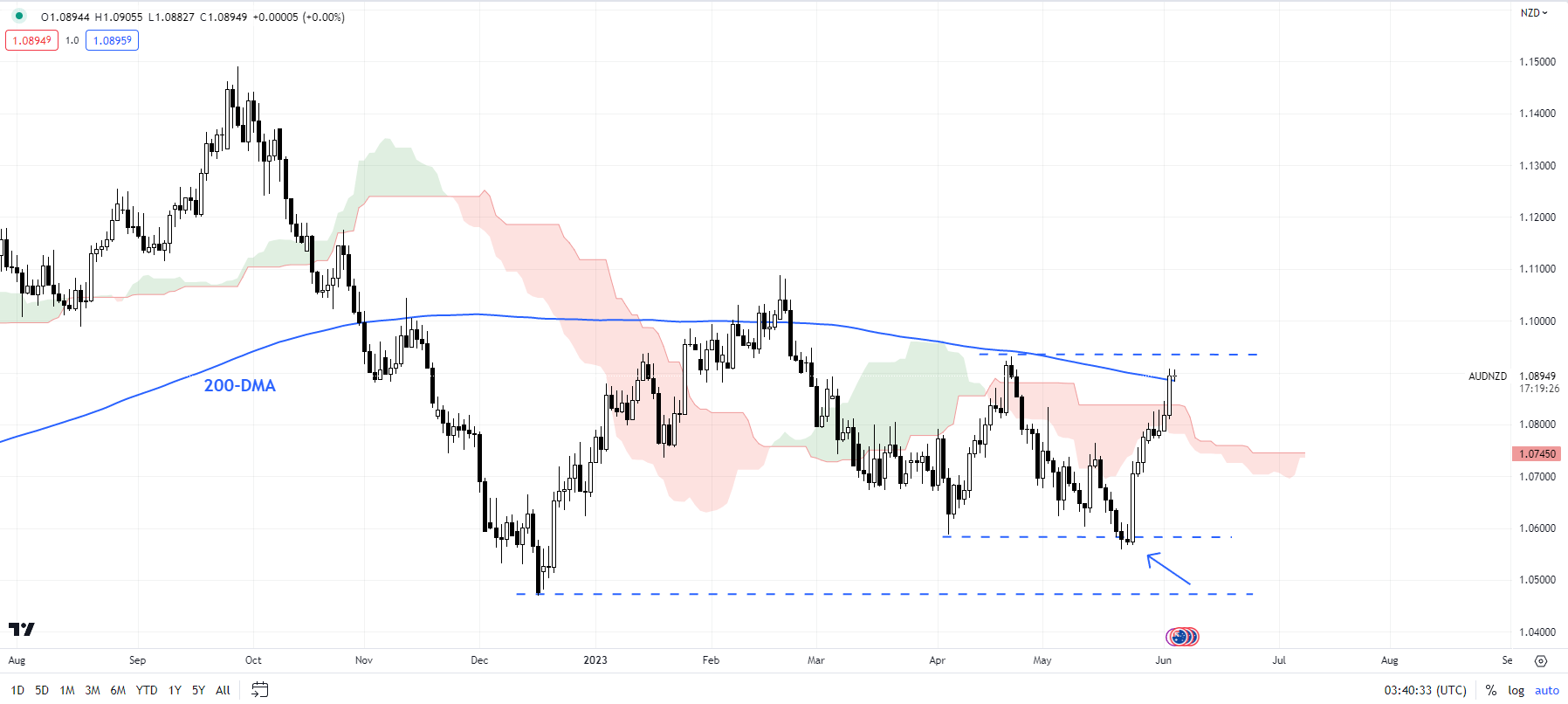

Daily chart of the Australian dollar / New Zealand dollar

Chart by Manish Gradi using TradingView

AUD/NZD: At the upper end of the range

Bullish momentum picked up in the AUD/NZD currency pair after settling above the crucial floor of the April low of 1.0585. The pair is now testing a dynamic ceiling on the 200-day moving average, coinciding with the April high of 1.0925. Given the importance of resistance, the AUD/NZD rally may stall a bit, especially given the RBA’s interest rate decision tomorrow. However, any break above 1.0925 would trigger a double bottom, likely to initially open the door towards February high at 1.1085, possibly towards 1.1250.

Recommended by Manish Grady

Basics of breakout trading

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish