Aurobindo Pharma (NS:) outperformed expectations in 4QFY24, with both sales and EBITDA showing significant year-on-year growth. Sales rose 17%, while EBITDA rose an impressive 68%, beating Goldman Sachs (NYSE:) expectations and those of the broader market.

This strong performance was driven by strong growth in key geographic markets, both developed and emerging. EBITDA margin also beat expectations, reaching 22.3%, 101 basis points higher than Goldman Sachs estimates. This improvement is primarily due to higher gross margins.

Displays: Now is the perfect time to seize the opportunity! For a limited time, InvestingPro is available at an irresistible 69% discount, priced at just INR 216 per month. click here And don't miss this exclusive offer to unlock the full potential of your portfolio with InvestingPro+.

Although Aurobindo did not provide specific consolidated growth guidance, the company remains optimistic about achieving strong growth in FY25. This optimism is supported by several factors, including continued momentum in the US market, and significant growth in Yogya (with a target Up to $150 million quarterly run rate), and expected increase in G Revlimid sales in the coming quarters.

The company's Production Linked Incentive (PLI) project is on track, aiming to reach peak utilization by September. Additionally, Aurobindo plans to commission its factory in China this year and expects to maintain an EBITDA margin of 21-22% in FY25.

Goldman Sachs has revised its FY25-27 EPS estimates to a range of -3% to +4%, reflecting the latest quarterly performance and updated business outlook. As a result, Aurobindo's 12-month sum-of-the-parts target price (SOTP) has been raised to INR 1,325 from INR 1,275, indicating an upside potential of 11%. The company maintains its Buy rating on Aurobindo, noting that the current valuation, which trades at a 30-40% discount to average coverage, mitigates most concerns related to pricing pressures and plant condition.

In Europe, Aurobindo's revenues rose 8% year-on-year and 5% quarter-on-quarter, to €203 million. This growth was in line with the company's guidance and helped minimize the effects of tax refunds. The company aims to maintain this revenue run rate in FY25 and is focused on improving margins from mid-teens levels to around 20% in the medium term.

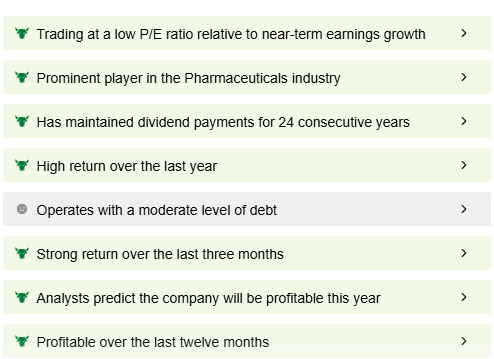

Image source: InvestingPro+

In addition to Goldman Sachs analysis, InvestingPro provides valuable insights into Aurobindo Pharma stocks. According to InvestingPro's fair value calculation, the real value of the stock is INR 1,270. This evaluation is derived from complex financial models that provide a comprehensive analysis of a stock's potential. InvestingPro's ProTips feature also underscores the stock's appeal by highlighting its consistent 24-year dividend history, low price-to-earnings (P/E) ratio, and its profitability over the past 12 months.

Image source: InvestingPro+

For investors looking for deeper understanding and actionable insights, InvestingPro stands out as a powerful tool. by click here By subscribing to InvestingPro, investors can access a wealth of information and tools that can help them make informed decisions and maximize their potential returns in the stock market, now available at a limited-time discount of 69%.

Read also: Boost your investment strategy with the Altman Z-Score

X (formerly Twitter) – Aayush Khanna