The cryptocurrency market continues to navigate a sea of uncertainty, and Avalanche (AVAX) is no exception. While AVAX has shown some resilience compared to its altcoin counterparts, a closer look reveals that the market is struggling with its altcoin counterparts. Mixed signals – A mixture of cautious optimism and underlying anxiety.

Related reading

Bullish whispers or mirages?

The future of AVAX remains shrouded in uncertainty. While there are some positive signs, such as relative outperformance and pockets of bullish sentiment, they are countered by worrying metrics such as diminishing market control and a significant decline in trading activity.

Avalanche: Resistance levels loom large

A look at the six-month chart of AVAX reveals a volatile ride, marked by sharp peaks and troughs. This volatility highlights AVAX's susceptibility to broader market trends and its dependence on specific developments within its ecosystem.

Over the past few months, AVAX has shown a pattern of rising prices followed by equally sharp corrections. Right now, the altcoin appears to be consolidating around the $38 mark after the recent decline from its April highs.

If AVAX can hold support around the crucial $35 level, there is potential for a path north, especially if a broader uptrend materializes in the cryptocurrency market.

However, significant resistance awaits us at $48 and $53 – price points that AVAX has repeatedly tested and failed to clear in recent months. A sustained break above these levels would signal a major shift in momentum, which could push AVAX towards the $80 or even $100 mark by Q3.

A tale of two markets: where do traders stand?

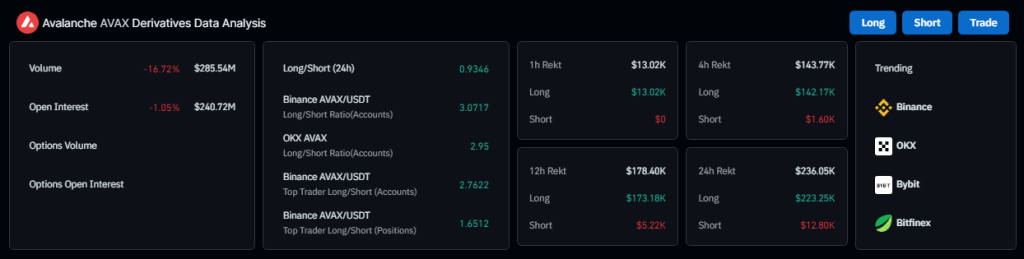

The trading landscape surrounding AVAX presents a strange dichotomy. Coinglass Data Reveals Staggering 60% Drop in trading volume, which indicates a significant decline in market activity. This is also supported by a relatively balanced long/short ratio across different platforms, which indicates a general hesitation among traders regarding the future of AVAX.

However, a glimmer of bullish sentiment emerged from Binance, the prominent cryptocurrency exchange. Here, the buy/sell ratio skews much higher, indicating a more optimistic outlook among individual traders on this specific platform.

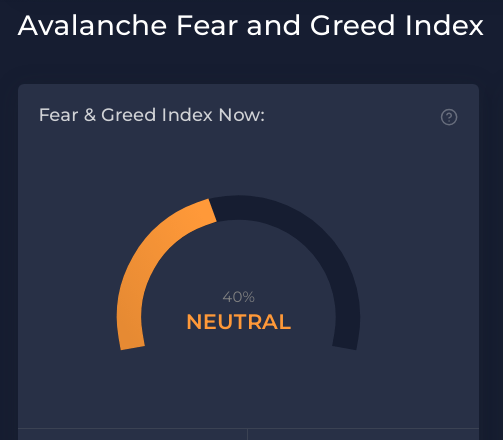

Meanwhile, with a rating of 40% on Fear and Greed IndexThe current AVAX market situation is characterized by a neutral mood, indicating that investors have balanced opinions.

Related reading

Loss of dominance and decreased interest?

AVAX's struggles extend beyond trading. The altcoin appears to be loosening its grip on market share, with search interest also declining. This translates into a lack of market control and potentially diminished public interest – not exactly a recipe for success for a token aiming for big gains.

Featured image from Summitpost, chart from TradingView